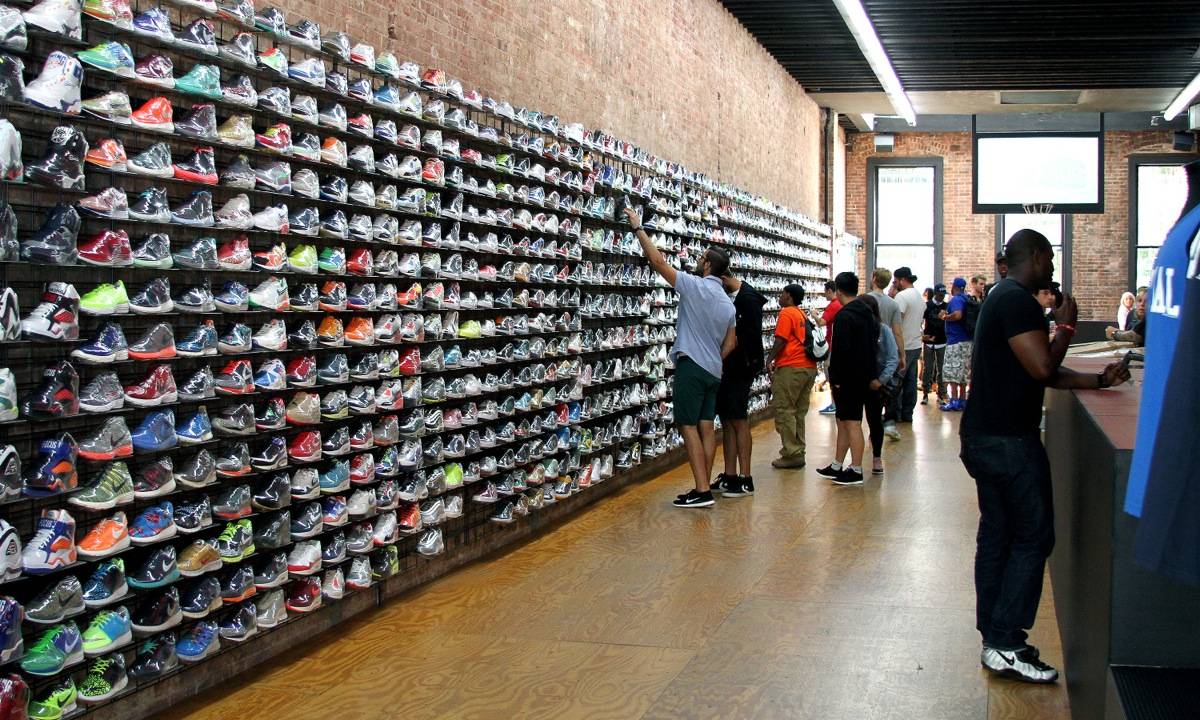

Foot Locker Invests $100 Million In The Sneaker Resell Market The most important investment in the history of the company

Foot Locker in 45 years of activity has become the leading sneakers and sportswear retailer in the world with an annual turnover of almost $8 billion.

Founded in 1974, the first store opened in Industry, California, now the company has 3200 stores in 27 countries.

Richard Johnson, Foot Locker CEO, said that the company's new goal is to continue to "inspire and empower youth culture" and in this sense the Californian company has announced an investment of $100 million in GOAT Group, that controls two of the most important brands in sneakers secondary market, GOAT and Flight Club.

"We want to create a more seamless, frictionless experience for our customer that wants to partake in the secondary market. The partnering with GOAT strengthens our relationship and engagement with our customer"

These are Johnson's words, company CEO since 2014, commenting on the news of the most impressive investment in the Fooot Locker history.

The story of GOAT, acronym of Gratest of All Time, begins in 2003, when Daishin Sugano, a student from Berkeley, bought a pair of Air Jordan 5 "Grapes" on Ebay, which turned out to be fake. At that point, together with one of his university mates, Eddy Lu, they had the idea of carrying out a process of authentication for the resale of sneakers. Two years later, in 2005, GOAT was born, which started the sneaker resell market, which at the moment is worth millions and millions dollars, as the entry of Foot Locker in the group shows.

In February 2018, GOAT incorporated Flight Club and its 3 stores (New York, Los Angeles and Miami), by 60 million dollars.

According to Recode, GOAT Gruop, after the 2018 investment, would have a value of $250 million. Foot Locker's strong and strategic entry could have increased GOAT's valuation up to 550 million. One of the two founders of GOAT, Eddy Lu, commented the investment:

"We want to use the investment to create a better experience for our customers and sellers all over the world"

The Foot Locker investment could revolutionize the relationship between buyers and sellers of GOAT, considering the fact that the Californian company stores all over the world could become physical points of reference for all those who want to sell or appear a sold out shoe, at a higher price obviously.

The economic impact of the sneaker resell world has been devastating in recent years, estimates ranging between 3 and 10 billion dollars worldwide.

The economic interest in the world of the resell market come now from every side: Farfetch, online sales platform of luxury products of the fashion world from over 700 stores in the world, bought Stadium Goods in December 2018 for 250 million dollars, Marc Beniof, co-CEO of Salesforce, has invaded 44 million dollars in StockX. The GOAT group, from 2005 to date, has received investments for $ 198 million. These huge increase of investment in the world of resell sums it up the most important investors in the world see a huge and unmissable opportunity to carve out their space in a market in constant and continuous expansion.