Hermès sued over "unfair commercial practices" A Californian court implies the purchase procedure for a Birkin is illegal

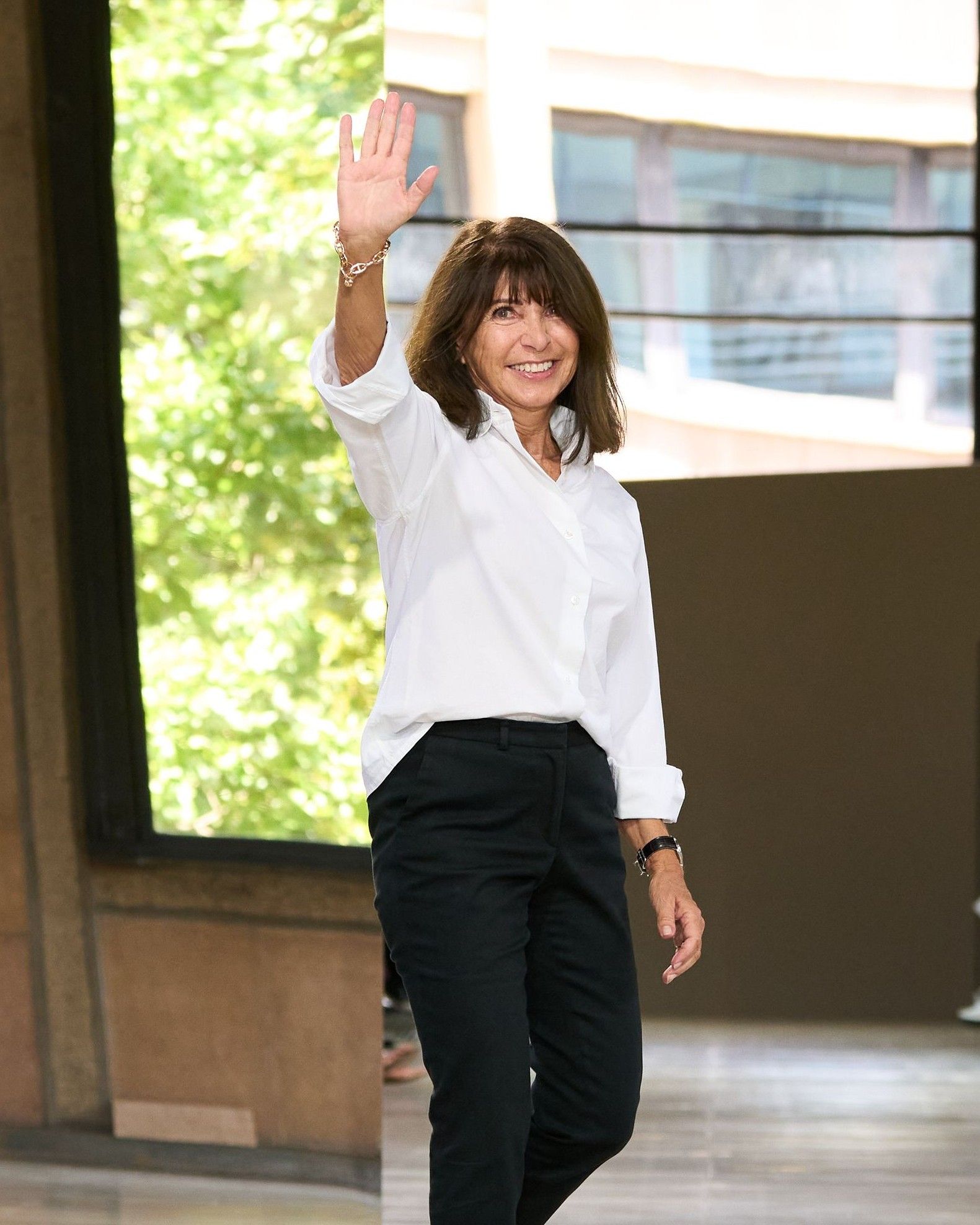

A California court has sued the French fashion house Hermès for unfair business practices in the sale of Birkin, a cult accessory of the brand. Tina Cavalleri and Mark Glinoga, who filed the complaint, argue that Hermès exercised the so-called «market power» given by the «unique desirability, incredible demand, and limited supply» of the iconic totes to raise their prices. In the document, Cavalleri and Glinoga accuse the brand of creating a scheme that forces customers to invest in other Hermès products to have the opportunity to buy a Birkin. The Hermès bag named after actress Jane Birkin was born in 1984 and soon became an inaccessible status symbol to most. Initially, to purchase one of these accessories, you needed to be on a notorious waiting list, which was later removed, but the value of the accessory continued to rise. Today, it is recognized as a safe-haven asset (or investment piece), with recent studies showing that the bag had an average return of 14.2% between 1984 and 2015.

Among the undeniable claims presented by Tina Cavalleri and Mark Glinoga is the fact that consumers cannot simply walk into an Hermès boutique and buy a Birkin: they must be deemed "worthy" even just to view it. This point is what makes the case against Hermès notable, as the customer's purchase history plays a significant role in their likelihood of being able to purchase a Birkin. The accusation was made after several attempts by Cavalleri and Glinoga to obtain the infamous bag, when store staff explained to the two customers that to potentially obtain one of the Birkin bags, they would need to spend more on other items from the maison. The case highlights the role of sales associates in the scheme, implying that since they receive 3% commission on sales, this process also benefits them, as they do not receive percentages on Birkin sales. According to Cavalleri and Glinoga's report, Hermès would be guilty of «voluntarily and intentionally engaging in predatory, exclusionary, and anticompetitive conduct with the design, purpose, and effect of unlawfully maintaining its market and/or monopolistic power.»