Is the diamond market in a crisis? Maybe, they're not forever after all

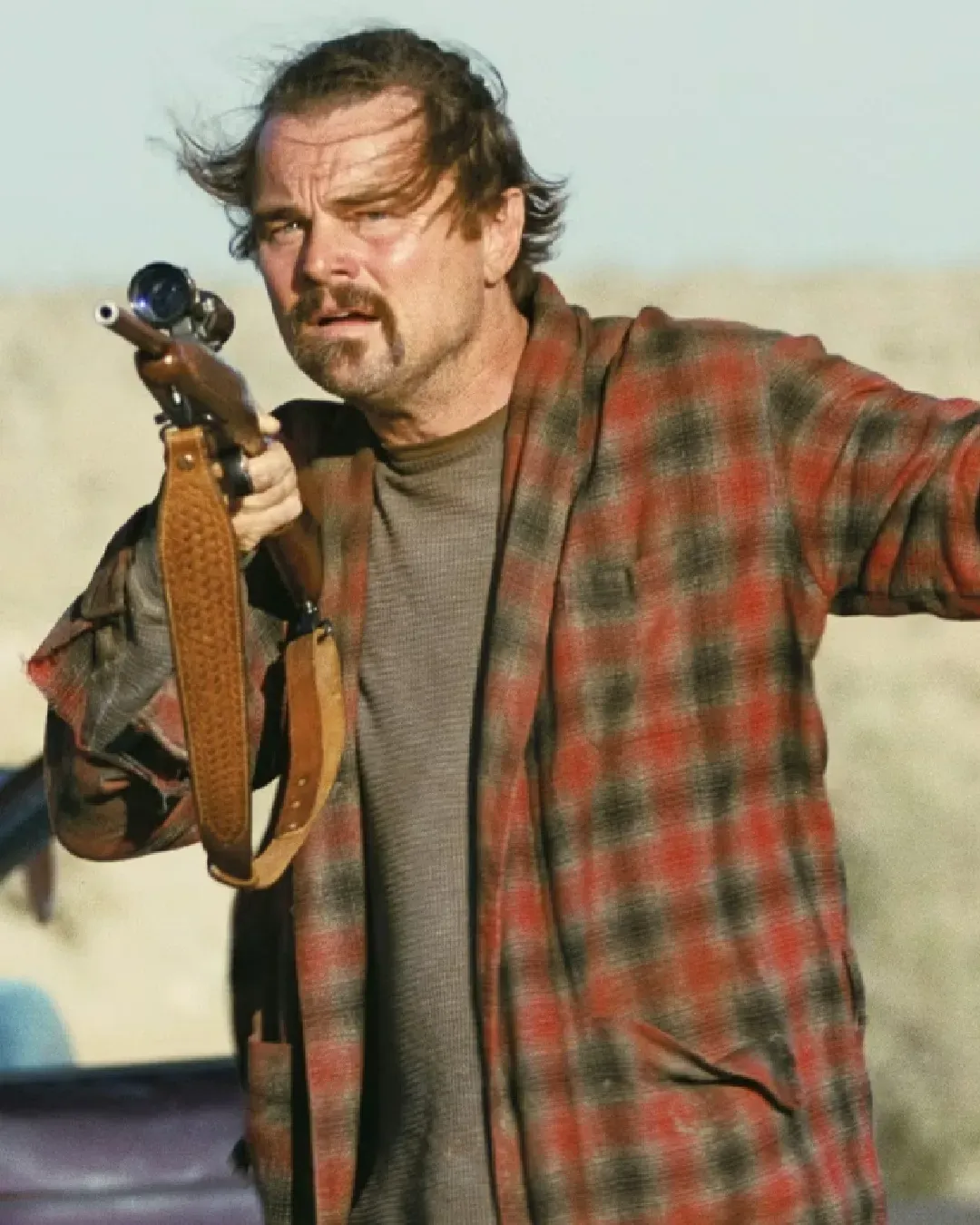

In a move that could change the configuration of the gems and jewelry industry, the mining giant Anglo American has announced plans to sell De Beers, one of the most important and historic diamond mining groups in the world, responsible for producing a third of the rough diamonds in circulation on the market. The divestment will also affect other sectors of Anglo American's business, which aims to streamline its portfolio and focus on extracting metals such as copper and iron to please shareholders in the midst of a market that has proven to be strangely volatile in recent months. The potential sale of De Beers marks a historic milestone for Anglo American, which took full control of the diamond company in 2011 from the Oppenheimer family. Since its founding in the 1920s, De Beers has been the most representative company in the global diamond market: films like Blood Diamond featuring Leonardo DiCaprio referenced the diamond company, and it has also been mentioned in one of the monologues in the recent House of Usher on Netflix. However, despite its storied history in the diamond industry, De Beers is facing a decline in sales, especially in key regions like China and the United States. De Beers reported a significant drop in revenue to $4.3 billion and rough diamond sales to $3.6 billion in 2023. This represents a 19% decrease in sales volume, totaling 24.7 million carats last year. Additionally, news of the divestment led to a decrease of over 3% in Anglo American's stock price. But why does the diamond market appear to be in crisis?

The Diamond Downturn

@ourfuturehq De Beers' $1B+ Strategy: Transforming Diamonds into Symbols of Love #debeers #diamonds #love #industry #storytelling original sound - Our Future

Several years ago, as happened in several other sectors, the pandemic introduced significant volatility into the diamond supply chain. According to Mining.com, in 2020 global diamond production plummeted to its lowest levels since the 1990s, drastically reducing the volume of diamonds entering the market. Although there was a partial recovery from 2021 to 2023, production levels remained substantially lower, between 15 and 30 million carats below pre-pandemic levels. By comparison, global diamond production was estimated at 118 million carats in 2023, up from 110 million in 2020 but still below the 136 million in 2019 and 147 million in 2018. **Diamond demand has also been extremely unstable**. After peaking in 2021 and early 2022, the sector experienced a sharp reversal in trend. The "bullwhip" effect occurred as producers and traders frantically restocked depleted inventories following strong demand in 2021 and early 2022. The oversupply of new goods led rough diamond buyers to drastically reduce purchases by the end of 2023. This demand pullback contributed to **a severe decline in De Beers sales** in the fourth quarter, with a 70% year-over-year decrease, equivalent to an inventory buildup worth about $1 billion. Similarly, the Russian company Alrosa suspended sales in October and November, accumulating a significant unsold stock.

a rare chaotic good thing to do would be to crash the diamond market by making perfect undetectable ones in lab

— Negativity meteor 401k (@qxrvnt) May 10, 2024

2023 was tumultuous, with dramatic price fluctuations and changes in supply and demand dynamics. After reaching its peak in the first quarter of 2022, with prices hitting unprecedented levels according to the Zimnisky Global Rough Diamond Price Index. The decline was not sudden but rather **a gradual descent over the year**, with a 15-20% decrease in the period considered until it collapsed by about 25% from the 2022 highs this year. These sudden drops have also had a profound impact on smaller, independent producers. In late October, **Stornoway Diamonds in Canada declared bankruptcy** for the second time, while South African Petra Diamonds postponed up to $60 million in capital projects, creating further stalls in the supply chain. To complicate matters, synthetic diamonds have become an increasingly viable alternative, now representing about 20% of global diamond jewelry demand. Although their acceptance is not yet complete, they have created another market segment in direct competition with natural diamonds. In response to the slow market, De Beers implemented one of the most significant price cuts in its recent history in January 2024. This strategic decision aimed to revive sales after a setback in the second half of 2023. Price adjustments include a general 10% reduction and deeper cuts of 25% for certain larger stones – **a perhaps drastic move** that underscored the urgency the company had in stabilizing the market and rekindling public interest.

What Happens Next?

Although De Beers is seeking a $40 billion valuation, and therefore represents a titanic presence in the industry, **no ship is so big that it cannot sink** – or at least malfunction. The collapse in diamond prices has coincided with a halt in the growth of the entire luxury market as China's recovery has been lackluster so far and demand from US consumers has cooled, with a value loss of over $100 billion since mid-April. Similarly, Richemont, owner of Cartier, reported an unexpected profit decline attributed to reduced revenues from luxury watches and limited spending by high-end consumers. But the vulnerabilities of diamonds are perhaps specific to the industry. As explained by Fortune, De Beers conducts **ten annual sales** where buyers, known as *sightholders*, are forced to accept prices and quantities set by the company. When the cost of diamonds rises, sightholders tend to speculate by anticipating further increases, practices that are vulnerable to speculative bubbles, which burst when consumer demand decreases. De Beers reported **a relative improvement** in diamond sales during its third rough diamond sales cycle of the year, totaling, according to Rapaport, $445 million in April, representing an 18% decrease from the same period in 2023. However, this figure marks **a 3% increase** from the second sales cycle and a 19% increase from the January sight. De Beers' latest results, released on February 22, still reveal a challenging scenario: **revenue fell by 36% to $4.27 billion in 2023** compared to previous periods. This revenue decline was accompanied by a significant decrease in overall sales volume, which dropped by 19% to 24.7 million carats. Additionally, the average diamond price underwent a decline, falling by 25% to $147 per carat.