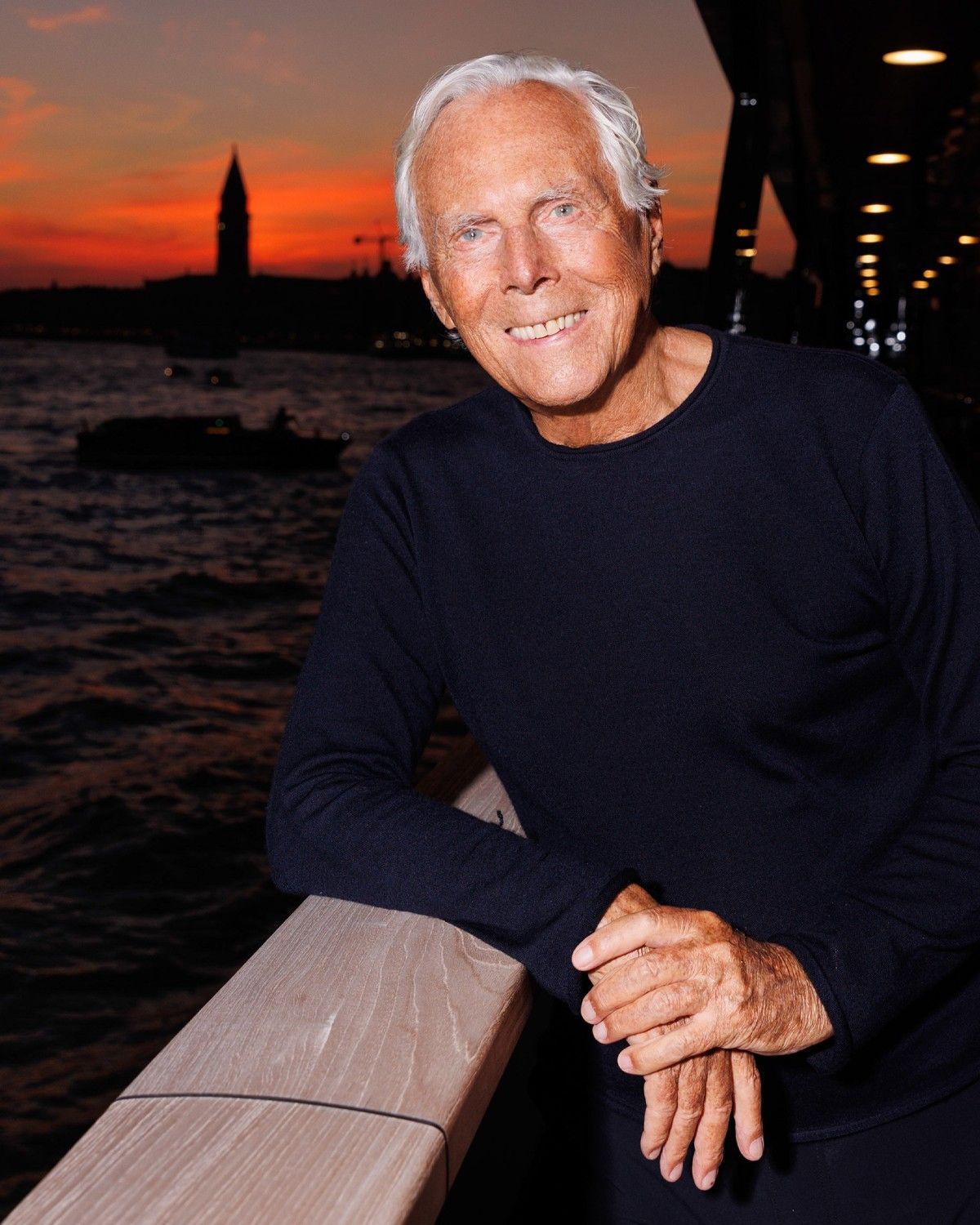

Back when Armani clarified plans for his succession Although many details still remain a well-kept mystery

In April 2024 Giorgio Armani discussed with Bloomberg several considerations about the future of his company, also addressing during the interview the much-debated topic of his own succession. Approaching his ninetieth birthday, Armani openly discussed the possibility of merging with a larger entity or going public: «Independence from large groups could still be a driving value for the Armani Group in the future, but I do not feel like excluding anything. What has always characterized the success of my work is the ability to adapt to changing times». This openness marked a notable change for Armani, who has historically maintained a firm position on keeping the company independent from mergers, listings, and ownership splits that in recent years have reshaped the geography of luxury. But the designer also clarified, to avoid speculation, that: «At the moment I do not foresee an acquisition by a major luxury conglomerate. But, as I said, I don’t want to exclude anything a priori, because that would be an anti-entrepreneurial course of action». Regarding a potential listing, the designer said that «it is something we have not yet discussed, but it is an option that can be considered – hopefully in the distant future». Armani placed great importance on the correlation between corporate values and brand perception: he showed cautious criticism of the French conquest-driven business model, saying he hopes for the «persistence of these values and the preservation of the independence of many of these companies as an essential principle».

Armani’s consideration of a merger or a listing, both options that would imply a decentralization of power, came at a critical time when the industry was witnessing an era of aggressive acquisitions, with major conglomerates like LVMH and Kering expanding their portfolios by acquiring smaller prestigious brands. Nevertheless, Armani’s willingness not to yield to market pressures and the mere logic of profit highlighted the presence of an Italian ecosystem led by family-owned companies such as Prada, Zegna, Moncler, Brunello Cucinelli, or Ferragamo which, even when facing the colossal size of the French mega-conglomerates, resisted and thrived. According to Business Intelligence analysts of the newspaper, Deborah Aitken and Andrea Ferdinando Leggieri, «a price of 8–10 billion euros for Giorgio Armani in case of acquisition or spin-off can be considered reasonable [...]. The gap of over 2 billion euros between the brand’s direct revenues, including licenses, and net revenues (based on 2022) confirms that Armani is highly dependent on licenses, so liquidity could partly be used to bring more licenses in-house, reducing supply chain risk and strengthening brand identity». These 2 billion-plus in revenues (data available from 2022) are significant, but they pale compared to the 80 billion that LVMH can churn out, even in the midst of a spending freeze, even if Armani did not seem enthusiastic about the acquisition policy of these large groups which always brings with it: «an inevitable change in values and a substantial upheaval, style included».

As for the actual succession, Armani spoke of «a group of trusted people close to me and chosen by me» which would seem to confirm what was revealed by Elisa Anzolin of Reuters, who obtained a confidential 2016 document outlining the composition of this group, which includes long-standing collaborators and family members. Nonetheless, the cautious openness the designer expressed on the subject of acquisitions and listings (although it seems between the lines that he only declared himself open to the idea so as not to exclude it categorically) inevitably leads one to consider what the potential advantages of one path or the other might be. A merger, for example, could offer Armani the benefits of scale, increased market penetration, and resource sharing – all crucial elements given the global scope of the commercial landscape we are talking about. By aligning with a larger group, Armani could leverage synergies in areas such as global distribution, marketing, and production while maintaining his design and brand ethics within a conglomerate that respects his unique market position and independence. On the other hand, a listing following the model of Prada or Zegna would provide Armani’s empire with access to the capital needed for expansion while still guaranteeing its independence. Going public could also attract and retain talent by offering stock-based compensation as Amazon already does.

It is clear, however, that all these options involve, as mentioned above, a decentralization of power, especially considering the complex composition of Armani’s business already mentioned by Bloomberg’s two analysts. A merger could, for instance, dilute the central power’s control over both creative direction and operational decisions, putting at risk a very precise identity that Armani has meticulously cultivated for decades. A stock market listing, on the other hand, would subject the company to the pressures and scrutiny of public investors and to market expectations, which could shift the focus from long-term goals to short-term financial metrics – which is precisely why several groups and brands at the moment would like to seek delisting, such as the Tod’s Group. Moreover, the luxury market is sensitive to shifts in consumer perception and brand positioning, and therefore any change in managerial structure or broader corporate strategy (which would include the corporate values underlying the strategy itself) must avoid altering that perception.