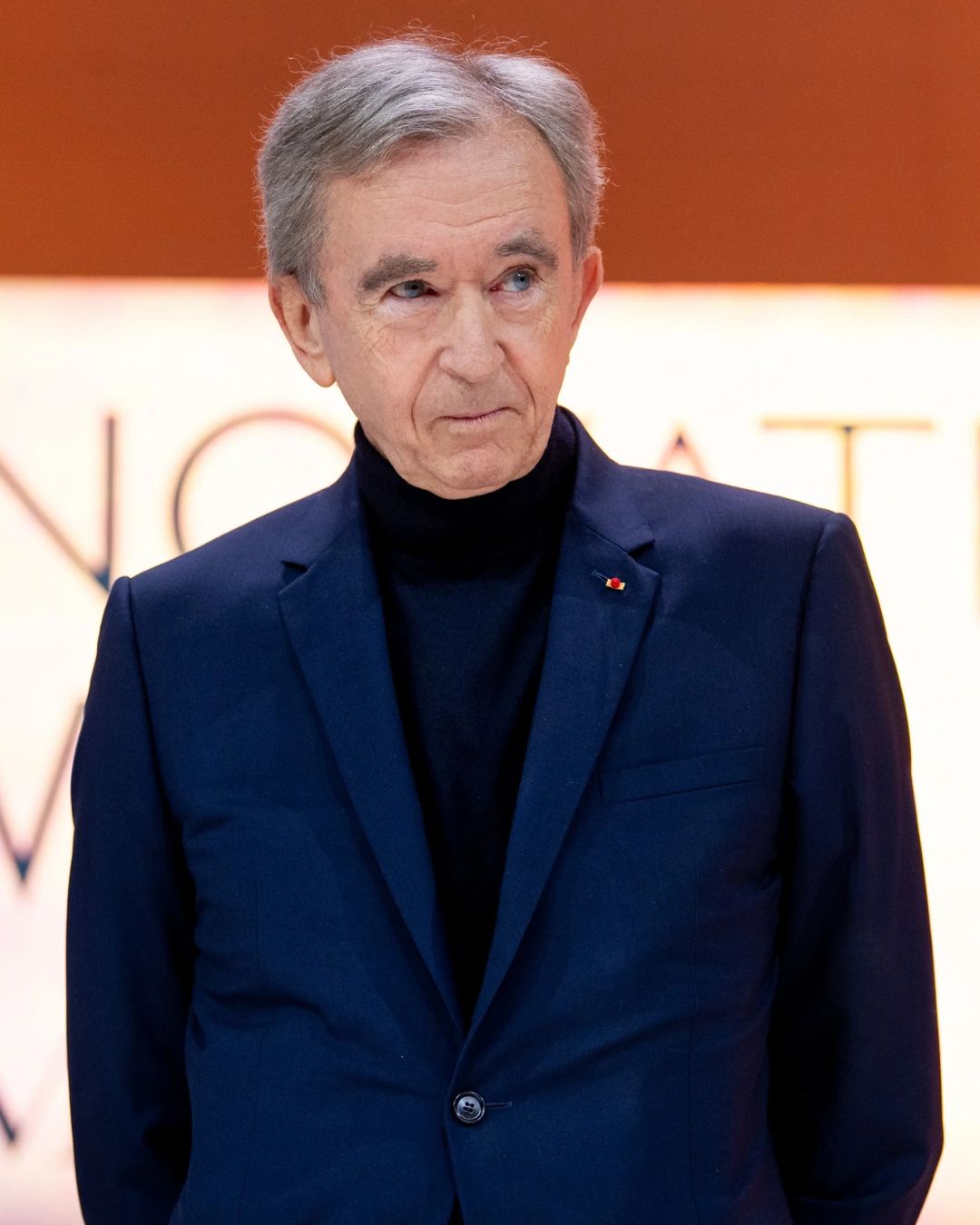

Arnault family spent 1.9 billion on British outlets Their confidence in your shopping is endless

Without missing a beat, even in the height of summer, L Catterton, the private equity firm supported by the LVMH group, has agreed to acquire Hammerson Plc's stake in Value Retail, a company that owns several shopping centers and outlet villages worldwide, including Fidenza Village. A transaction worth 1.9 billion dollars will mark a notable change in the ownership of luxury retail spaces in Europe. The acquisition includes stakes in nine luxury retail properties located outside major European cities, particularly the Bicester shopping village, about 60 miles northwest of London – an outlet that attracts millions of international shoppers each year. The deal will provide Hammerson with 600 million pounds in cash, which will be used to reduce the company's debt in a context of declining retail property rents and values. Following the announcement, Hammerson's shares saw a significant increase, rising by as much as 10.2% in London trading, the largest intraday gain the company has seen in over eight months. The company plans to use up to 140 million pounds of the proceeds to buy back shares, which constitute about 10% of its market capitalization. Additionally, it aims to improve dividend payouts to 80-85% of adjusted earnings.

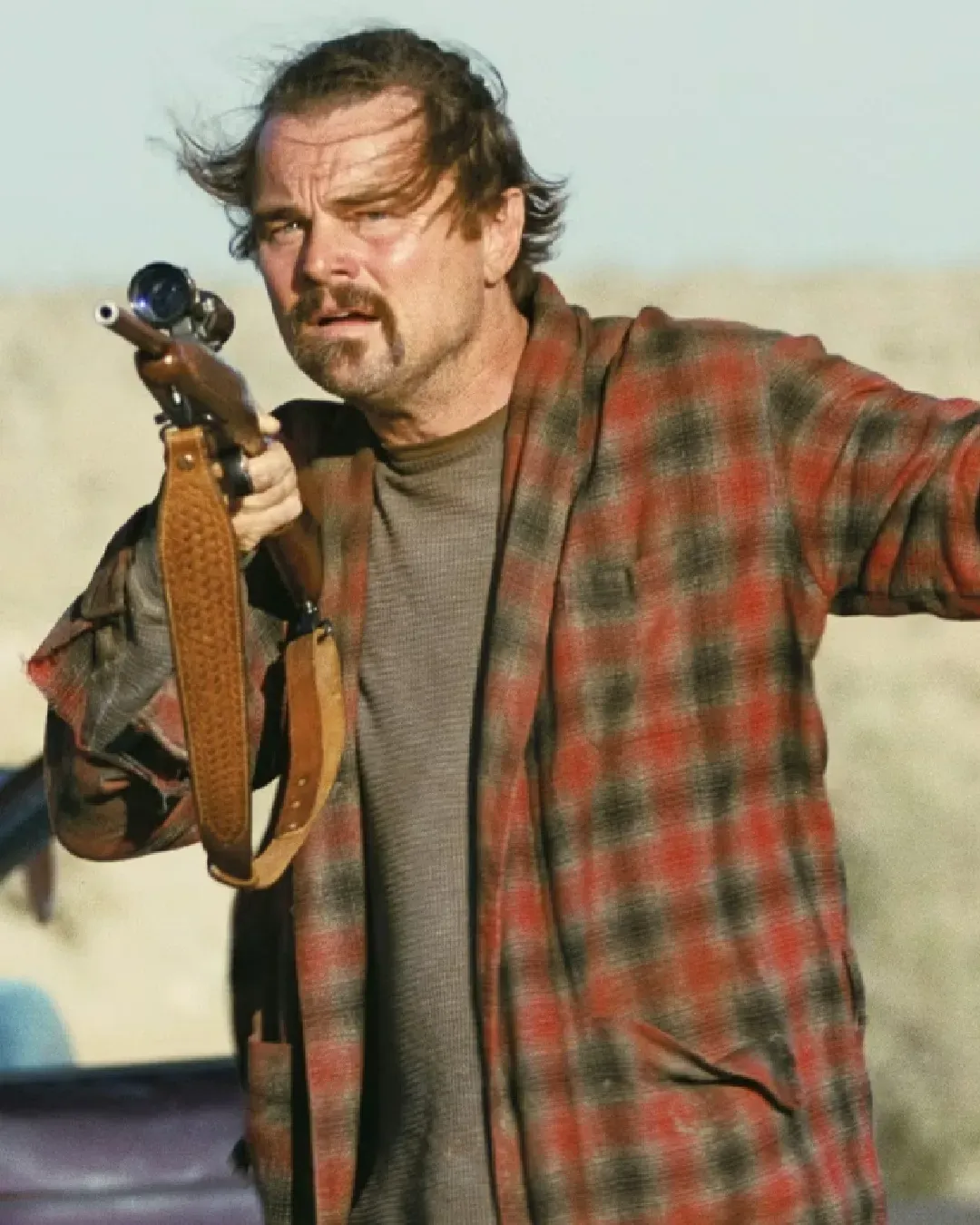

Value Retail, which manages some of the most profitable outlet centers in the face of the rise of online shopping, is now under the majority control of L Catterton. Michael Chu, global co-CEO of L Catterton, expressed enthusiasm for the opportunity to leverage the company's extensive experience in luxury retail to support and grow Value Retail's business. For L Catterton, this acquisition is part of a broader strategy to exert greater control over prime retail locations that includes entities like Sephora and Le Bon Marché Rive Gauche, potentially enhancing the luxury shopping experience in the off-price segment. But what does all this really mean? LVMH is rehearsing the acquisition of outlets. In practice, not only will British consumers give their money to LVMH by shopping in boutiques but also by buying at discounted prices – and we know that the Arnault family does not like prices that are too low. Therefore, it will be necessary to monitor whether outlet prices will rise, whether the phenomenon of lower-quality second lines produced exclusively for outlets (another of the industry's dirty secrets) will take greater hold, and especially whether the acquisition of Value Retail will represent the privatization of a “valve of relief” that allows the mega-group's owners to internally manage the disposal of unsold products and the profit margins derived from their sale.

Certainly, if not a gold mine, there is definitely a gold vein hidden in these outlets. Value Retail has recorded a robust performance, with total brand sales in Europe and China increasing by 16% and a 13.4% increase in visits in 2023. The company's strategy of avoiding e-commerce in favor of superior customer service and unique shopping experiences has proven successful. With the support of L Catterton, Value Retail is ready for further growth, particularly as it prepares to open its first retail project in the United States, Belmont Park Village, in New York this September. In short, the expansion into the off-price world has begun.