Topshop's downfall and the end of the 'high street' dream The brand symbol of the 2000s Brit aesthetics is on the brink of collapse

Topshop is the latest name to be added to the long list of brands irreparably affected by the pandemic, especially those belonging to the fast fashion sector. Arcadia Group, the parent company of the brand founded and led by Philip Green, who also owns Topman, Miss Selfridge, Dorothy Perkins, Evans and Burton, among others, entered what is defined administration, that is, was commissioner last Monday. The company's brands will continue to operate while waiting for a buyer and Deloitte company will oversee this transition period.

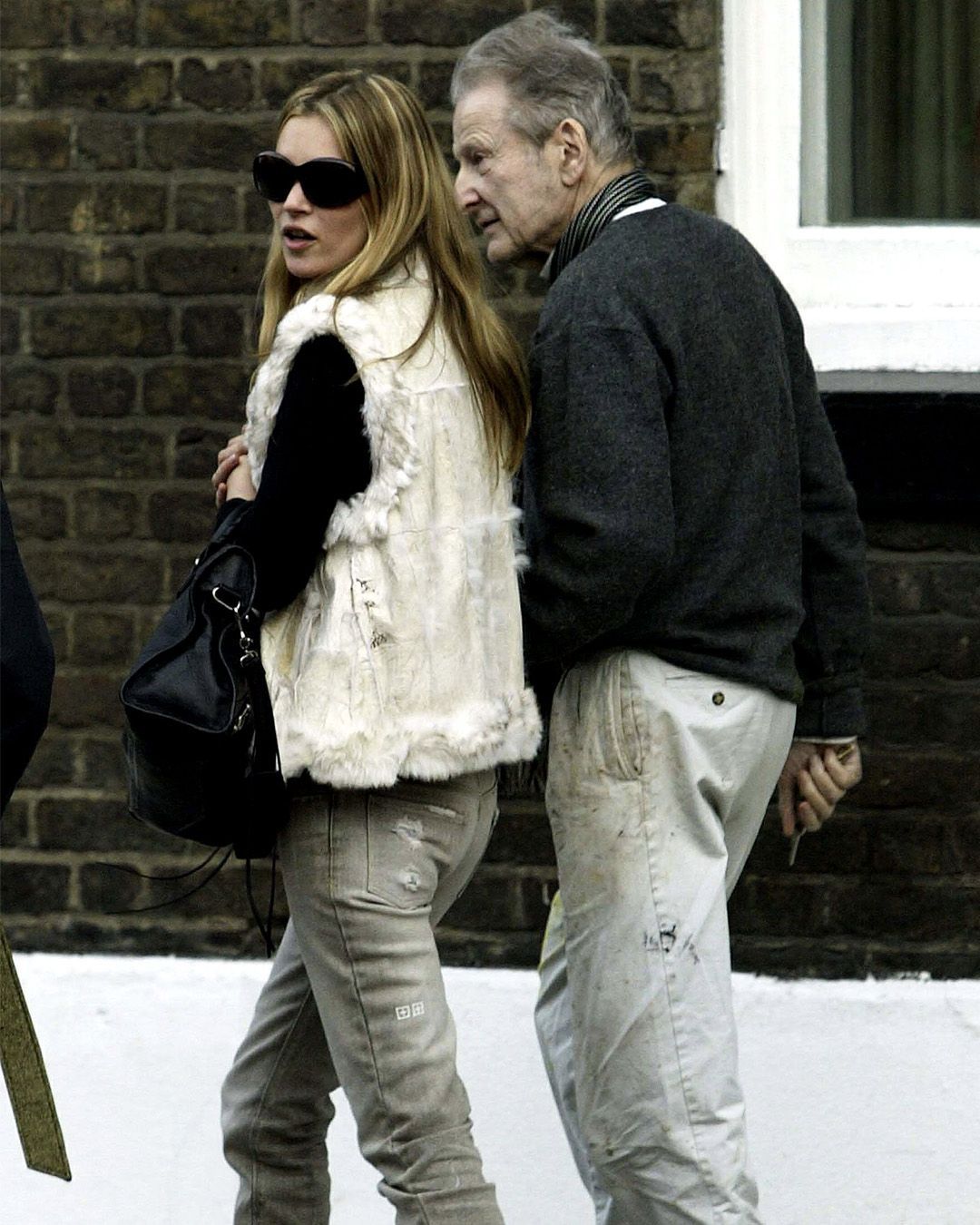

This is certainly not sudden and unexpected news, because like other brands of the industry, first of all, H&M, Topshop was in dire straits even before the pandemic. In some ways, however, that of Topshop represents an even more striking and dramatic decline, because with it also ends the real golden moment of high street fashion, which had filled the gap between cheaper fast fashion and prêt-à-porter, finding an intermediate position that would allow a large mass of consumers to approach fashion with cool and successful products. Especially since the beginning of the 2000s and for the following decade, Topshop was the coolest brand in the UK - and consequently the world: it showed twice a year during London Fashion Week with the Topshop Unique line (the latest show was held in 2017); the brand used to host exclusive parties and events with the most prominent celebs on the scene, from Alexa Chung to Cara Delevigne; Kate Moss signed an ongoing collection with Topshop and the brand had created capsules with emerging designers at the time, such as Christopher Kane and JW Anderson.

An aura of coolness that coincided with the heyday of that Brit aesthetic made popular by the aforementioned Chung or by other very popular style icons on Pinterest, such as Sienna Miller and Pixie Geldof. This was, however, crushed by an antiquated business model and too fierce competition. Competitors such as Zara have managed to intercept trends at a faster pace, at a lower price and find a more effective social communication, all actions that Topshop struggled to implement. Most of all, the transition from physical to digital that had decisive effects on many brands during the lockdown, strengthening some and irreparably damaging others, was missing. Topshop was still based on a brick-and-mortar model, therefore on a capillary network of stores spread over different continents (although not all of them received the same reception, for example, the brand has never really managed to breakthrough in the United States), a model that has already decreed the end of large department stores such as Neiman Marcus, J Crew and Barney's New York. The strong and effective digital presence is what has guaranteed the success of platforms such as Asos, Boohoo and Pretty Little Thing, Topshop strongest competitors.

Topshop's main problem is its identity: it's no longer clear who it's designed for, who it's intended for, who the final consumer should be. There are still many brands that thrive with a large network of stores, but success also comes from a precise targeting of their audience: Brandy Melville is aimed at the younger generations, Primark at consumers who want to spend the least amount of money possible, Zara works thanks to the audience of fashion enthusiasts. Who is Topshop for? Its business model and its aesthetics have remained stuck in its years of maximum expansion, failing to reinvent itself in the face of a generation of consumers that have changed, more attentive, more aware of their means, of what they are looking for and where to find it.

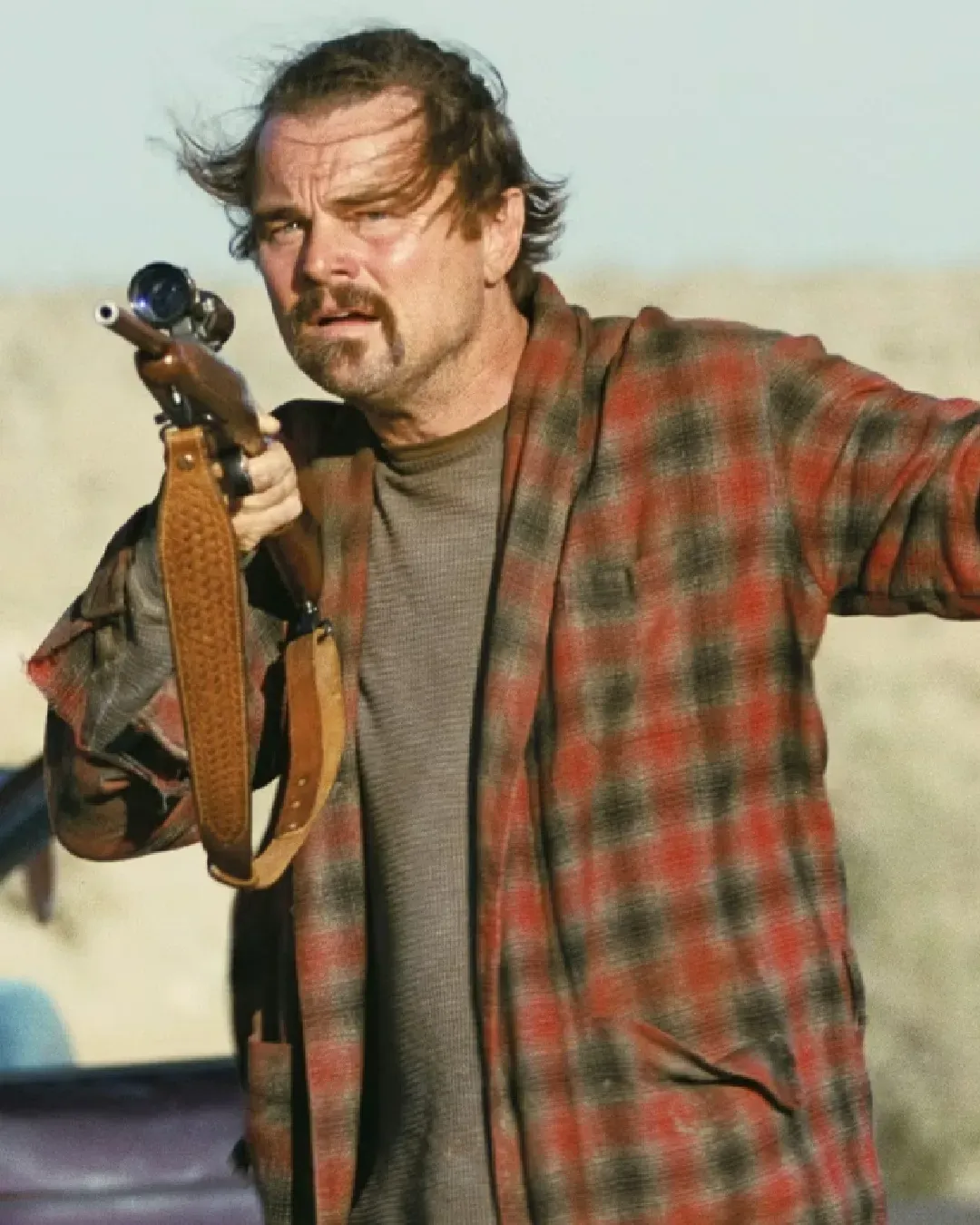

Sir Philip Green, the founder of the Arcadia Group and owner of Topshop, has represented another big problem for the brand in the last two years, as this article on the Guardian reports, which already at the beginning of 2019, marked the substantial end of the brand. When #metoo was in full swing, Green had been hit by accusations of harassment and misconduct, allegations that had also derailed the agreement with Beyoncé, who initially was supposed to design (and sell) her Ivy Park collection together with Topshop, only to then pass to adidas. Green would have not been able to gather a £ 30 million loan from potential lenders, leading the group to the current situation.

In any case, the administration puts more than 13 thousand jobs at risk along with the possible closure of 400 stores. However, it seems that there would already be potential buyers, particularly interested in Topshop and Topman, the brands with the strongest heritage and still with great recognition, which could be completely distorted and restructured after an acquisition. Among the interested buyers, there would be the same Boohoo Group, the giant of the UK online fast fashion, which in some ways represents the 2.0 evolution of the plans and aesthetics of Topshop. According to many analysts, if Topshop and all the brands in the group fail to avoid bankruptcy, Arcadia would become the largest case of corporate collapse in Britain at the time of the pandemic.