Why fashion still needs the middle class You can live on billionaires alone

The data has been circulating for several years, but many only took notice when Il Corriere della Sera reported it at the beginning of the month: every year in Italy, 200 billion euros in wealth are transferred through inheritances and wills, a record in Europe. But it's a story we all know because we've lived it: almost every Italian Millennial tends to be amazed at how their grandparents, and even their parents, managed to support a family, even a large one, and buy houses with salaries that were normal back then but meager today. Those good times we think of, spanning from the 1970s to the early 1990s, represented a period when the Italian middle class was at its peak - a time that fundamentally ended in 2008 without returning, bringing us now to a new era where 5% of families own 46% of the wealth and the gap between social classes is wider than ever, according to a recent OECD report; for instance, 40% of European families are financially vulnerable. However, this isn't the case everywhere. According to data from Visual Capitalist reported by Il Sole24 Ore, approximately 113 million people are expected to join the middle class in 2024, 81% of whom reside in Asia: primarily in India and China, accounting for 57% of the "block," followed by Indonesia and Bangladesh. In comparison, Europe and North America will contribute only 5 million people to the middle class over the year. In other words, social mobility in the West is a joke. But what does this matter to fashion?

International Hunt for Aspirational Customers

@loveluxury.co.uk What colour Birkin would you get? #birkin #blue #client #uae original sound - LoveLuxury

For years, the fashion industry has targeted the ultra-rich of this world, but it needs the middle class. Or, at least, the higher echelon of the middle class: those who buy a designer bag for a special occasion, who enter a boutique to purchase a belt, a t-shirt, or a wallet, and who, in general, aspire to the lives of millionaires/billionaires without being one. These occasional sales of products, so to speak, less demanding actually represent a significant volume, the sudden absence of which in recent years, due to both rising prices and a shift in spending towards experiences rather than luxury goods, has weighed heavily on brands. This has led to two reactions from the fashion industry: the first was to focus all attention on the few remaining ultra-rich who buy regularly and without much concern for the price (according to Bain, in 2023, 5% of consumers generated 40% of luxury sales), and the second was to chase the vanished middle class in Europe through various emerging markets - China, historically, but now also India where the advancement of a new middle class, whose volume will increase from 60 to 100 million individuals in the next three years, and a spending that will hover around 30 billion euros by 2030. And perhaps that is why L Catterton, one of the "arms" of LVMH, announced today the formation of a new joint venture with Indian tycoon Sanji Mehta to work on investments in the country.

LVMH consolidated luxury to a point where we don't have luxury anymore. Last man standing is Hermès and a couple of diamond dealers against cookie-cutter commodity chic that is bankrupting the middle class and forcing wealthy people shop for vintage and employing a tailor

— Blair Dulder CPA (@runaway_vol) March 24, 2024

But recently, even Australia, particularly the rich mining and oil region centered around Perth, has become a new attractive hub for luxury investments. Nevertheless, this is because the wealthiest class has expanded, not the middle class. According to Tanya Tindall, general manager of the local company Kailis Jewelery, interviewed by BoF: «There’s definitely a bubble not impacted by any cost-of-living [crisis] issues. The aspirational customer is the one who is still struggling. One who’s aspiring to that entry-level $1,000 silver piece is a harder sale than for somebody who wants to buy that $5,000 to $10,000 necklace». The fashion industry relies on this upper-middle-class clientele. In India, the growth of individual wealth should generate the so-called "wealth effect" - that behavioral phenomenon where the perception of economic well-being encourages spending, creating virtuous cycles excellent for luxury businesses. However, the aspirational customer (even though on average wealthier than the typical middle-class exponent since, on average, they spend between €3,000 and €10,000 annually on luxury items) has become an increasingly multifaceted entity that according to a recent McKinsey study can have an age range between 20 and 50 years - although they are usually more mature - but there is also a 26% of consumers in their forties who spend an average of €3,000 per year on luxury items with care. Regardless of the composition of this somewhat undefined but spending-power-endowed group, its importance is established: according to McKinsey, these "average" consumers represent 18% of total luxury sales – a turnover of €273 billion annually.

A tiring, tired luxury

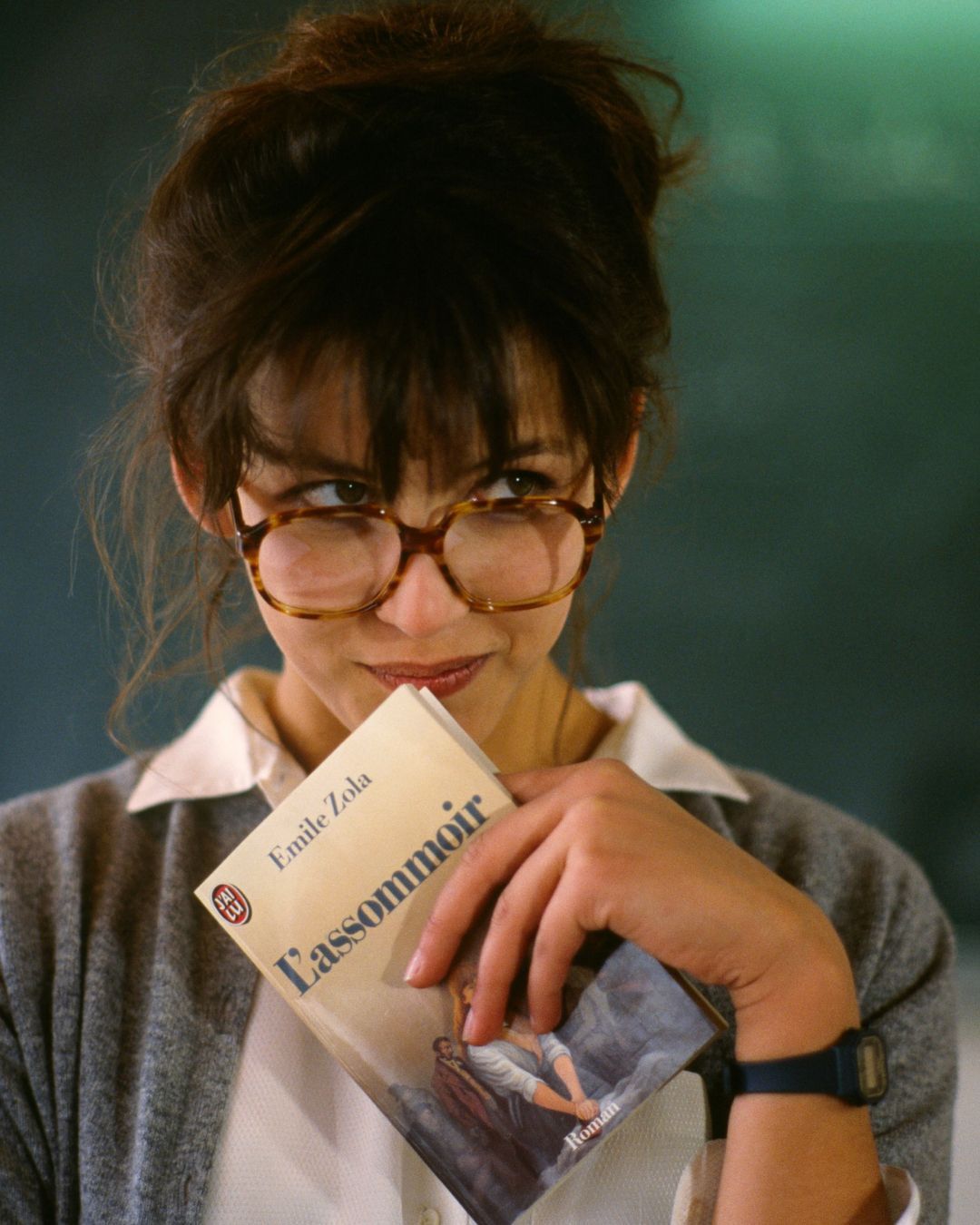

Therefore, there is still a need for a middle class: if not for the increasingly unattainable world of luxury, then at least for all the rest. In recent days, Diet Prada has posted on Instagram a harsh condemnation of the extreme excessiveness of luxury items such as a Hermès straw bag where you can't even choose the color for $10,000, a Saint Laurent faux fur for $15,000, and a pair of Chanel flip-flops for nearly a thousand dollars - in addition to the already famous silk dress by Chloé for over $26,000. The comments under the post are revealing. The creative director of Nomadic Collector, Stefani Mitchell, wrote: «Is any of this actually luxury? If it’s still mass produced, I mean if they dispose of nearly $7B worth of product yearly, if they don’t pay workers? The original houses were luxury - made by artisans and families who’s craft was part of their legacy. What is being discussed here is just over priced mass produced products using the names of long dead masters and marketing to deceive “consumers”. Real luxury is the handmade caftan you pick up at the 100 year old stall in the fez medina on a trip or the small batch cheddar from upstate New York. Luxury means you know the hands that made it. The source is key».

These earrings are METAL with GOLD COLOR FINISH for $715 like not an ounce of real gold for $715? pic.twitter.com/bd4Gh23Qn6

— Budget Side Hustle (@bimbudgeting) December 9, 2023

Another Norwegian gentleman wrote that brands «made it embarassing to be 'aspirational', so I’m now supporting more local 'luxury' brands»; a sentiment echoed by model and influencer Brett Staniland who added: «I’m also fed up of fashion brands selling shoes for obscene money when all the actual shoe makers in Northampton, England from brands that are basically 200 years old are making shoes that will last forever, and which most of these fashion shoes are based on, for around 70% less than these».

A Emerging New Paradigm

Who’s wearing Todd Snyder?? Reveal yourselves!! $4M to $100M in revenue in 9 years???

— LT (@michelinmillen) March 22, 2024

But change is beginning to arrive (or emerge, given that it arrived long ago) even in fashion itself, where a new wave of brands is emerging that want to dress the public without making them take out a mortgage. A few months ago, Jacob Gallagher of WSJ wrote a profile of designer Todd Snyder who went from four million dollars in sales in 2015 to a hundred million dollars in 2023 and is also expanding with great momentum. The article discusses how this expansion is based on the «increasingly vacant center of the apparel market» populated by «white-collar workers—bankers, tech entrepreneurs and marketing professionals—who strive to be better than the Gap, but not as ostentatious (or expensive) as Gucci». Highlighting how Snyder has positioned himself as a prestigious commercial offer capable of generating loyalty but making himself accessible to a type of clientele that, if it were Italy, would extend well beyond metropolitan luxury consumers reaching the wealthy bourgeois of the provinces who, in numbers and spending power, are perfectly capable of supporting the success of a brand. In Italy, we know such brands well, even if we associate them more with simple clothing than with fashion: Pinko for example closed 2022 with €285 million in revenue and expected, last year, to close 2023 with €330 million, while Fabiana Filippi, now present in over 30 countries with 1300 Multibrand and 48 monobrand stores, closed 2022 with over €71 million in revenue - in short, the world of middle-class brands already exists, it just needs distinctive aesthetics and narratives somewhat like Stussy did decades ago, which should be the benchmark for the success of these brands.

@drewjoiner A closer look at Our Legacy #fashion #fashiontiktok #ourlegacy #summerfashion #digitaldenim #fashiontrends cherry blossoms - narpy

All indications suggest that the new luxury (at least for those living outside the top 1% and not buying second-hand luxury items) will increasingly be represented by a wave of brands that grow exponentially after adopting former luxury prices: Our Legacy, whose turnover has tripled in four years and will total, according to estimates, €40 million in sales in just the first half of 2024, on average costs half or less than half of a traditional luxury brand today; the same goes for Charles Jeffrey Loverboy or Heliot Emil who sign collaborations, show at fashion week, and generally have a vitality and contemporaneity that normal luxury has long forgotten with accessible prices for an upper-middle-class customer but never as absurd and unthinkable as those of Hermès; finally, during the last Milan Fashion Week for men, Chaz Jordan, already founder of Ih Nom Uh Nit, launched 1989 Studio, a brand born with the idea of «bringing an high level of products to a consumer that is now price conscious and price sensitive». Here's how Jordan spoke about his decision to make his products more accessible: «This has been the sentiment for quite some time. It's just the people didn't care what the price was as long as it had a name associated with the the brand. But now that the maisons are starting to lose a bit of that spark and that creativity, the consumers are focusing on other things in the market that speak more to them as individuals. And I think having accessible prices is a bonus because the previous luxury customer is looking for new brands. […] So I think now it's appeal to the luxury sensibility in terms of style, in terms of execution, in terms of presentation. But then make it affordable for those who aspire to have it».