Is the Kering group preparing to acquire another Italian brand? Gucci's extraordinary success could influence the group's strategy in the coming months

The Kering group's second quarterly report for 2021 indicated a 159.5% growth in net profits – marking a complete recovery from the crisis into which the lockdown had thrown the luxury sector thanks to a recovery in retail in North America and asia. What is very interesting, however, is that, in the middle of the Kering portfolio, Gucci's profits jumped by 86%, beating the already optimistic predictions of analysts and bringing, by itself, an increase in revenue for the entire group of 11.2%. Gucci's extraordinary results are not only a positive sign for the group's investors, which took a few more months to recover from the 2020 crisis, but signaled a new role of absolute protagonism that Gucci has within Kering. Gucci in fact generated more than 80% of Kering's total operating revenue last year – effectively making the group dependent on its performance but also giving it enough financial power to launch into a new acquisition, especially at a commercially eventful historical juncture like this.

Is Kering preparing for a new acquisition?

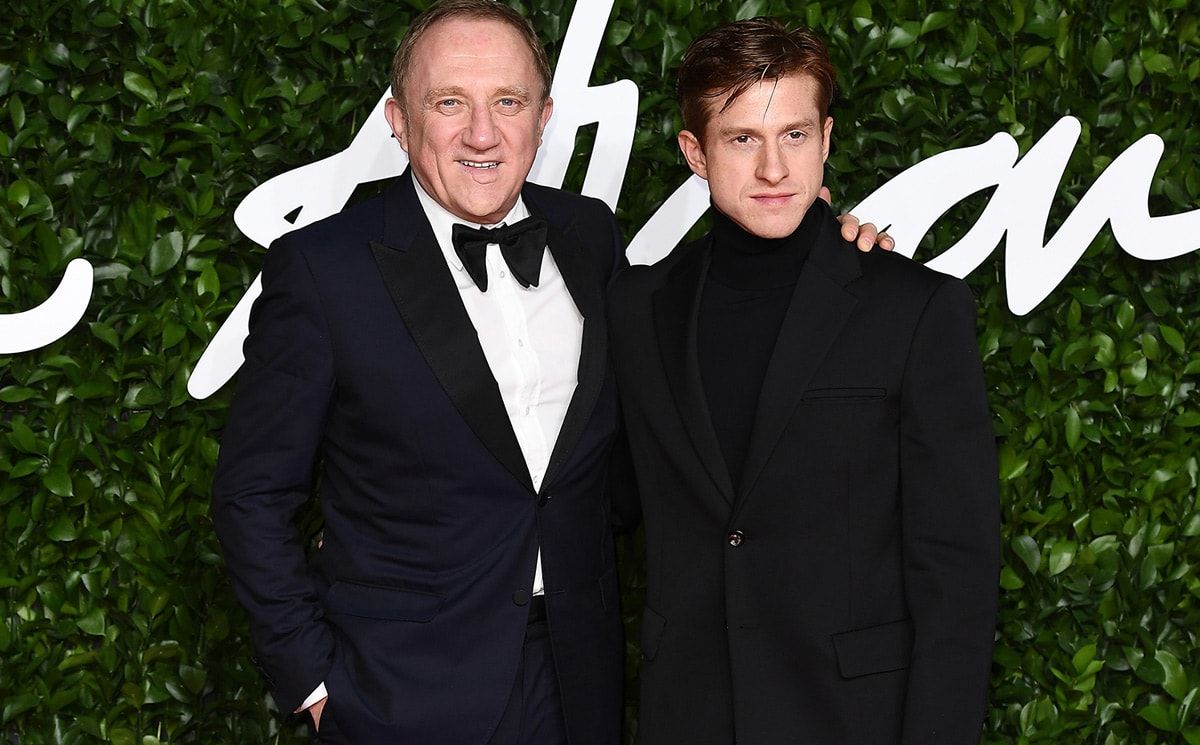

These results not only make the idea of an acquisition increasingly concrete, as confirmed in April by CEO Pinault and occurred with the acquisition of the eyewear brand Lindberg, but also make the group's entry into the ecosystem of Italian fashion brands increasingly plausible, which in recent months is experiencing an intense period of acquisitions, mergers and repositionings. But what are the brands that Kering could try to acquire? According to independent journalist Astrid Wendlandt, a potential future acquisition could be Burberry, a brand that could benefit from an international platform and above all from delisting.

Other potential brands that could end up on the market, as written by Business of Fashion, could be Valentino, currently owned by the Qatari royal family through the Mayhoola investment fund, but also Salvatore Ferragamo, who according to some rumors would be about to sell to new investors part of the control of the company, 70% owned by the Ferragamo family but which will certainly wait some more time before considering an acquisition considered the imminent the arrival of the new CEO Marco Gobbetti. The fact that another Italian heritage brand is passing into French hands is not unheard of considering how, just this year, a majority stake in Etro was acquired by L Catterton, LVMH's private equity fund. Yet whatever design Kering has in mind, he will have to face the increasingly insistent idea of a large Italian luxury conglomerate – an area that has seen an important movement in recent months, especially with regard to the potential deal between Exor and Armani.

The comeback of Italian luxury

According to anonymous sources cited by Astrid Wendlandt, the deal between Armani and the Agnelli could in fact see the light as early as September. If this were the case, the Italian luxury fashion landscape could change forever, even if, as we said, the last few months have been full of significant events: recently, for example, Ermenegildo Zegna was listed on the New York Stock Exchange for 3.2 billion dollars; last year, however, Moncler added Stone Island to its family and recorded revenue growth of 118% in the second quarter of 2021 compared to last year; then there is the OTB group that relaunched Diesel and acquired Jil Sander and Claudio Antonioli of the New Guards Group which acquired Ann Demeulemeester.

However, the Italian market is still rich in brands owned by the founding families, such as Prada, Salvatore Ferragamo, Missoni, Brunello Cucinelli and Dolce &Gabbana, which will now have to navigate between the new challenges posed by a market increasingly dominated by multi-brand conglomerates also facing the thorny issue of succession. All of these companies may want to look for a common platform that creates a more robust business and financial structure for each of the individual companies – and Kering itself could be an interested buyer, considering how, both according to Renzo Rosso and Remo Ruffini, the birth of a confederation of the great Italian brands still seems far away, even if there is the shared value of Made in Italy that has motivated, for example, both the union of Stone Island and Moncler and the co-participation of Prada and Ermenegildo Zegna in the acquisition of one of the most important cashmere factories in the country to protect the Italian production chain.

Precisely in this sense, as an Italian company with an enormous financial capacity, Exor could represent a possible alternative for many brands and a possible acquisition of Armani could give a strong signal of encouragement in this sense, especially considering how Giorgio Armani himself has explicitly said that he does not want his company to end up in foreign hands.