LVMH has also been hit by the luxury crisis Last quarter they had not grown, now they have really dropped

At first, we were surprised that the sales of the largest giant in the fashion industry did not grow – but now they have actually fallen. In the third quarter of 2024, LVMH recorded a 4.4% drop in revenue, failing to meet market expectations. Total revenue reached 19.07 billion euros in the three months ending on September 30, a figure below the 20.01 billion euros initially estimated by analysts. This decline is particularly due to lower growth in Japan, where the yen recovered value after a period of weakness leading to a halt in the wild shopping spree of bargain-hunting tourists. Excluding the impact of currency fluctuations, sales decreased by 3% compared to the previous year, indicating a slowdown from the second quarter when organic revenues had increased by 1%, a figure that already suggested a near-stagnation. The key fashion and leather goods division posted sales of 9.15 billion euros in the third quarter, down 5% on an annual basis and well below the Visible Alpha analysts' forecast, which had instead estimated a 1% increase. Organic sales of watches and jewelry were also down 4%, while the wines and spirits sector saw a 7% contraction. On the other hand, the perfumes and cosmetics sector saw a 3% increase, and selective retail, including brands like Sephora, recorded a 2% increase.

@quarterchart Louis Vuitton is slowing down? The LVMH group who owns Louis Vuitton, Dior and Tiffany among other brands miss on revenue for the first half of 2024 and the stock went down 7%. The company reported a revenue of $45.2B down 1% YoY. This is mostly due to Asia (excluding Japan) where sales are down 14% QoQ on the second quarter. Hermès also reported during the week and didn’t see a revenue slowdown.

original sound - Quarter Chart

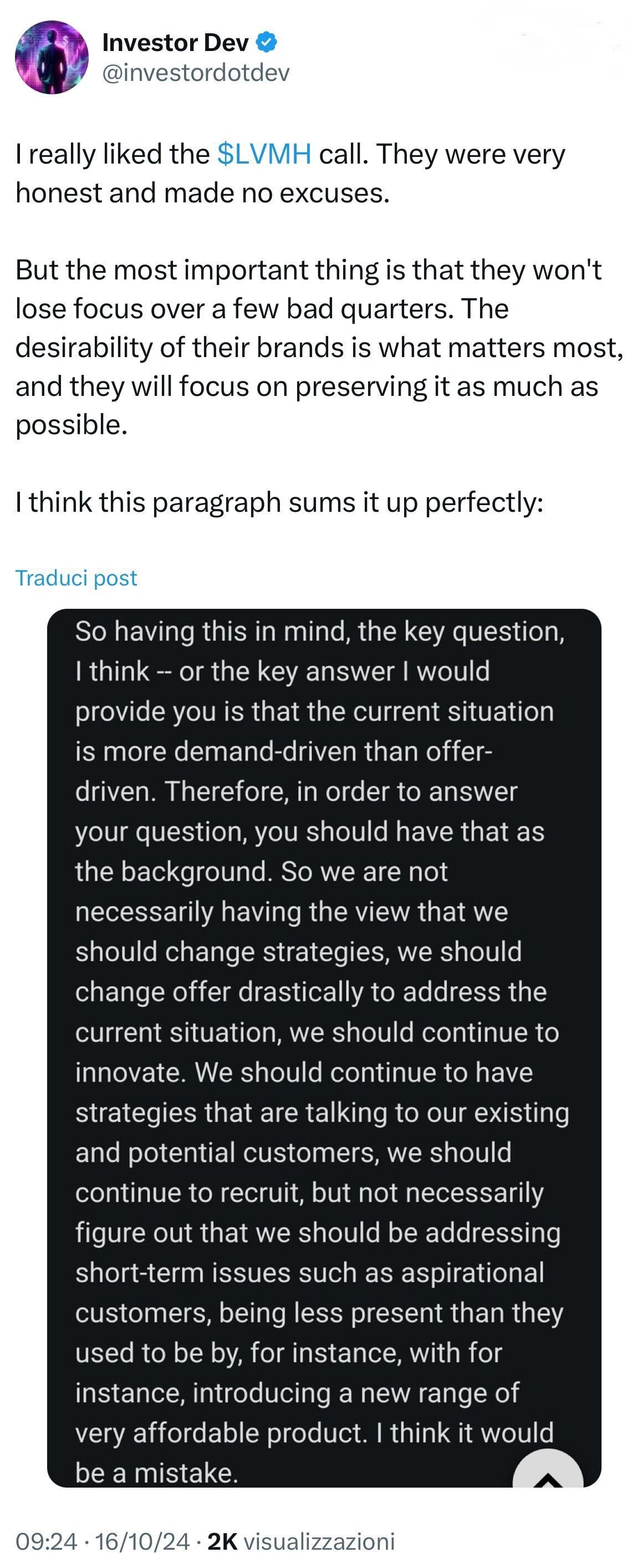

Despite the uncertain economic climate, LVMH expressed confidence in its strategy, always focused on increasing the desirability of its brands and the quality of its products. The company expressed confidence in maintaining global leadership in the luxury sector even in 2024: while other groups are growing, some very well, they would hardly reach the scale of Bernard Arnault's titan. LVMH also emphasized the importance of the Chinese market, which, although currently experiencing an economic downturn with growth below 5%, remains a significant driver for luxury consumption. Analyzing regional performance, there was a 16% decrease in sales in Asia (excluding Japan), while the U.S. market remained stable. In Europe, sales increased by 2%, and Japan saw a significant 20% increase. Chief Financial Officer Jean-Jacques Guiony stated that, despite economic challenges and low consumer confidence in China, Chinese demand for luxury products remains solid. On the corporate strategy front, Guiony ruled out that the current luxury market slowdown is linked to the price increases implemented in recent years, emphasizing that the products sold in 2024 are very different from those in 2019 and that the price increase is mainly due to an improvement in the product mix rather than a pure price hike strategy. Finally, Guiony stated that the current downturn is of a cyclical nature and is therefore expected to pass, and the group is optimistic about the future of the luxury sector, driven by the growth of the upper middle class in China and other emerging markets.

The issue of prices is perhaps the most debated point of contention. It is clear that LVMH's management categorically excludes this as a problem, as the group’s policy wouldn’t allow price reductions even if they wanted to — especially now that overproduced and undersold products are accumulating in warehouses around the world. In this phase of crisis, it is better to hold on to existing customers rather than trying to attract new ones by lowering prices and opening the gates of the kingdom to “aspirational” buyers. Meanwhile, the unsold product stacks are quietly channeled through outlets, sample sales, and, of course, the gray market that many brands have recently begun to handle themselves. Now the issue is finding another high-volume market that can absorb enough sales to return the fashion brands’ growth rates to positive figures. Projections suggest that China could recover by 2025, but the feeling is that, even if the economic winds turn favorable again, a fundamental cultural shift has occurred here, characterized by luxury shame, a preference for local brands, a nationalistic focus on consumption, and also, on the brands’ part, that they have reached the critical mass of brand commercialization — a threshold beyond which the sense of excellence is lost, and individual products become mere logo displays for that segment of customers who still believe in their power.

Indeed, one potential problem lies precisely in the matter of cultural capital. Issues with the Chinese market began when a new generation entered the workforce, facing problems and contradictions that have disrupted the flow of capital that once established China’s enormous potential two decades ago. It’s no coincidence that Guiony mentioned hoping for the emergence of a Chinese upper middle class to drive future sales in the country, thus raising the question of which social class has been fueling sales up until now and why it has stopped. Therefore, it would be useful to understand to what extent today’s Chinese Gen Z values the traditional concept of luxury in the first place and to what extent they can actually afford it. It’s certainly noticeable today that there is a lack of a figure capable of acting as a “cultural bridge,” like Virgil Abloh did once sparking the interest of this new generation, which is more cynical, more accustomed to aggressive marketing, but also, on average, poorer, in a form of luxury that, aside from marketing, is doing everything it can to remain as exclusionary (not exclusive) as possible. We may not know the spending habits of the world’s wealthiest and most eccentric individuals, the famous billionaires capable of emptying an entire store on a whim, but we assume that even their wardrobes are becoming too full, their closets redundant with repetitive collections, and their capital increasingly tied up in beauty, travel, and the new biohacking trend.

Deputy Chief Financial Officer Cécile Cabanis downplayed the concerns, explaining: «Overall, demand has been characterized by two opposing trends. On the one hand, Chinese client demand remained fairly dynamic in the first half of the year. However, Chinese consumers are facing increasing macroeconomic headwinds, which, of course, impact their confidence and weigh on their discretionary spending. On the other hand, Western client demand has shown a sequential improvement, albeit a very gradual one, as inflation and interest rates remain high. In a nutshell, the net effect of these two trends was slightly positive in the first half of the year and turned slightly negative in the third quarter». However, this explains LVMH's performance without addressing the general context in which many other brands and groups are also seeing this decline in sales volumes, painting a less relaxed scenario than was discussed during the earnings call.