Why Shein is becoming an empire The fast fashion giant's reaches new peaks as it awaits its Wall Street listing

When the term "fast fashion" is pronounced, the mountains of clothes in the Chilean desert come to mind, the protests of underpaid workers in the factories of Dhaka, and a series of clothing items that reproduce the latest trends in polyester. In recent years, packages with the zip of Shein have been added to the list, along with all the controversies surrounding the Chinese brand. The formula that has made the brand a giant in "fast" fashion production is simple: selling objects and clothes at more than affordable prices, to the detriment of the planet and human rights, as well as the health and safety of its workers. This year, the paradox that afflicts the world of shopping is growing even more: second-hand is spreading three times faster than the global clothing market, but Shein has seen its profits more than double, reaching $2 billion compared to the $700 million in 2022, according to revelations from the Financial Times.

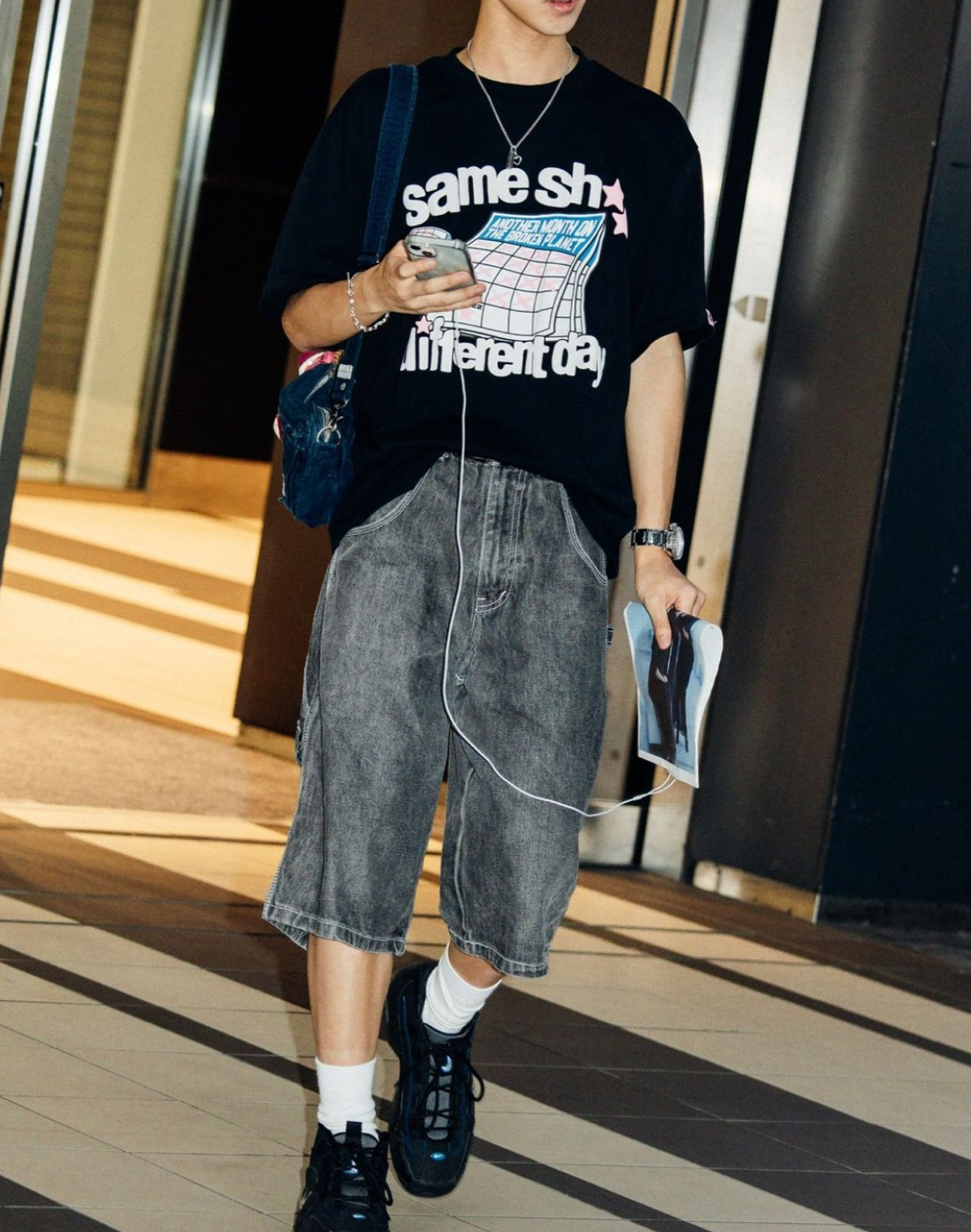

If research like that published by ThredUp shows that more and more people consider the intrinsic value of a garment before purchasing, Shein's successes prove that consumers haven't stopped investing in fast fashion to prefer vintage or sustainable products: they've just started buying more. Despite everything suggesting that the target of the Chinese platform is Gen Z, as reported by the same Financial Times and other journalistic outlets, recent research shows that Shein's average customer is a 35-year-old woman who spends more time shopping than most of the population. What made Shein the world's most famous fashion brand was not the young people, but the adults trapped between commitments and the high cost of living, between the stress of not being able to afford quality clothing at affordable prices and the speed of a service that doesn't discriminate. Functioning like Amazon, with a huge online market where between 2,000 and 10,000 new models are added daily, the business works with 6,000 clothing factories in China and software to calculate which items are in demand and which are not. Now, Shein is awaiting regulatory approval from Beijing to be listed in New York or London, but the fast fashion giant's power grab is already underway in the United States, having already invested $2 million in lobbying activities in Washington.