Is winter coming for luxury sales? Revenue drops everywhere - but Hermes remains invicible

There is concern in the luxury world. Between a general reshuffling of creative directors, an attempt by each company to reposition itself in the market by simply raising prices, a divided and complex socio-political scenario and the economic wobbles of all luxury markets except Japan, the winds of winter are blowing coldly over the fashion industry. The post-pandemic luxury sales boom has given way to a period of uncertainty, leading many to wonder whether an ice age is on the way and, if so, how long it might last. LVMH, perhaps the most prominent player in the luxury sector, reported 9% growth in the third quarter for its fashion and leather goods unit, Louis Vuitton and Dior. Although this growth figure was positive, it marked a slowdown from the more robust performance in the first half of the year that rang some alarm bells for analysts and investors. The luxury giant posted an 8% drop in shares, its most significant daily decline in almost two years, a figure that Jean-Jacques Guiony, the group's CFO, explained to Reuters: «After three roaring years, and outstanding years, growth is converging toward numbers that are more in line with historical average». Factors such as the Federal Reserve's increase in interest rates and the collapse of the Chinese real estate bubble exerted their influence in those leading markets: especially in the Asian market, excluding Japan, revenues increased by 11%, less than a third of the 34% growth recorded in the second quarter. Rather than negative news, this is non-positive news; it sounds like semantics but it is not.

2023 Q3 revenue: €4,5 billion, down 9% on a comparable basis

— Kering (@KeringGroup) October 24, 2023

“Beyond the challenging macroeconomic conditions and softening demand in luxury, our revenue in the 3rd quarter reflects the impact of our decisions to further elevate our brands and their distribution.”

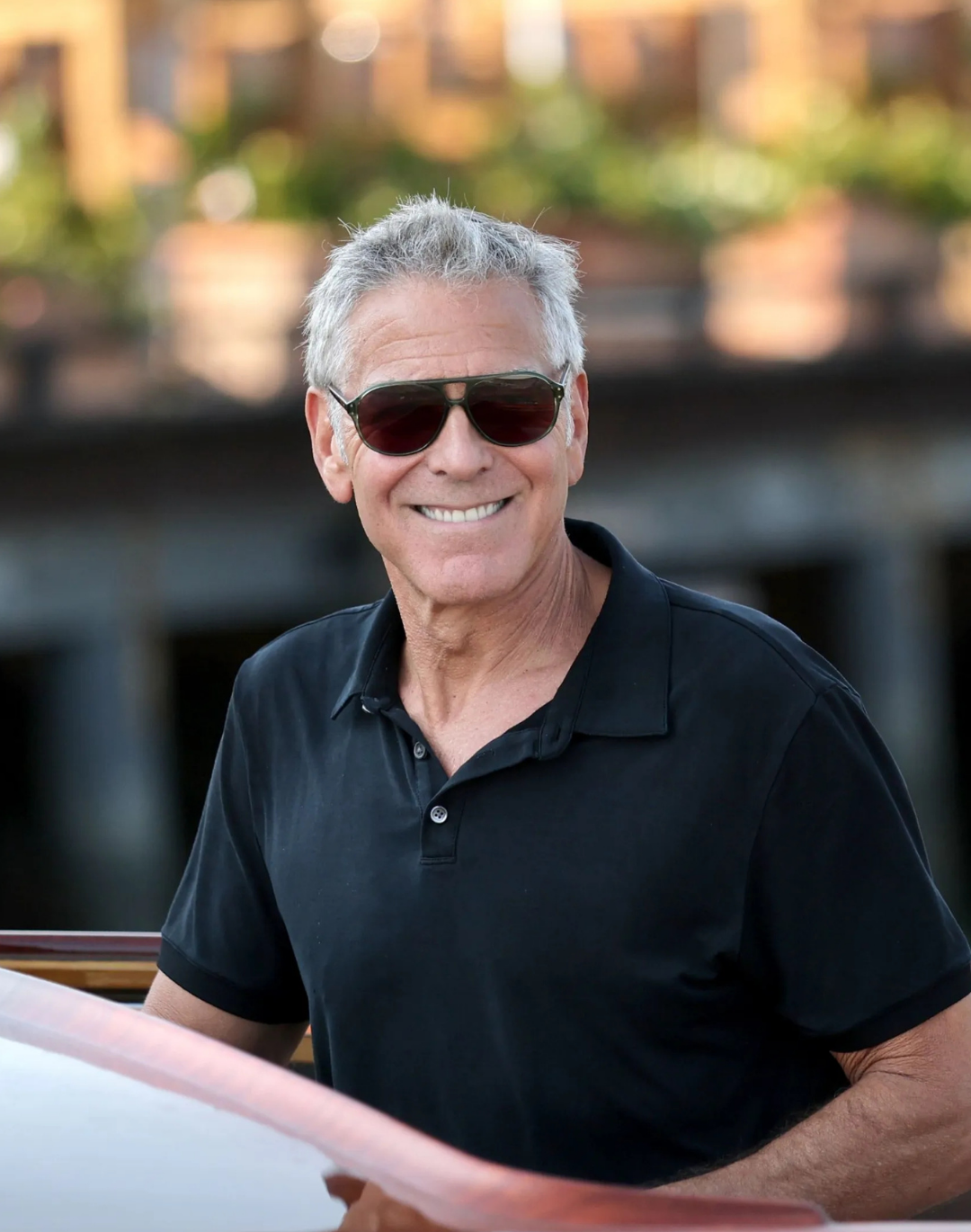

FH Pinault pic.twitter.com/zc41e7m1jj

Even at Kering storms are brewing: in the third quarter of the year revenue fell 9% compared to the same period last year with a drop in sales that affected all brands. And while Gucci is still in a moment of transition as De Sarno's new collections are not yet in shop, Saint Laurent's revenues fell 12% taking into account changes in exchange rates, inflation and extraordinary events and Bottega Veneta's fell 7%. The quarter was «soft» for Alexander McQueen, «uneven» for Balenciaga and the only ones to grow were the Eyewear department, up 31%; Brioni, the quiet luxury stronghold; and jewellery brands such as Boucheron, Pomellato and Queelin. According to Pinault, this downward revenue reflects the exorbitant investments made in differentiating the brand portfolio and elevating existing brands, as well as establishing greater control over wholesale sales - future statements will also have to take into account the acquisition of Creed, not counted here, and the influence of the Creative Artists Agency acquired for seven billion in recent months. Nevertheless, although not fatal, a haemorrhage remains a haemorrhage: the pressure on creative directors to make up for lost ground will be sky-high in the coming season. As always unstoppable, however, Hermes has shown total resilience in the face of economic adversity. Remaining among the very few independent brands and following a 'purist' strategy that is very different from the omni-channel and celebrity-driven approach of the large groups, the Dumas family brand can definitely compete even against bigger heavyweights than itself. Despite expectations of slower growth, Hermès reported a 15.6% year-on-year increase in sales in the third quarter - a result attributed to Hermes' persistent appeal to its hyper-fidelised clientele. The same can be said of the Zegna Group, which saw revenues rise 20.8% in Q3 with a strong increase in a market that has now become as difficult as North America.

The consensus on this point is that consumers around the world are becoming more selective, focusing their budgets on 'must-have' brands. But there is another thing the financial reports may not say: not enough is being sold because too much is being sold. Recently, the regular customer of a well-known Milanese brand complained about the excessive frequency with which the boutique staff contacted him about new products and collections. Even if he wanted to, it would not be possible to buy everything and the constant messages and drops had started to annoy him: in life as in retail, never put yourself in a position where you get three 'no's' in a row. Together with the overstimulation of a clientele whose wardrobes are already full of clothes, and the disappearance of occasional customers due to the raising of the price barrier, the recycling of creative directors has also created a problem of loyalty and continuity as the aesthetics of some brands vary from year to year and in some cases you can buy collections of a creative director who has already left the brand in boutiques today. It is a vicious circle: a new creative director has to create trust, but if his 'residency' is limited to only three seasons, at the next changing of the guard the brand's aesthetics will shift gears again and the status of the designer in question will inevitably have changed if not lapsed. There is now a disconnect between creative directors and collections due to the excessive mediation and interference of marketing departments, CEOs, commercial departments and so on: except in the case of indie brands (which, however, always sell with difficulty due to their instability), it is sometimes difficult to grasp the authoriality of a certain collection, its belonging to a unique creative vision that makes its designs seem authentic and not a simple branding operation. Moreover, by dint of producing four or more collections a year, it is obvious that the novelty factor but also the creative room for manoeuvre is diminished.

@angelsafternoon bruh moment

Xtal - Aphex Twin

Paradoxically, in this scenario, Hermès continues to win both because, despite changing creative directors over the decades, its aesthetic has remained continuous and consistent, without any particular jolts or shocks; and because it is the only brand that makes it a point of honour not to sell its iconic products on a first-come, first-served basis, at least not immediately. It is the only brand that literally makes its customers work hard to get them to buy one of its legendary bags: buying a Birkin or a Kelly means going through an initiation, entering a putative family by making yourself known in the shop, signalling yourself by buying products for months. When you are in, you are in an exclusive club where you only stay by continuing to buy. An attitude that does not necessarily follow the logic of cost as a parameter of value that other brands profess by trying to reposition themselves by only raising costs: it is an artificial, petit-bourgeois sense of exclusivity, a door that anyone could open simply if they had the money. The supreme example is Burberry's €16,900 viscose dress, which has gone viral precisely because no one can understand why it costs so absurdly much: it might have been more profitable to make a dress costing one sixth of that amount but make it iconic enough to sell several thousand. Rather than wondering when and if luxury customers will return to sales, in short, one should perhaps ask how and why they should.