5 macro-trends of the luxury industry for 2021 From China's new rise to the upcoming M&As

If there is anything certain that 2020 has made us understand, it is that the pandemic has played an accelerating role for all ongoing processes.

This is perhaps the main positive outcome of a year in which - according to McKinsey's report - the revenues of the entire industry has fallen by 93% compared to 2019 and pre-crisis activity levels are unlikely to return before the third quarter of 2022. In such an extreme and at the same time unpredictable scenario that none of the great fashion players had predicted, it is important to identify the macro trends that characterize the market in 2021 in order to face the challenges of a year perhaps even more full of surprises and twists than the previous one.

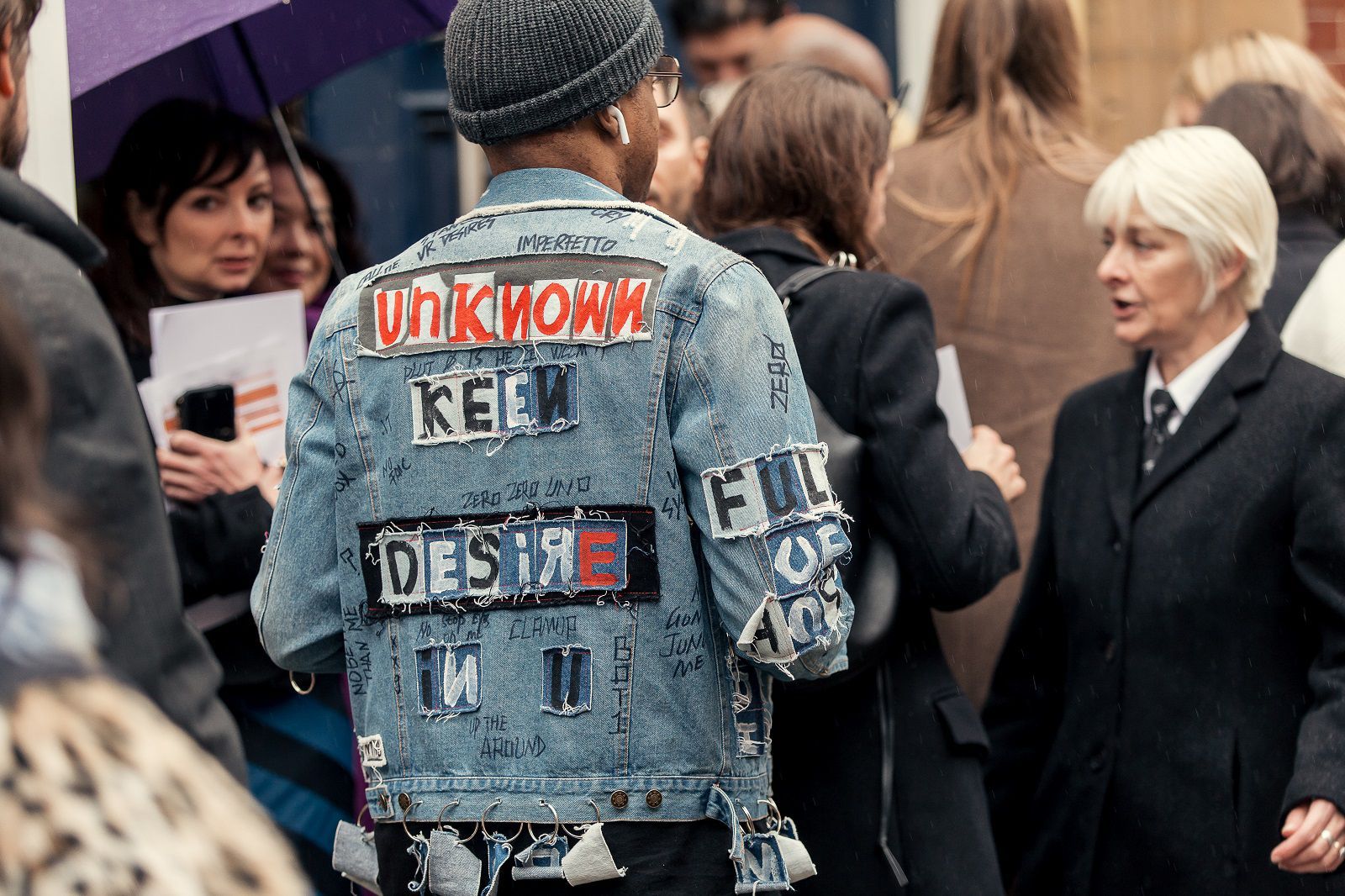

Digital first, but with a human touch

One of the most obvious effects of lockdown was the ecommerce industry's boom. Major players, such as ASOS, FARFETCH, Revolve and Zalando, outperformed in 2020, arriving as early as August they had handled more than 35% more orders than in 2019. However, many brands have understood at their expense that it is not enough to have an e-commerce to make online sales: the shopping experience will necessarily be different from that in the boutique, but it must still represent a special moment in which the consumer manages to get in touch (and in a privileged way) with the storytelling and identity of a brand - in short, a stage in the relationship between brand and customer and not a simple commercial transaction. For this reason it is important to support digital sales both through storytelling and through the improvement of the user experience.

A cutting-edge brand is Gucci, which has experimented with AR and microgaming technologies, but interesting ideas have also been offered by Yeezy with the preview of its new site. Research - at graphic and programming level - will be the key to innovating a strategic and still very homogeneous sector.

China's crucial role

A glaring impact of the pandemic is the collapse of tourism globally and the consequent importance of local markets. The first is China, which many estimates estimate will become the first global apparel market in 2025 or - probably even earlier. Unlike In Europe, the Chinese economy has already rebounded compared to the first wave of Covid-19 and the absence of Chinese tourists in Europe - which in many cases accounted for 35% of sales - highlights the disproportion between China's trade possibilities compared to those of Europe.

On the one hand, therefore, luxury brands will have to find a strategy in Europe to contain the loss of stores and get in touch more with a local public, on the other to develop a series of ad hoc strategies on the Chinese market. Since 2009, when China began building an internal market to make up for the crisis in the West, the main differences have emerged between the "old" European market and the new Chinese market - differences that can be summed up in three points: the rise of Gen Z in China, a generation that grew in consumer welfare with a psychology different from its Western peers; the new ecosystem of Chinese brands that, supported by the national government, are also making room in the West and becoming increasingly valuable "internal" allies; and the extreme segmentation of the nation that rewards more a highly specific and localized type of marketing.

True sustainability, not greenwashing

Beside the preventive measures for Covid-19, sustainability was the hot topic of the year. In the face of the climate emergency, more and more voices have begun to demand a significant implementation of sustainable measures and technologies in the fashion field. A field that saw a huge acceleration in 2020 but that has also been subject to the phenomenon of greenwashing - which occurs when a brand advertises as sustainable or revolutionary initiatives that little or nothing affect its overall ecological footprint. Over the past year, sites like Good On You have increased the accountability of many brands – underlining the ambiguity of their practices and providing accurate information to a much more attentive and demanding generation of consumers than previous ones on the subject.

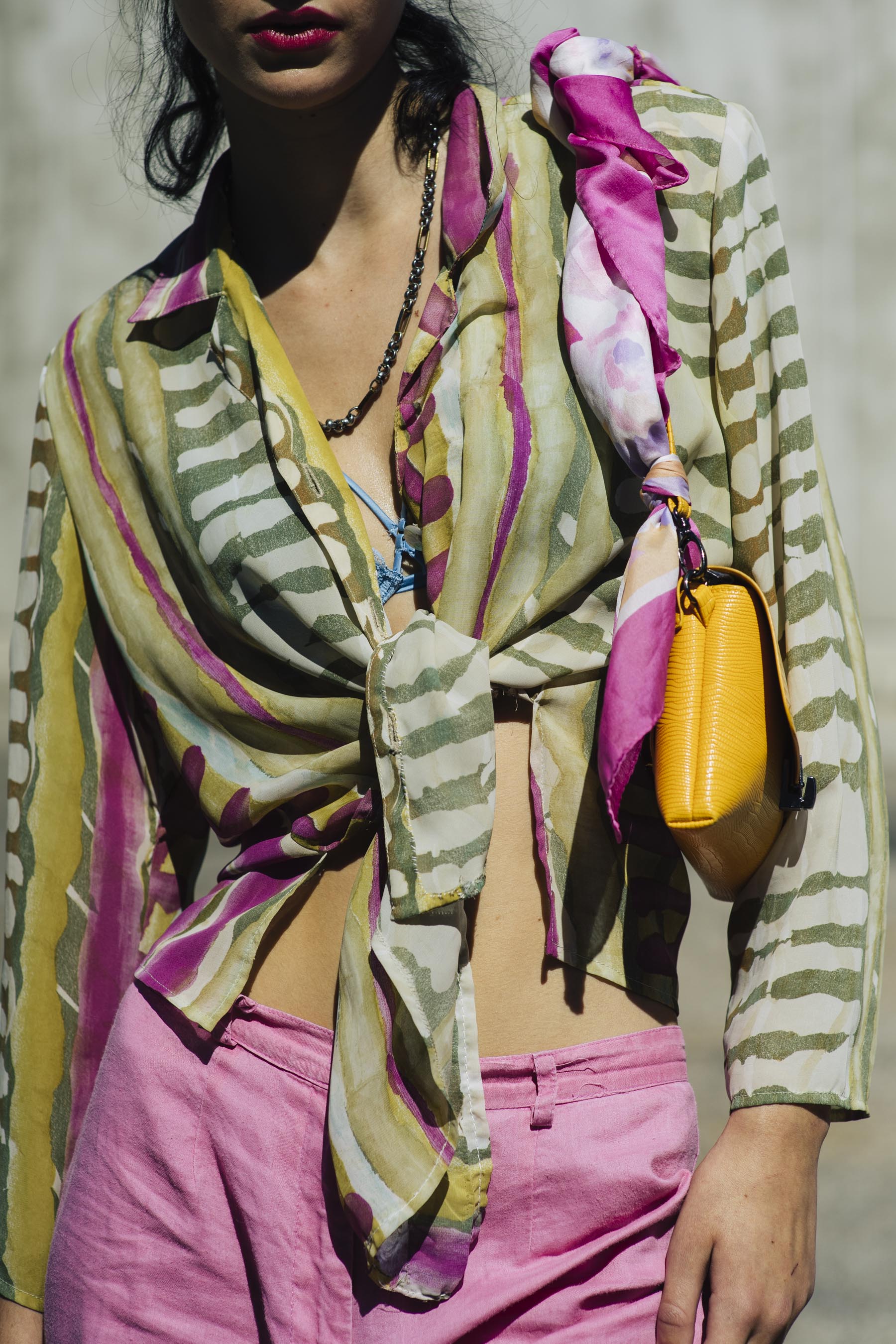

The cross-sectoriality of luxury

Fashion is, by its very nature, the most forward of all luxury companies – a kind of litmus test of economic and social changes. The cross-sectorality experienced by many large brands in the past year has been the main device to circumvent the physical limitations to creative shows and workflows imposed by the pandemic. But in the future the links between the various disciplines as well as between the most "artistic" and the more commercial creative world will become ever closer. Great protagonists of 2020, in this sense, were the car manufacturers, who finally began to change their communication, turning again to Gen Z, which does not buy cars despite the symbolic status vision well built in contemporary pop culture. Virgil Abloh's collaboration with Mercedes, Yohji Yamamoto's collaboration with Lamborghini and maserati's dual "MMXX: Time to be Audaciuos" event, real and virtual, awarded at the Best Event Awards World, are all good examples. Slightly further back, however, Ferrari remained, both in terms of sport and branding.

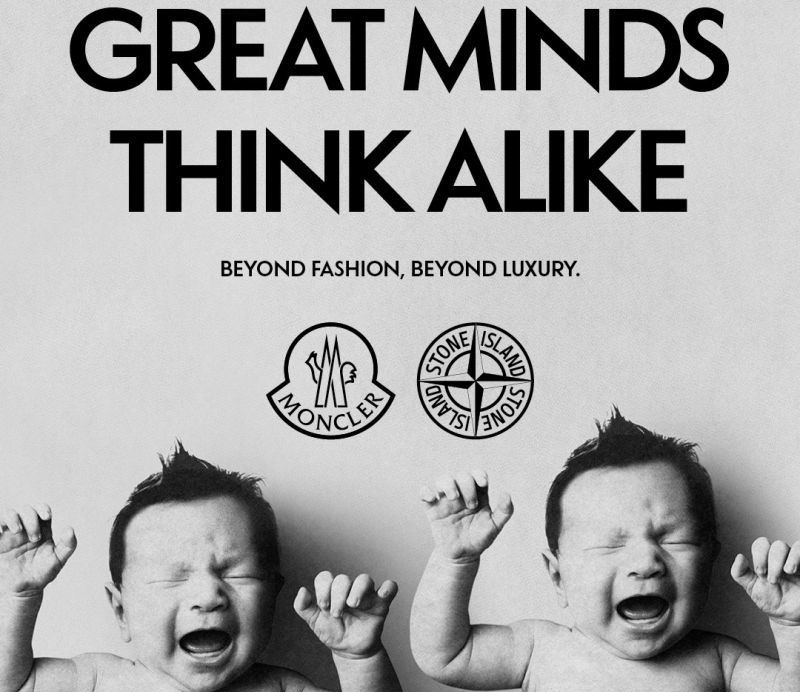

M&A: mergers and the conglomerate model

Like all economic crises, the one caused by the pandemic will leave a polarized scenario, increasing the economic gap between healthy and struggling companies. Three acquisitions totaling nearly $20 billion dominated the last quarter of 2020. The deal of the year was finally finaled in October, when LVMH agreed to pay $15.8 billion for Tiffany, the biggest deal ever made in the luxury industry. In November, VF Corporation, which owns Timberland, Vans and The North Face, bought Supreme for $2.1 billion. And finally, at the beginning of December, there was the all-Italian merger between Moncler and Stone Island for $1.4 billion. There is a clash between mega-conglomerates (LVMH and Kering) ranging from fashion to hospitality through food, and instead those focused on a specific area or type of products, such as the New Guards Group. For the future, the eyes will be on the great players that have remained independent so far: Burberry, Prada and Valentino on everyone.