LVMH and Kering sales tumble nearly 30% The second quarter of the year still closes dramatically

If the financial datas published by Vogue Business have declared which are the brands that have found value during the pandemic, with a clear triumph of Hermès (+13% on the value of the shares on Paris stock exchange) and Li-Ning (+8% on the Hong Kong market), few other brands in the fashion world have been able to resist the consequences of the health emergency. Specifically, just a few weeks ago Burberry announced that its sales plummeted -48%, followed by those of Nike and adidas which fell by 38% and 19%, while the Capri Holdings group (that owns Versace, Michael Kors and Jimmy Choo), already in difficulty, is expecting in the coming months a drop of -70%.

Follwing the initial estimates of the first quarter of the year, in which the pandemic had already led to an estimated -15% drop in sales, the shares of the two large competing groups LVMH and Kering in the first half of the year respectively fell by 9% and 14%. This already dramatic situation must be accompanied by the equally dramatic collapse of sales, which for both luxury conglomerates touch the threshold of almost -30% compared to 2019.

The first signs of difficulties had already made themselves felt in March, but at the end of the second quarter of the year, the LVMH group confirmed that, until June, revenues decreased by -38%. This is a slight improvement compared to analysts' expectations, which forecasted a drop of -42%; in general, however, in the first half of 2020 the financial statements fell by -27% compared to the same period of 2019. This means that the drop in the first quarter, already considerable, continued throughout the second half of the year, despite a slight recovery after the end of the lockdown, especially on the Asian market. The top brands, including Louis Vuitton, Dior and Moët Hennessy paradoxically have been profitable; the biggest drop was in sales of watches and jewelry, which decreased by -39% compared to 2019, but also by brands such as Sephora and Le Bon Marché (-33%). The drop in sales means that LVMH reported incomes of approximately € 18.4 billions (over $ 21.6 billions).

Kering was slightly more impressed than his rival, with a drop of -29.7%. If in the second quarter of the year the revenues of physical stores decreased by -43.4%, however, online sales increased by +47.2%, once again thanks to the Asian market. Gucci, the group's crown jewel, is the perfect example: after a solid start, the brand saw a drop in revenue of over € 3 billions (about $3.6 billions) in the first six months of 2020 (-33.5% from 2019), respectively reporting a -36.1% drop in wholesale revenue and a +51.8% increase in online sales.

The Kering group only provided specific data for Gucci, Saint Laurent (-30%) and Bottega Veneta (-8.4%). As for Balenciaga and Alexander McQueen, the only note made by Kering is that "they remained firm". In general, all the other maisons of the group have brought to a profit of € 919.1 millions (around $ 1.07 billions), with revenues in decrease of the -25%, while its estimated turnover around € 5.3 billions (about € 6.3 billions) is almost a third less than in 2019.

Our maisons have shown remarkable agility in implementing measures to adapt their costs and accelerate the growth of online sales," said Bernard Arnault, President and CEO of the LVMH group; "We continue to be driven by a long-term vision, a deep sense of responsibility and a strong commitment to environmental protection, inclusion and solidarity. In the current context, we remain even more firmly dedicated to showing continuous progress in these areas.

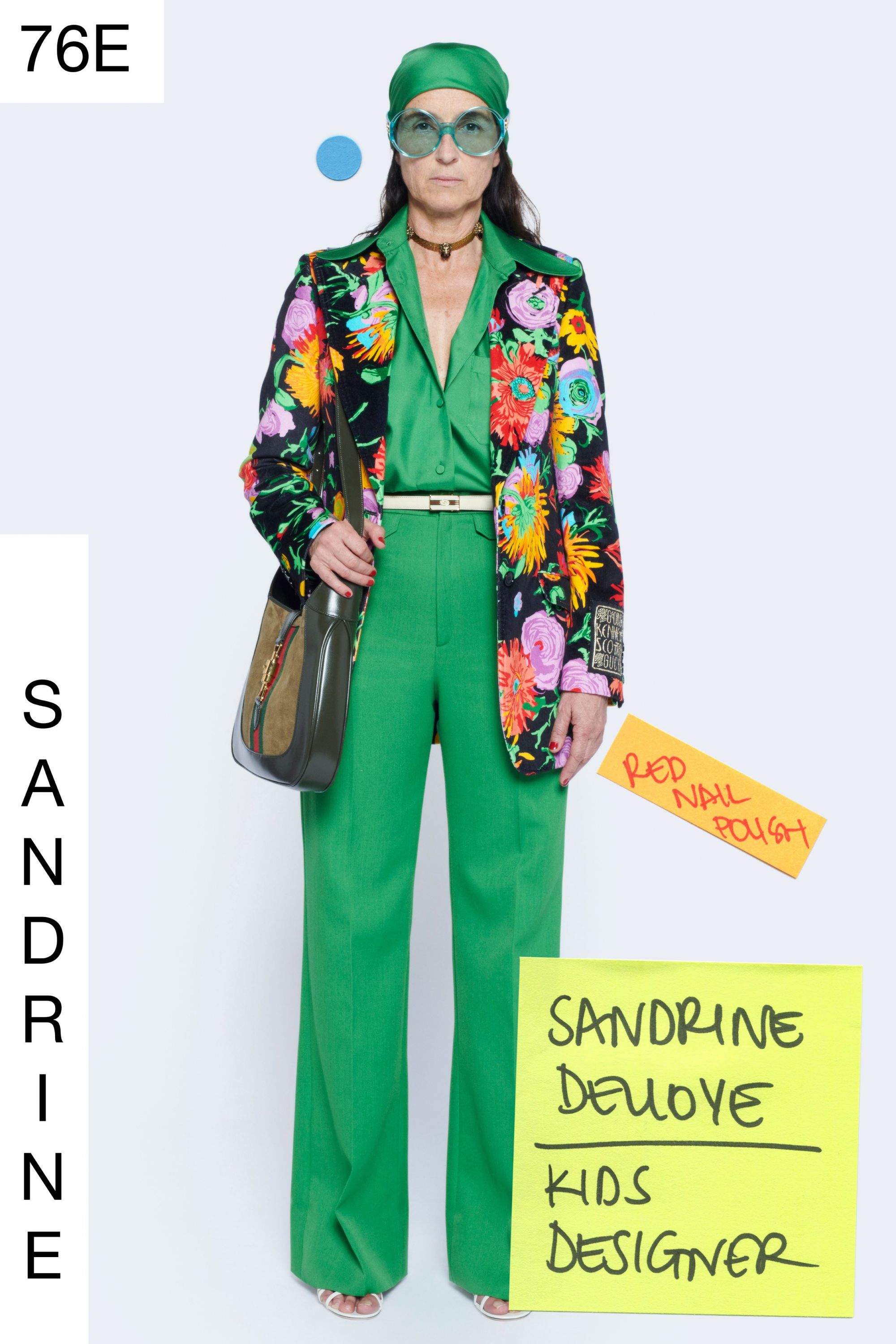

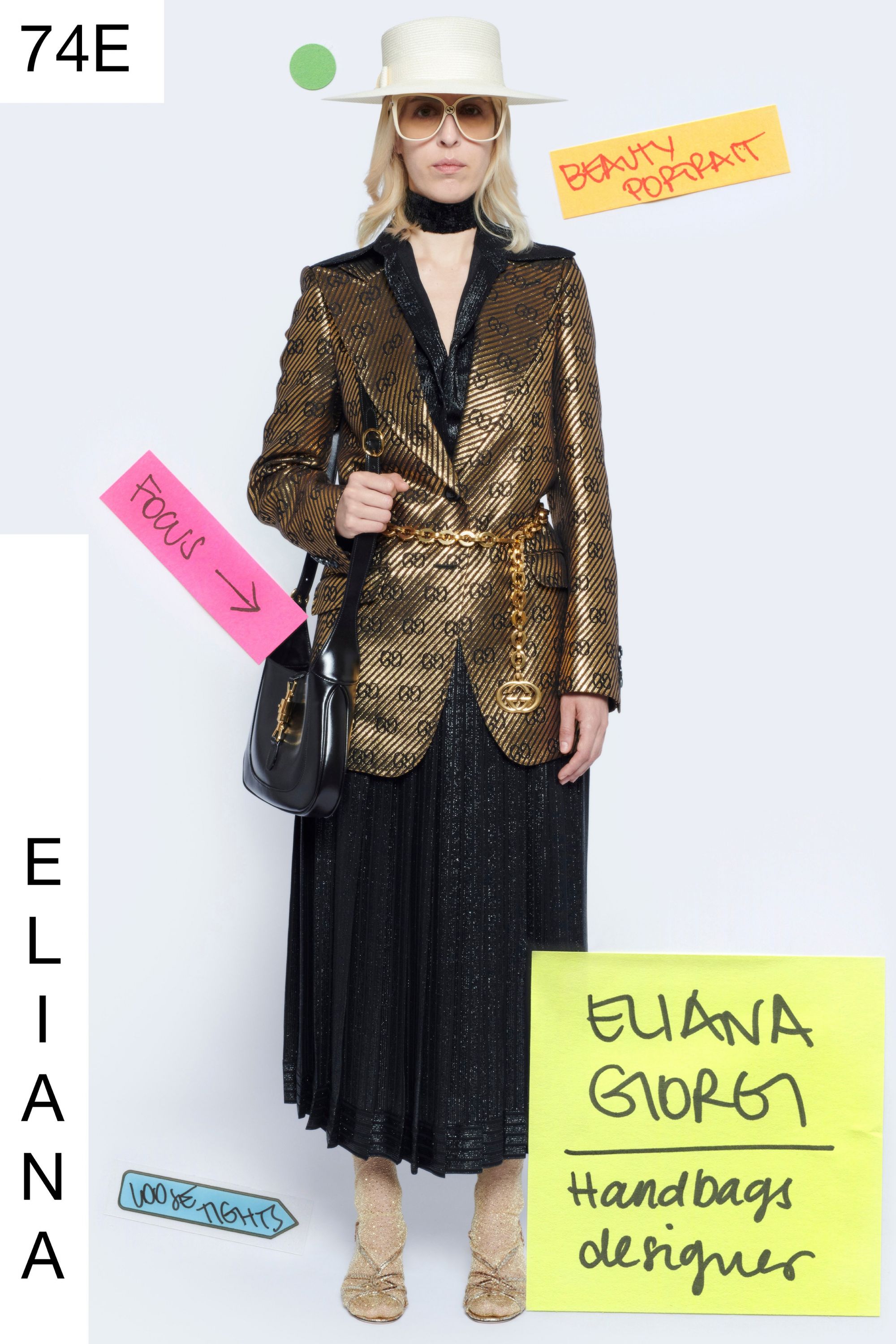

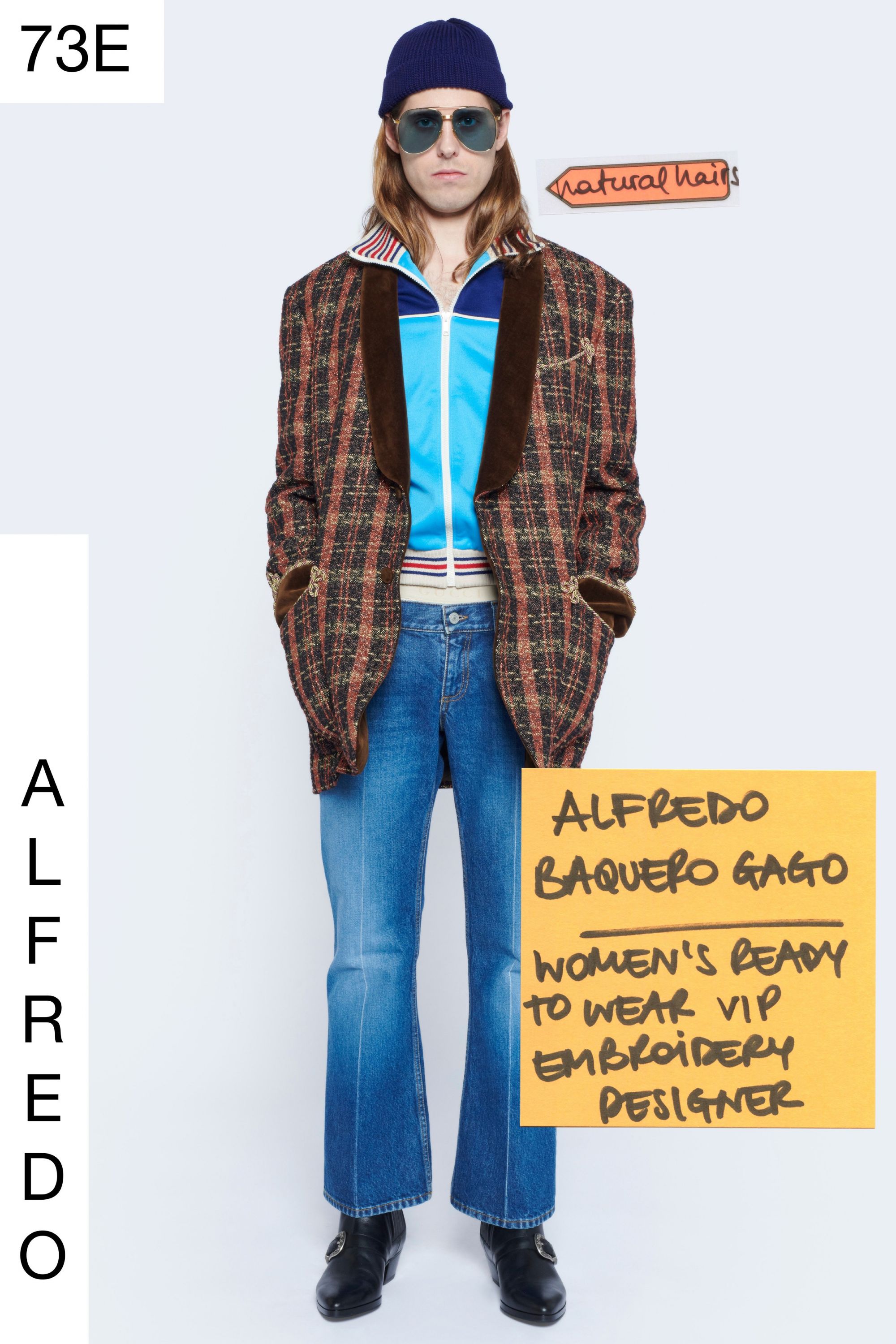

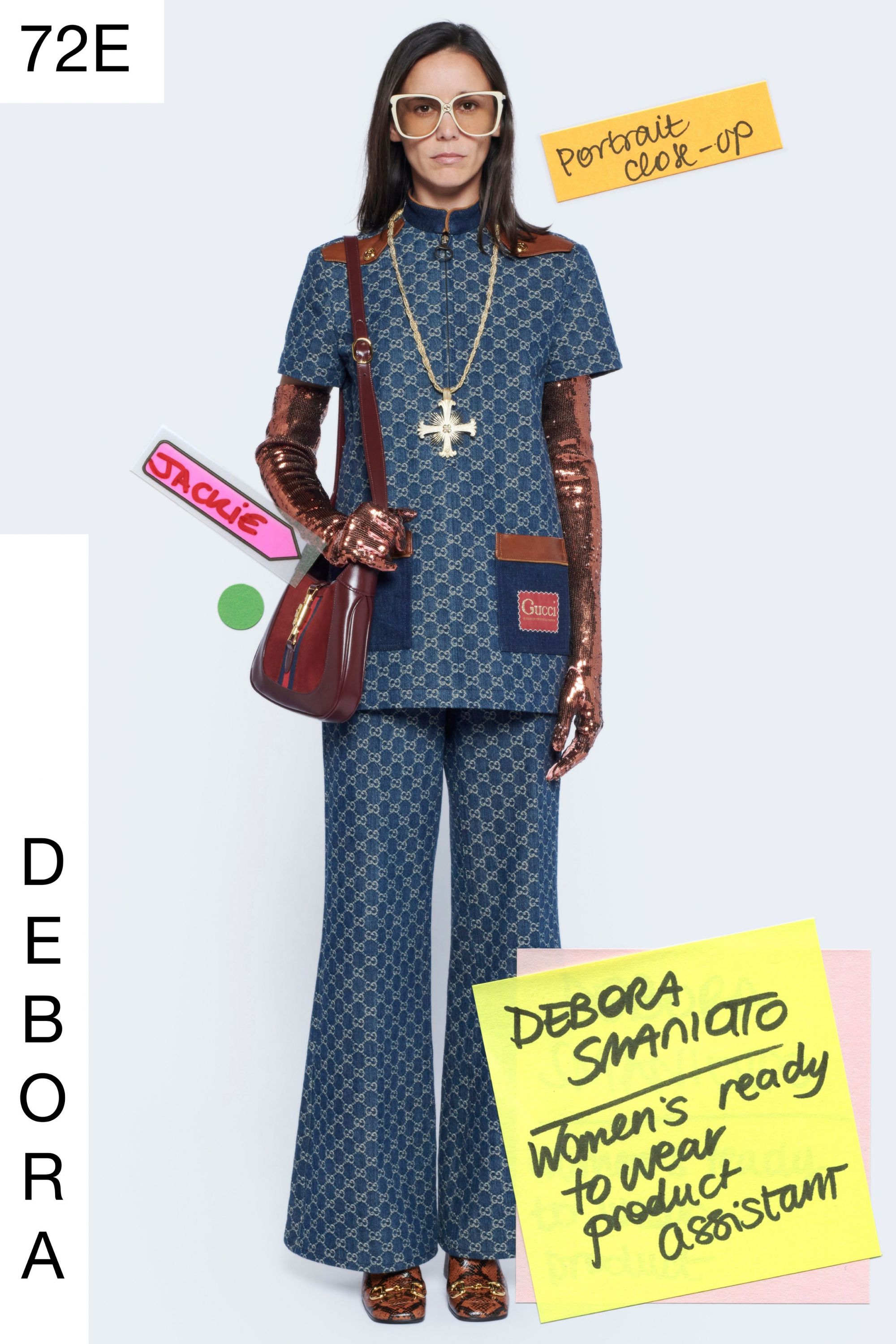

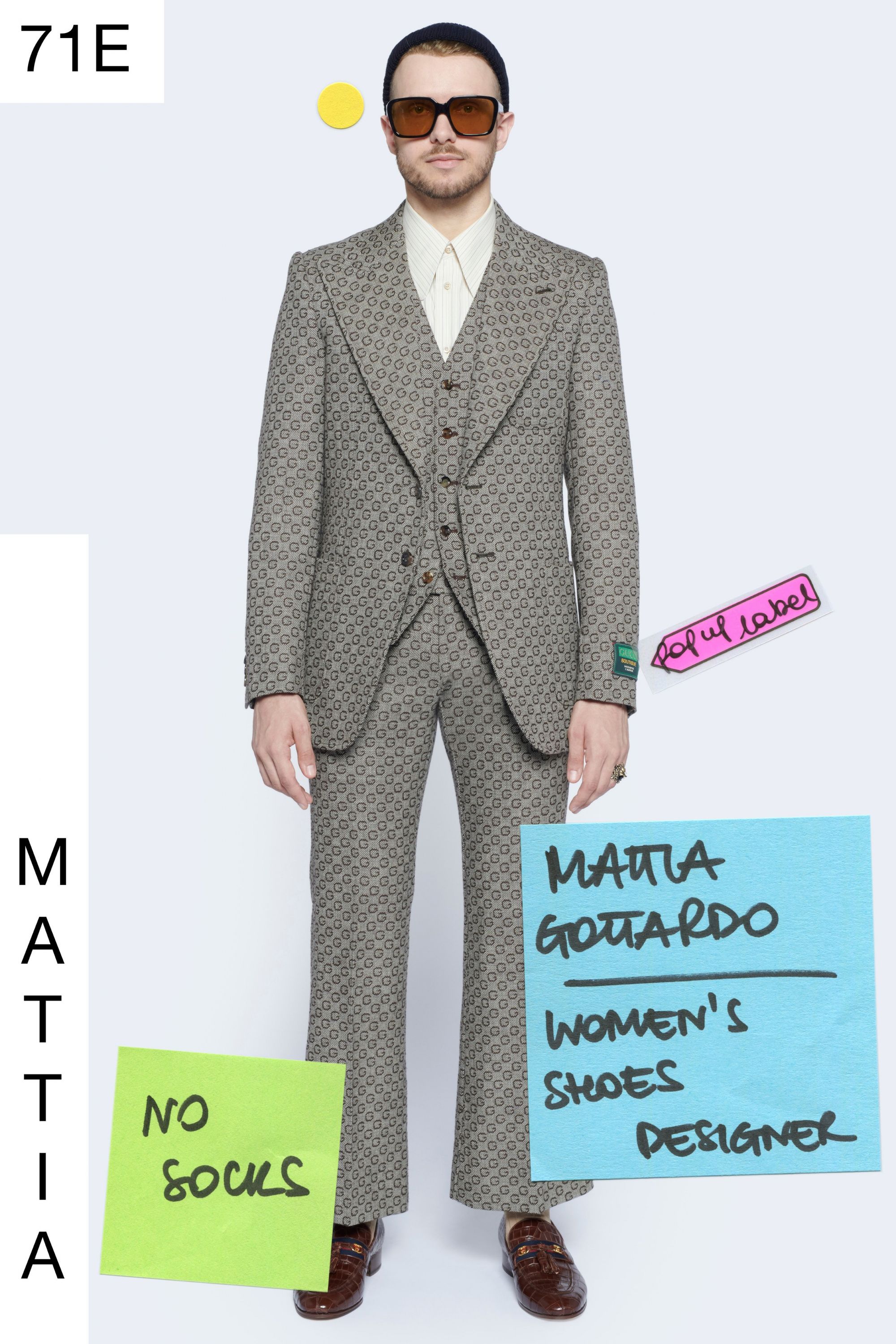

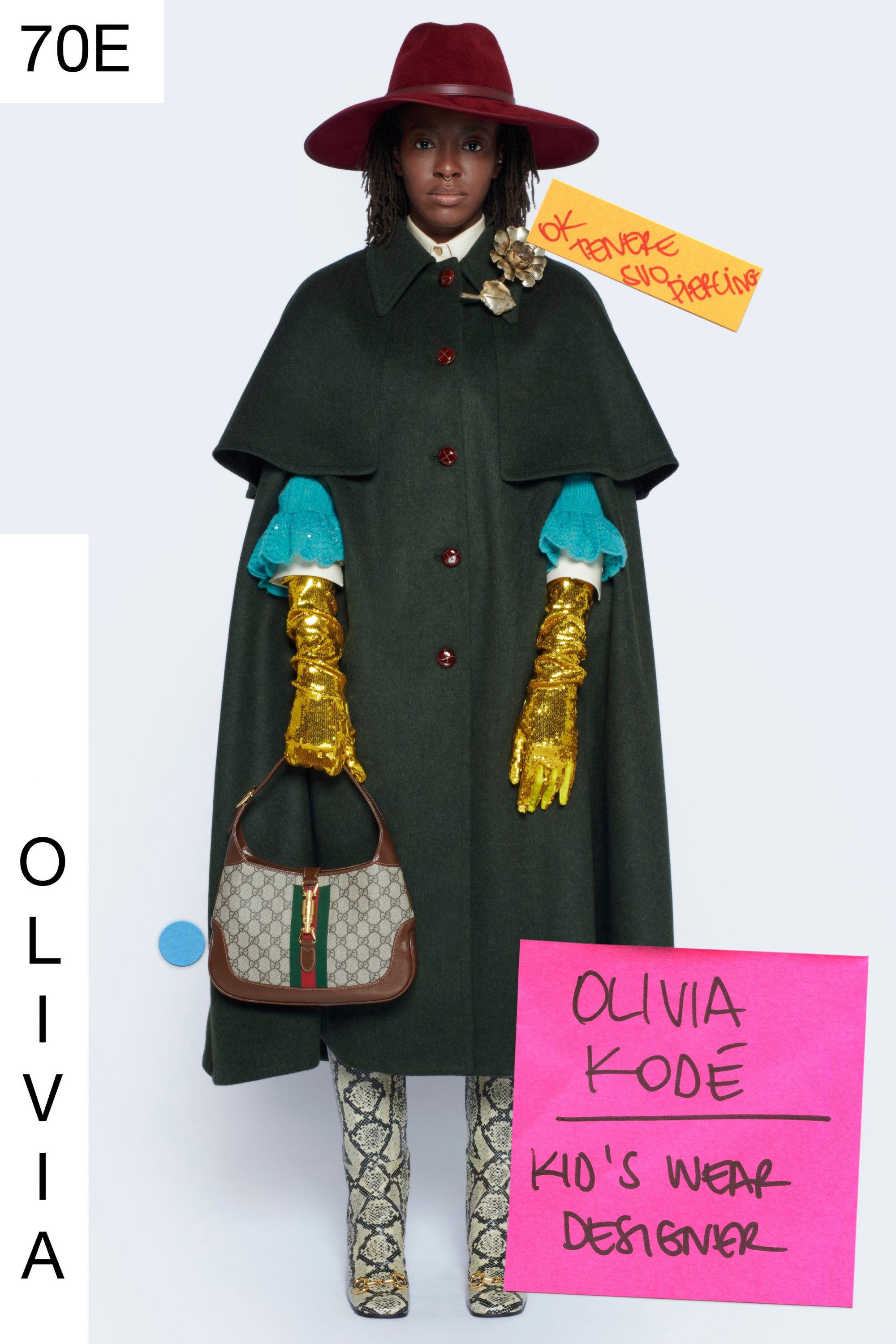

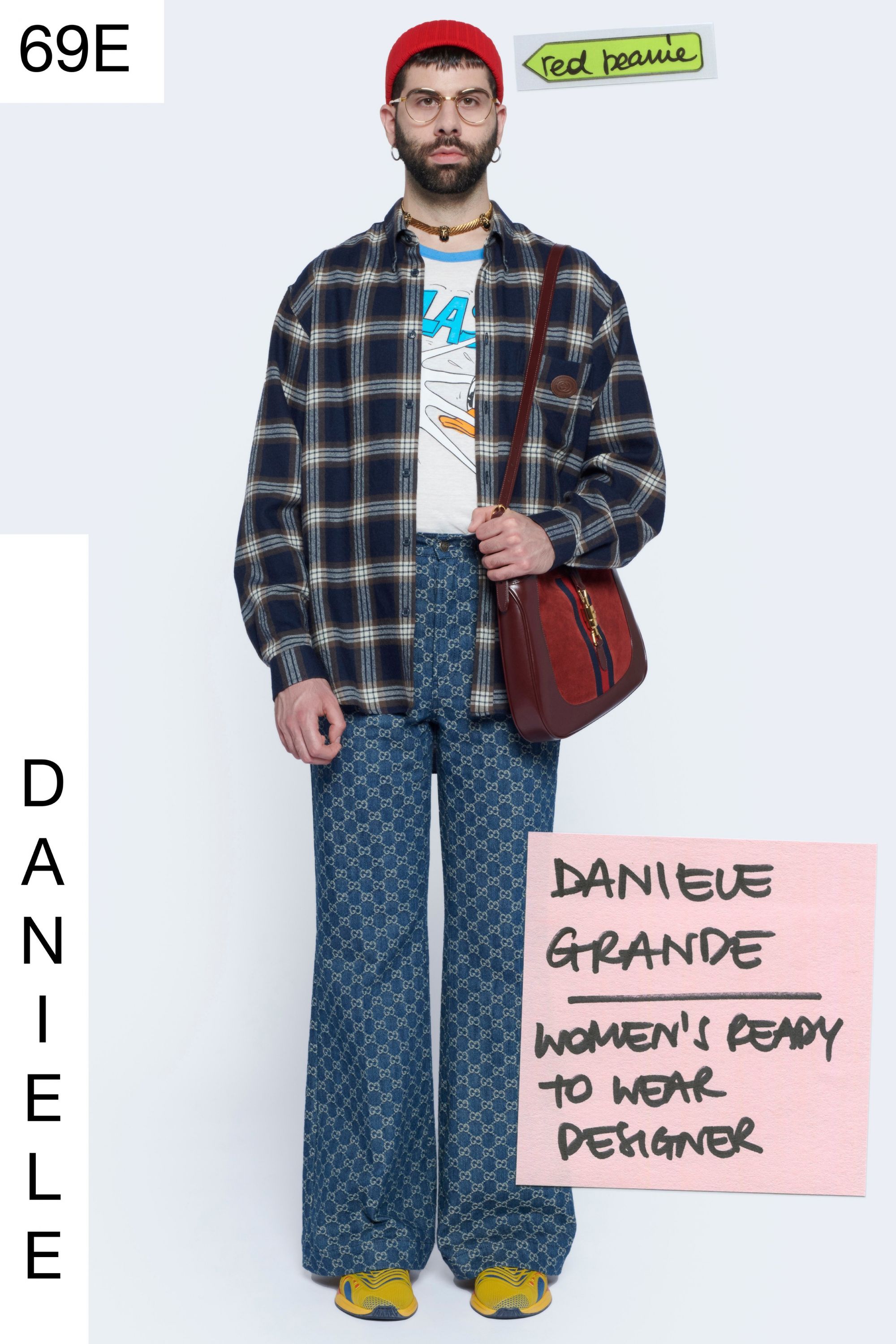

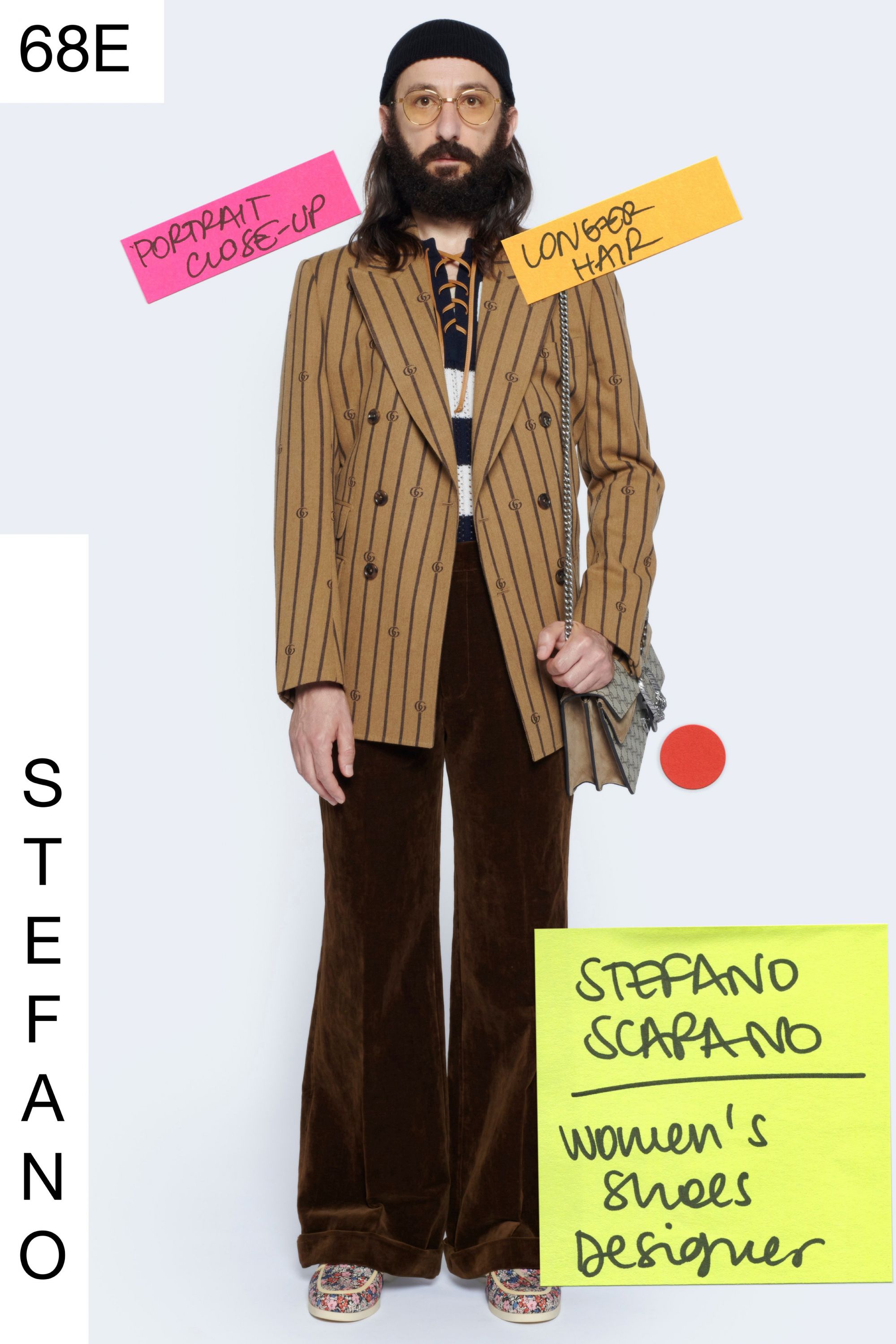

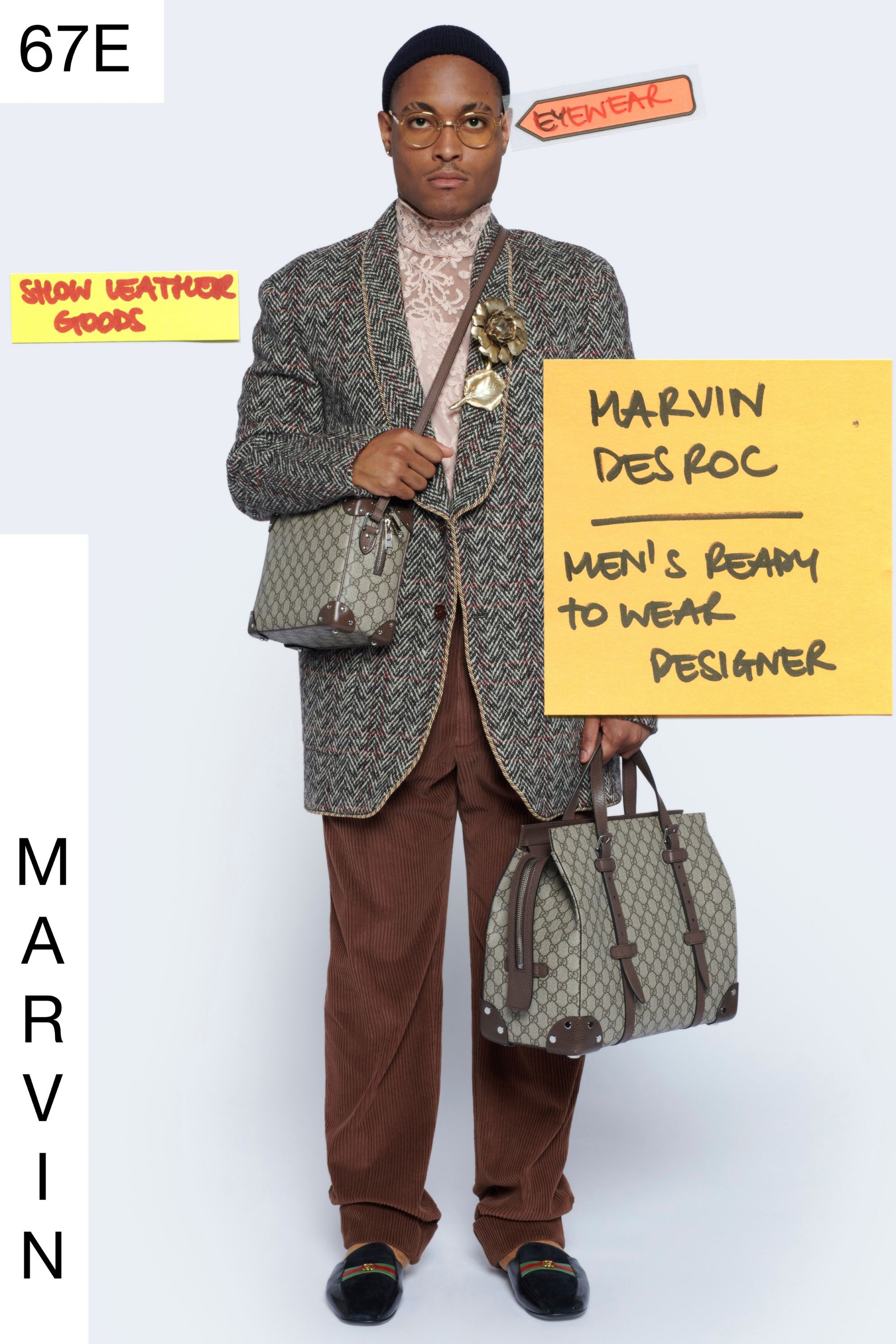

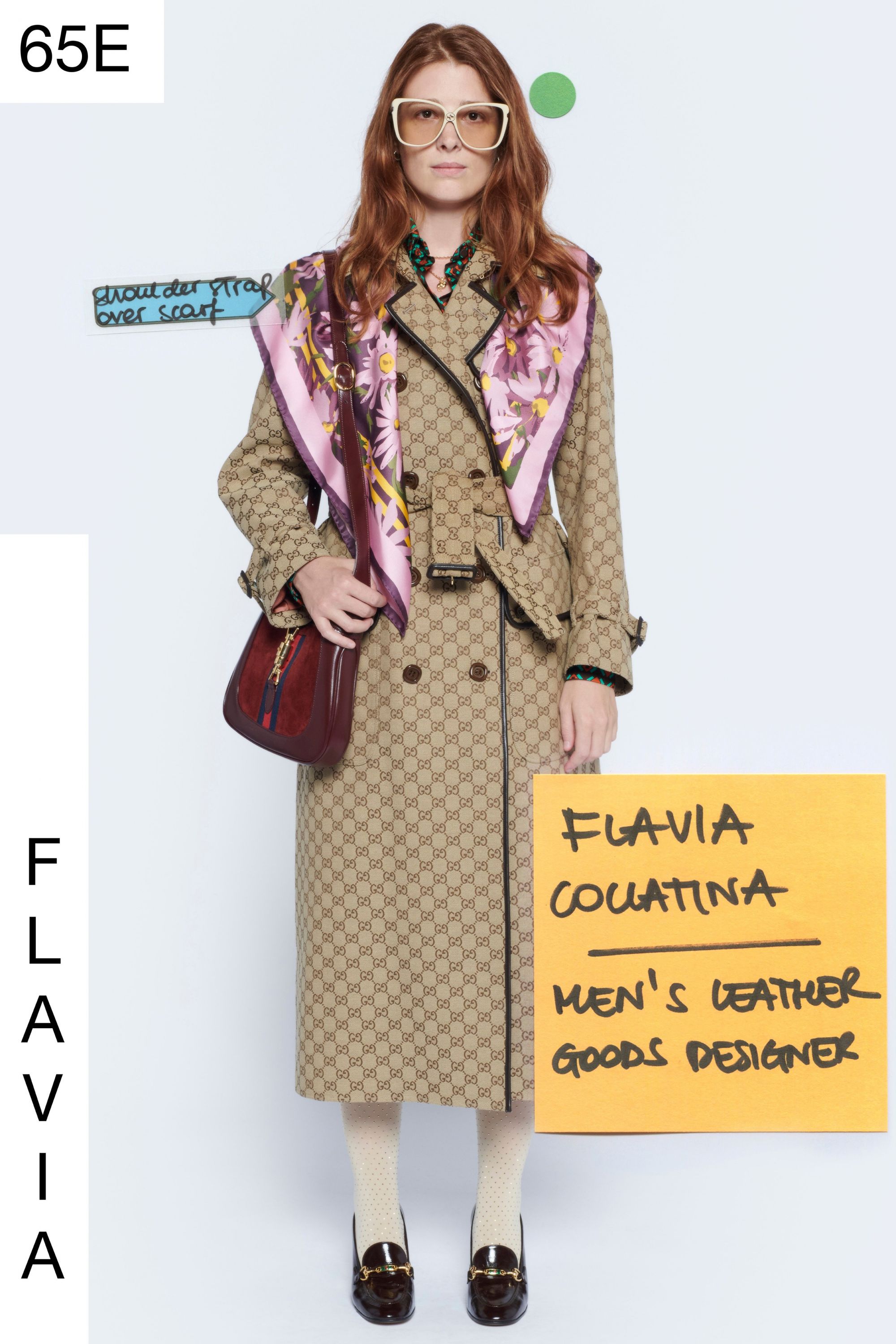

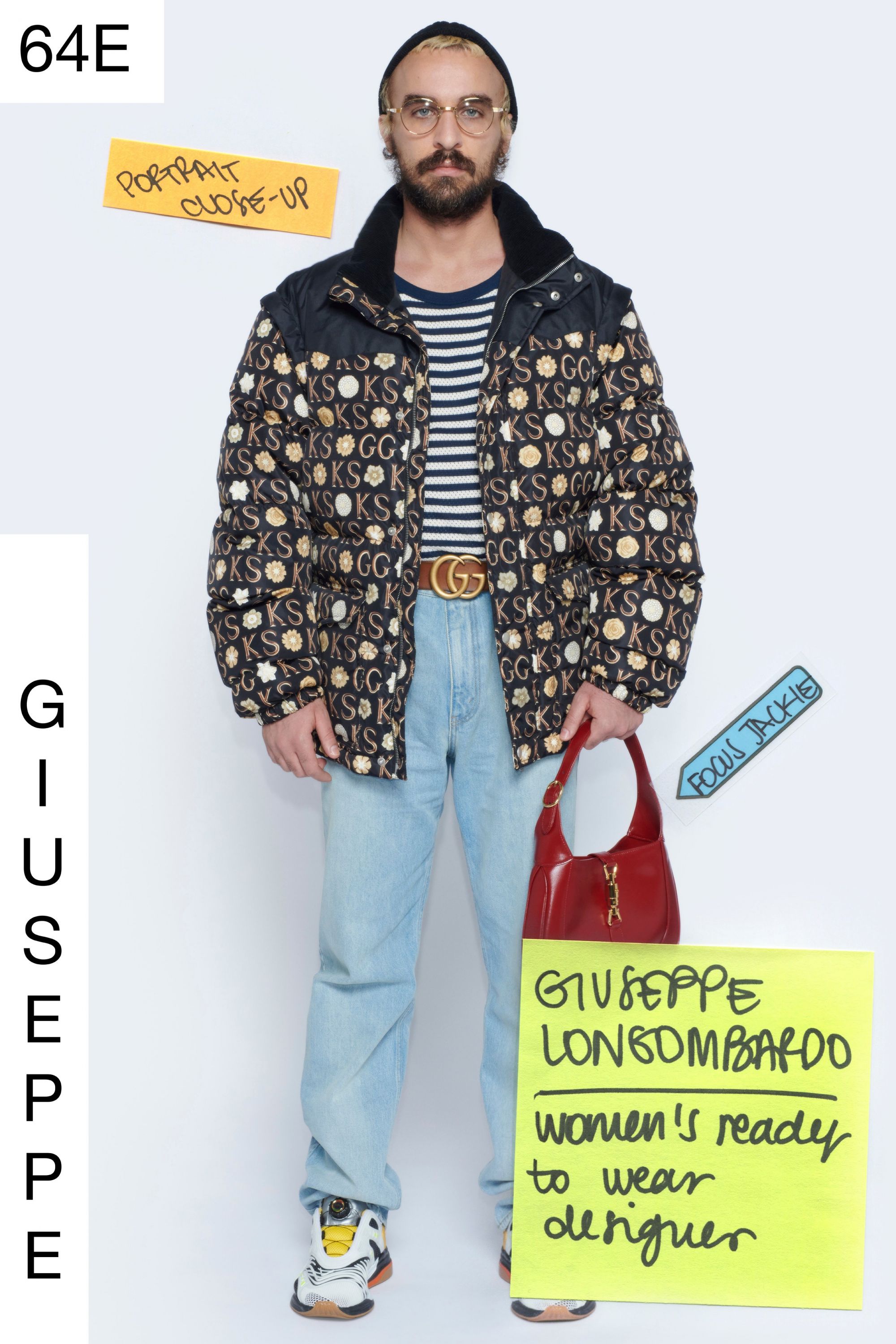

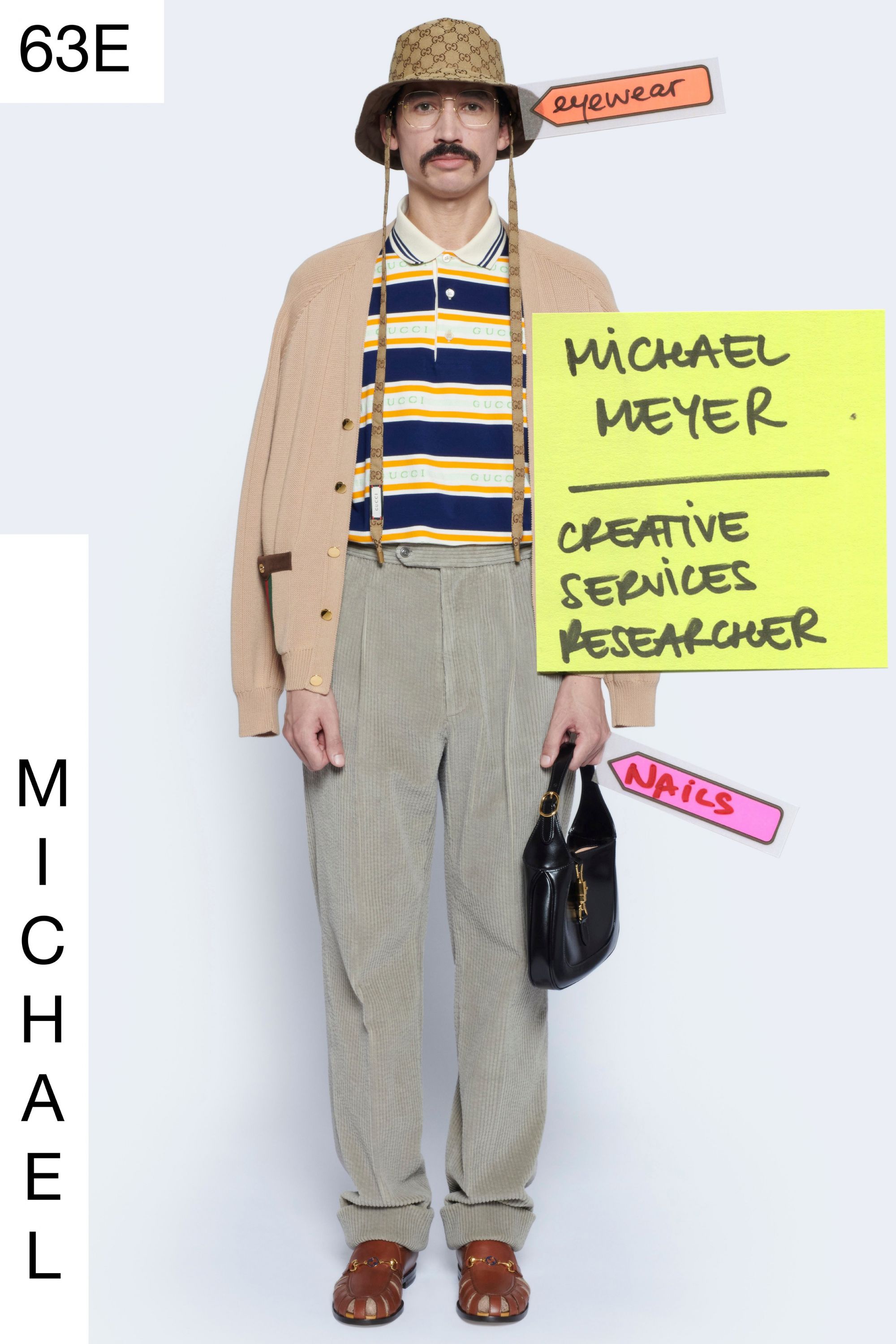

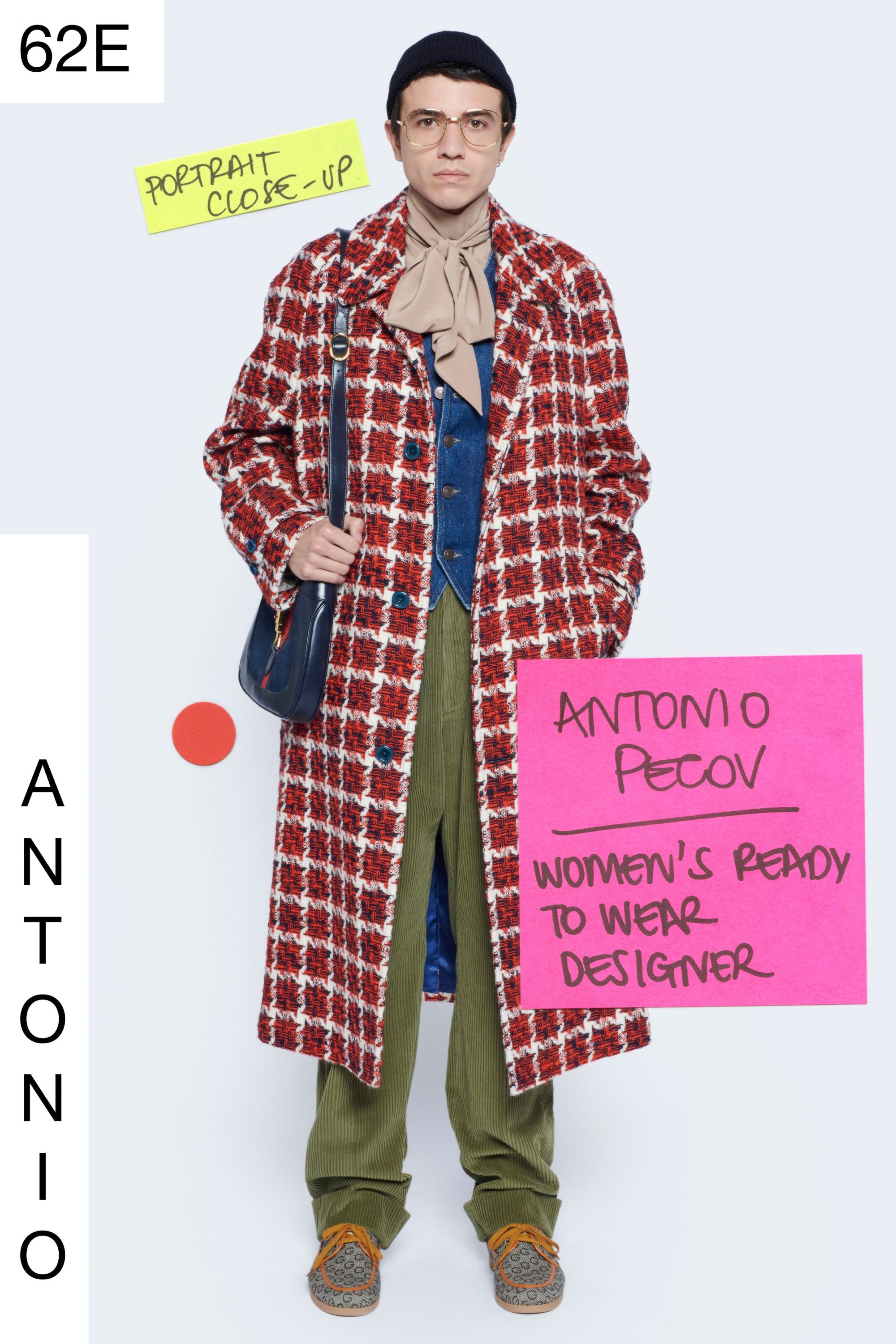

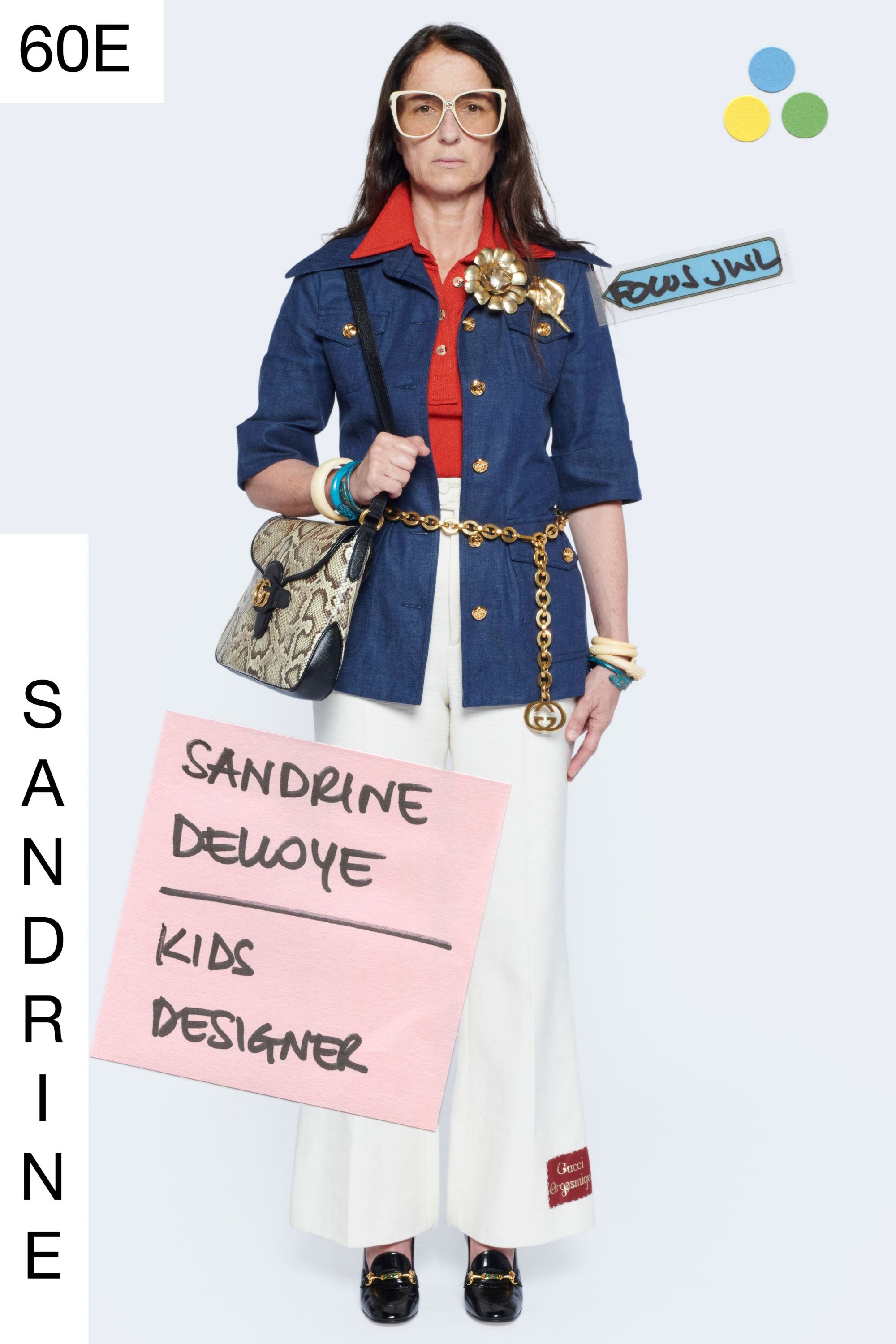

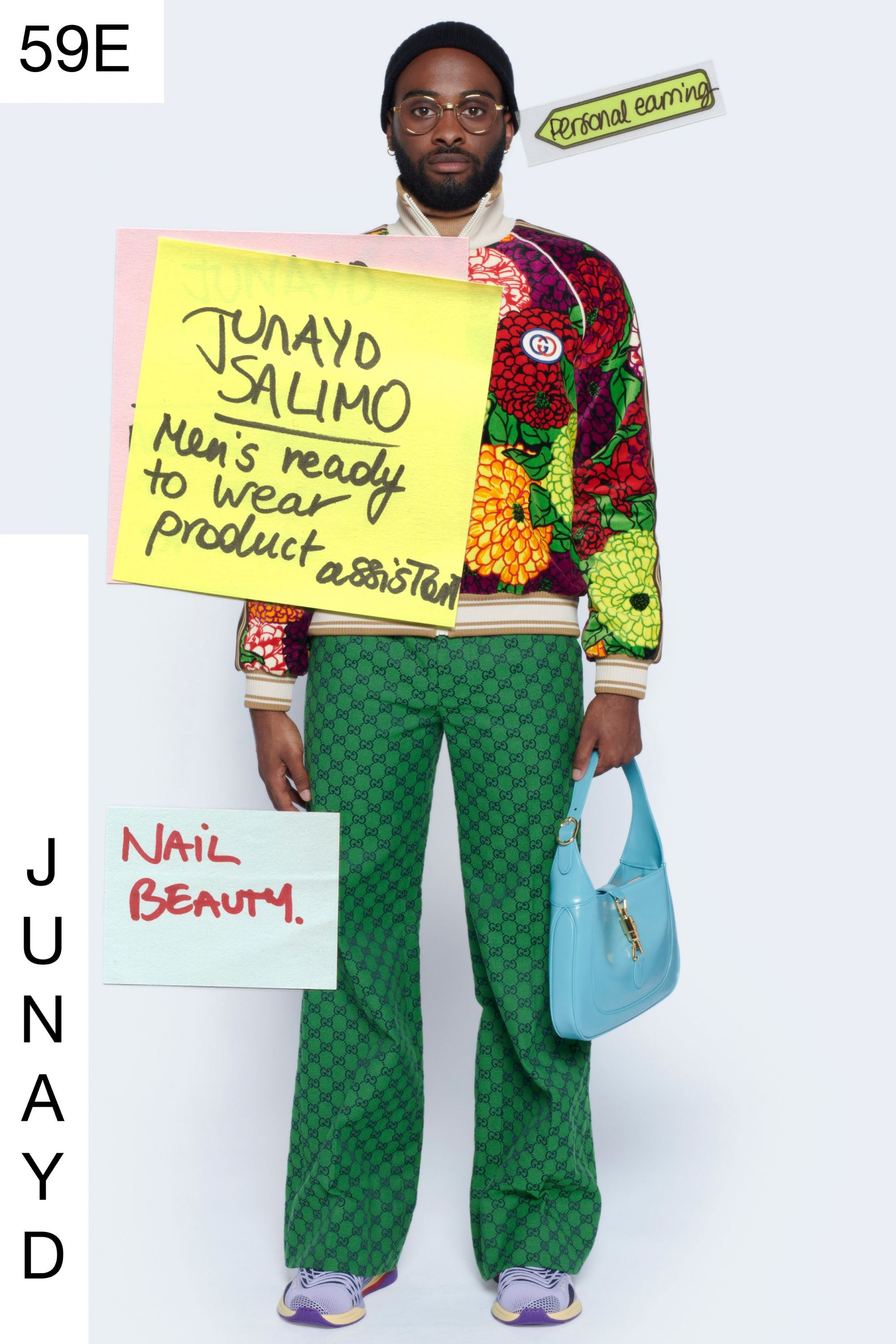

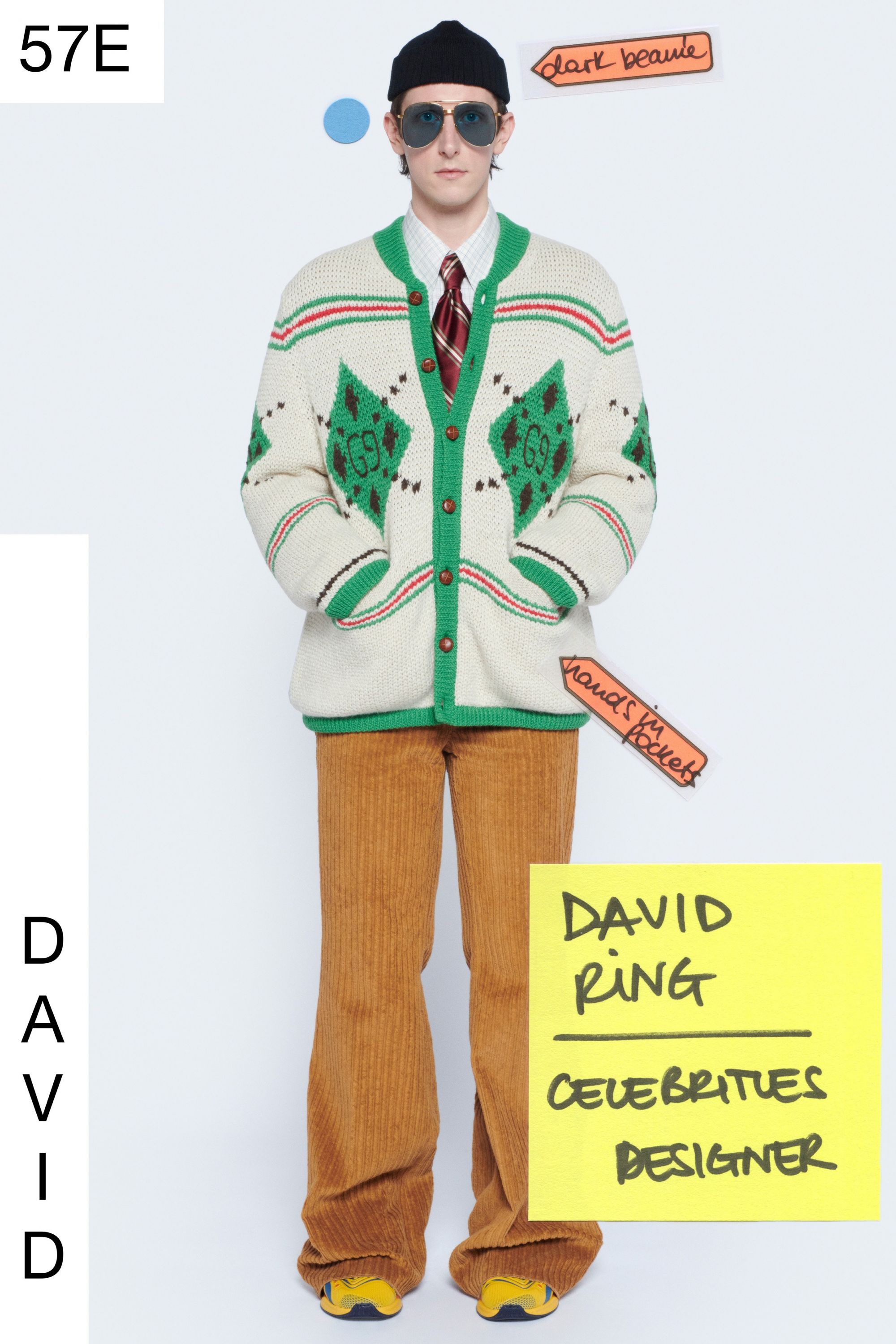

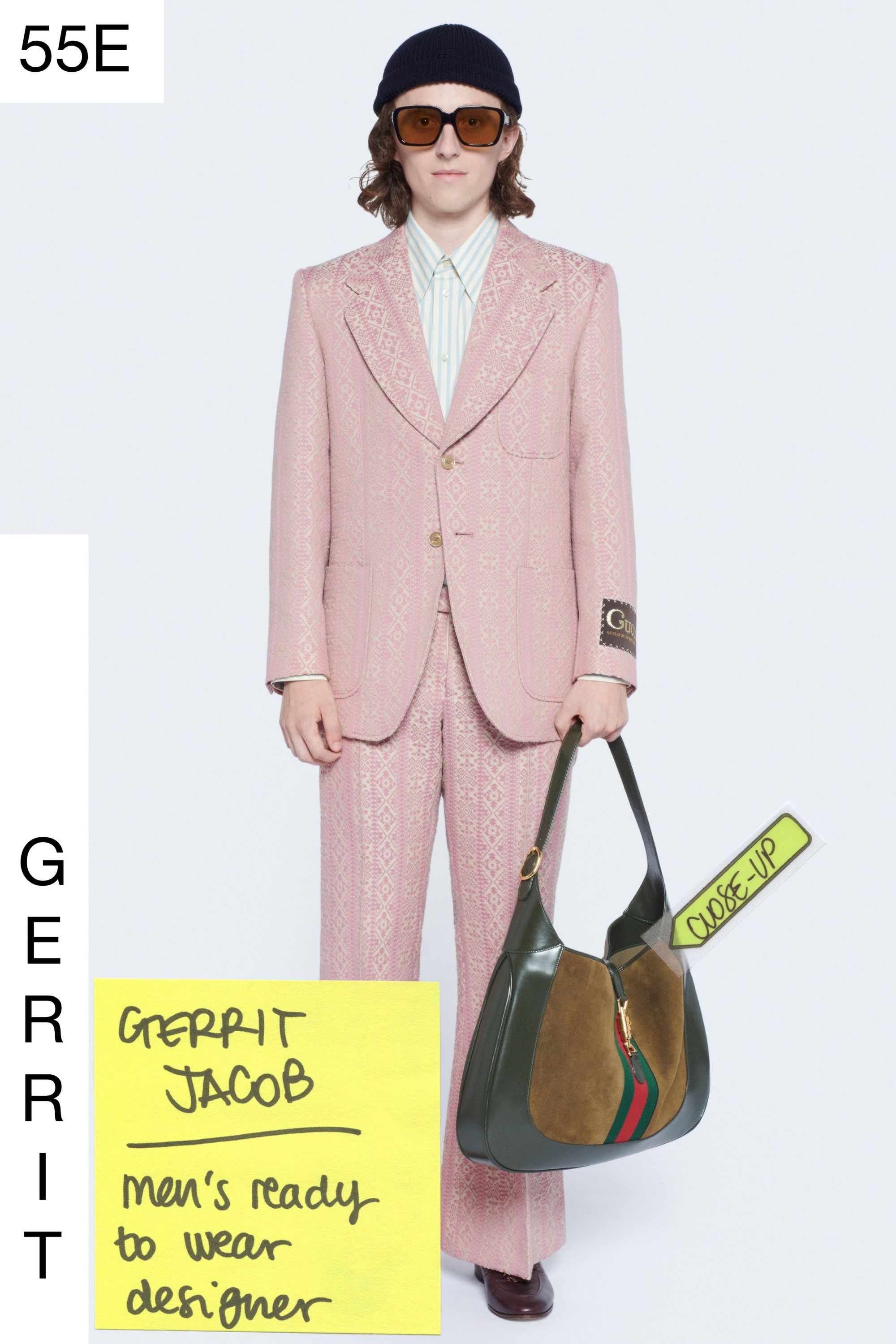

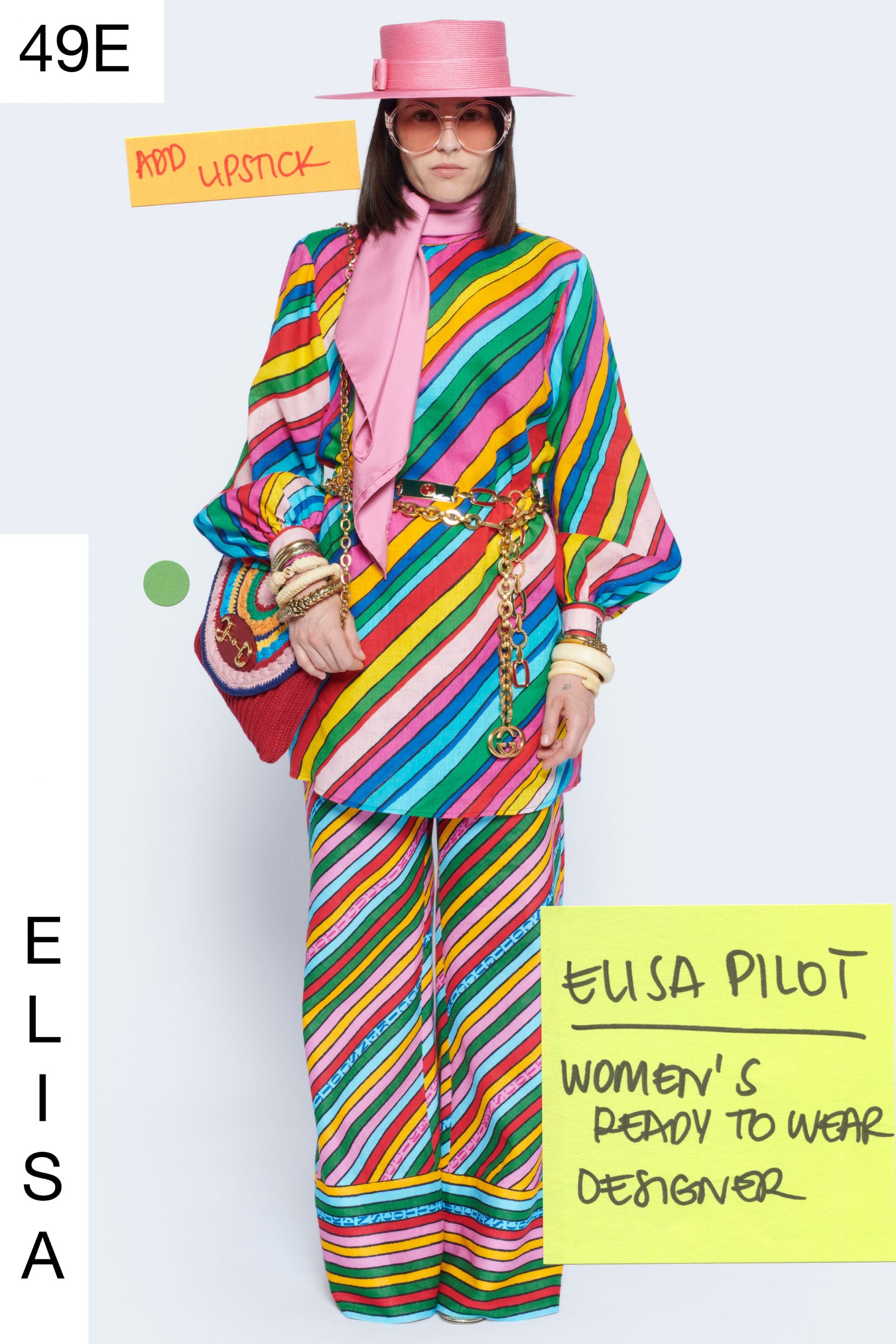

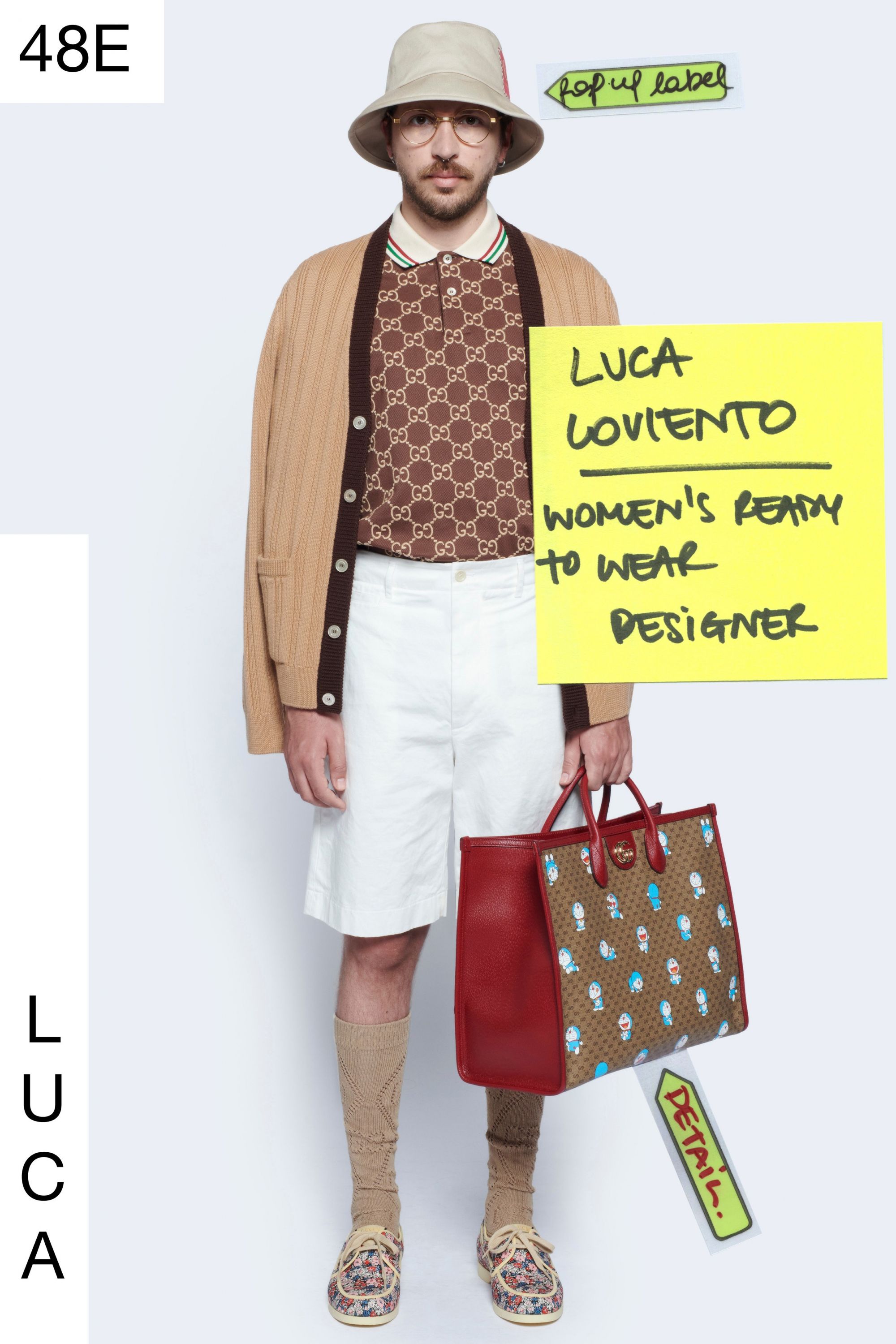

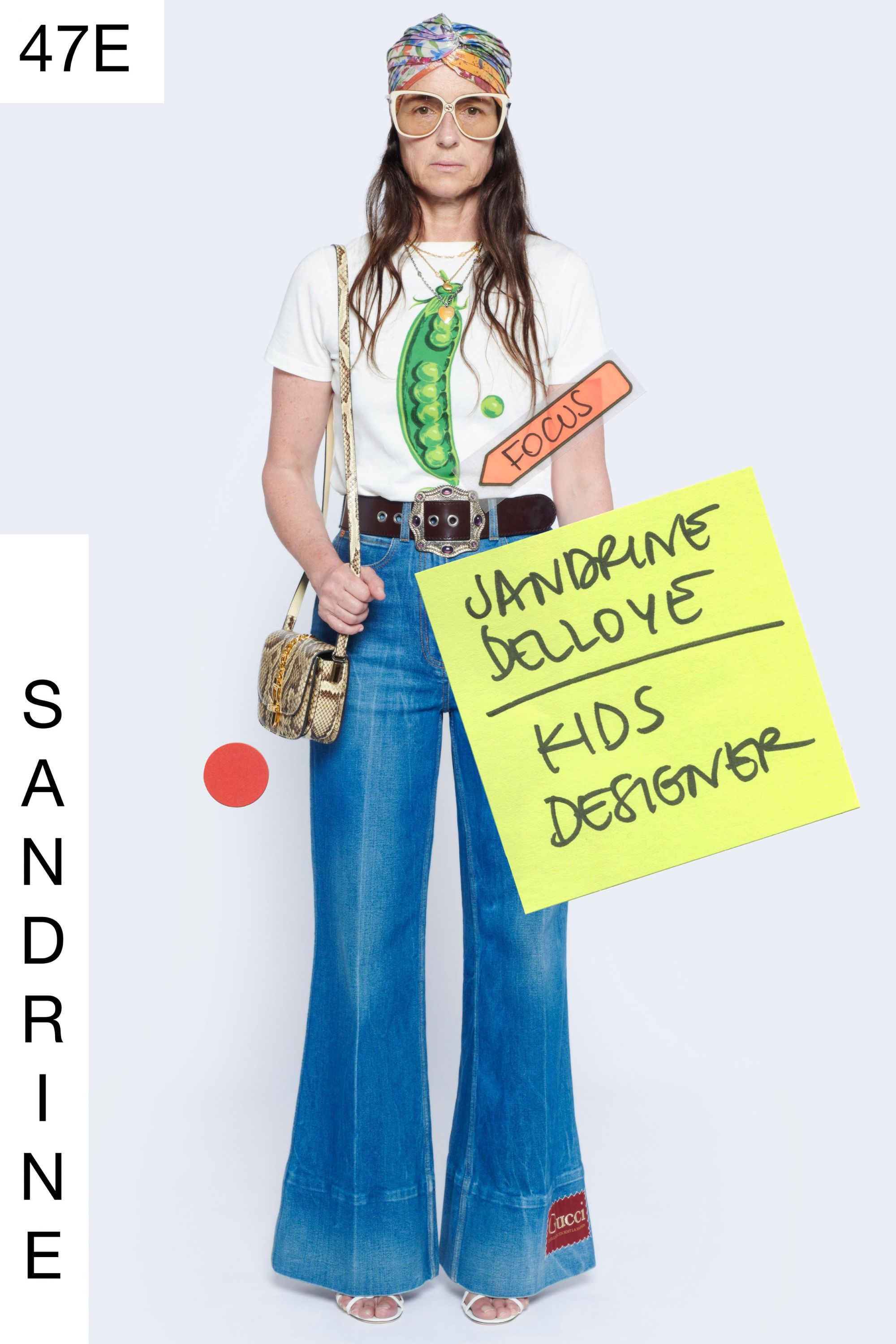

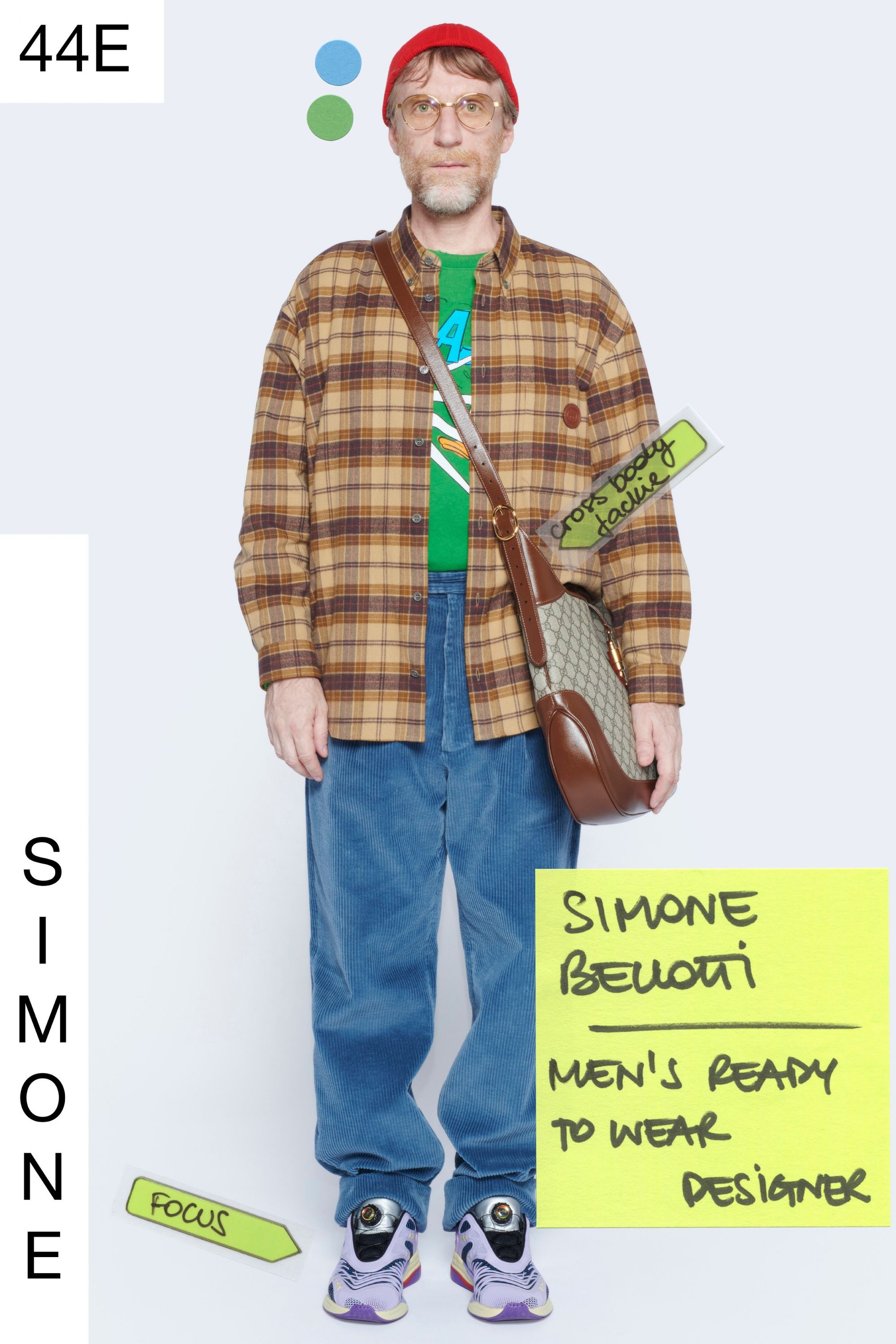

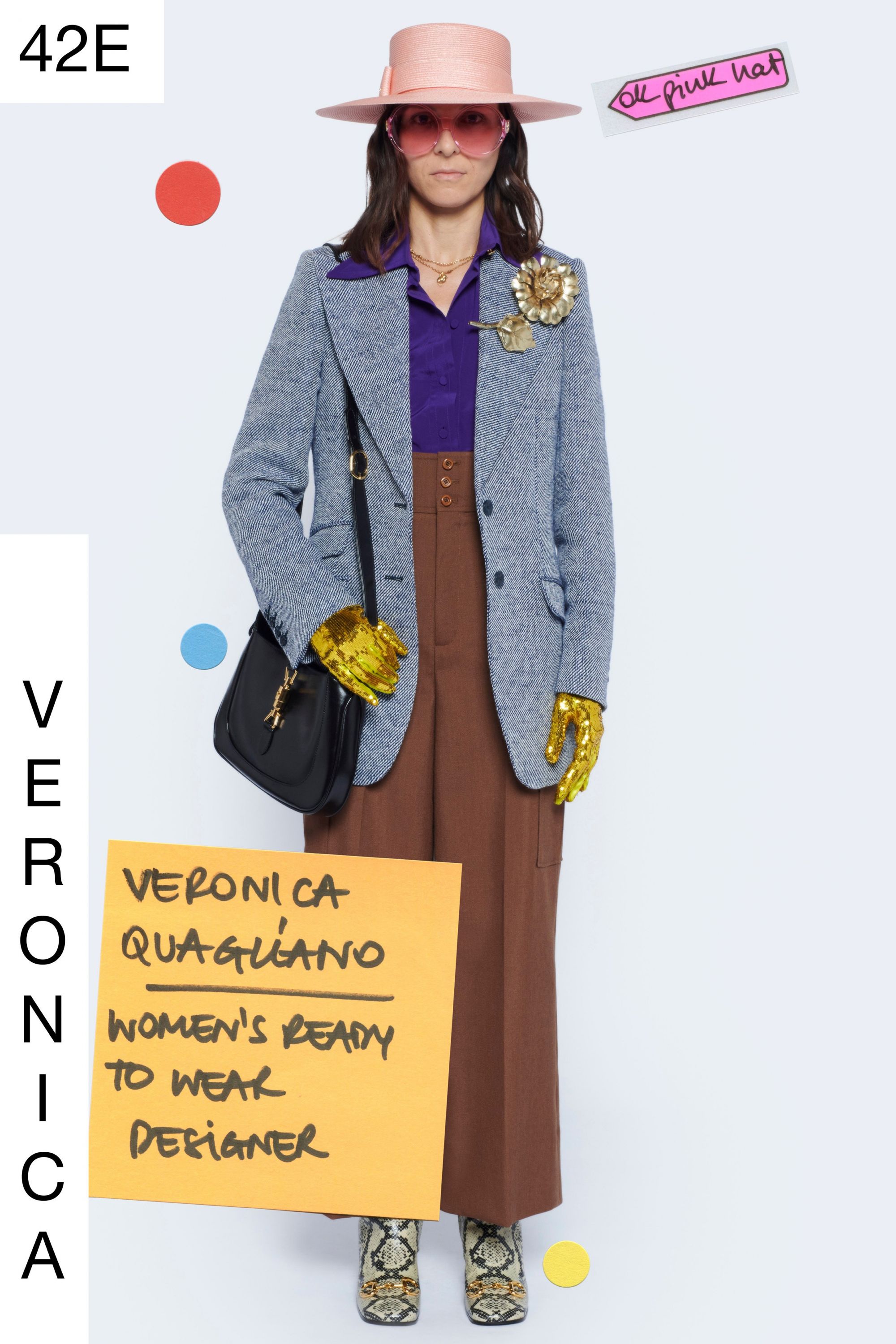

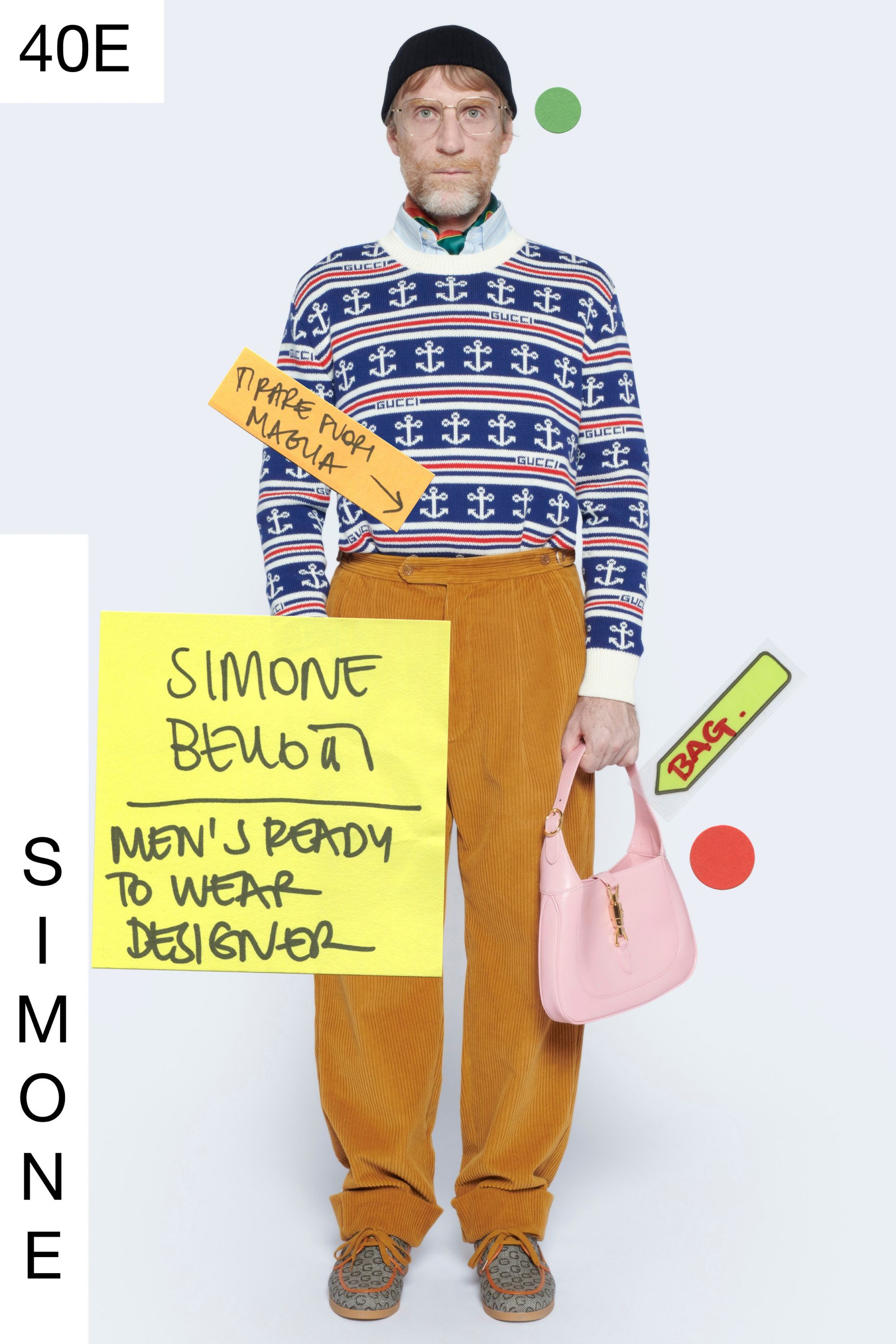

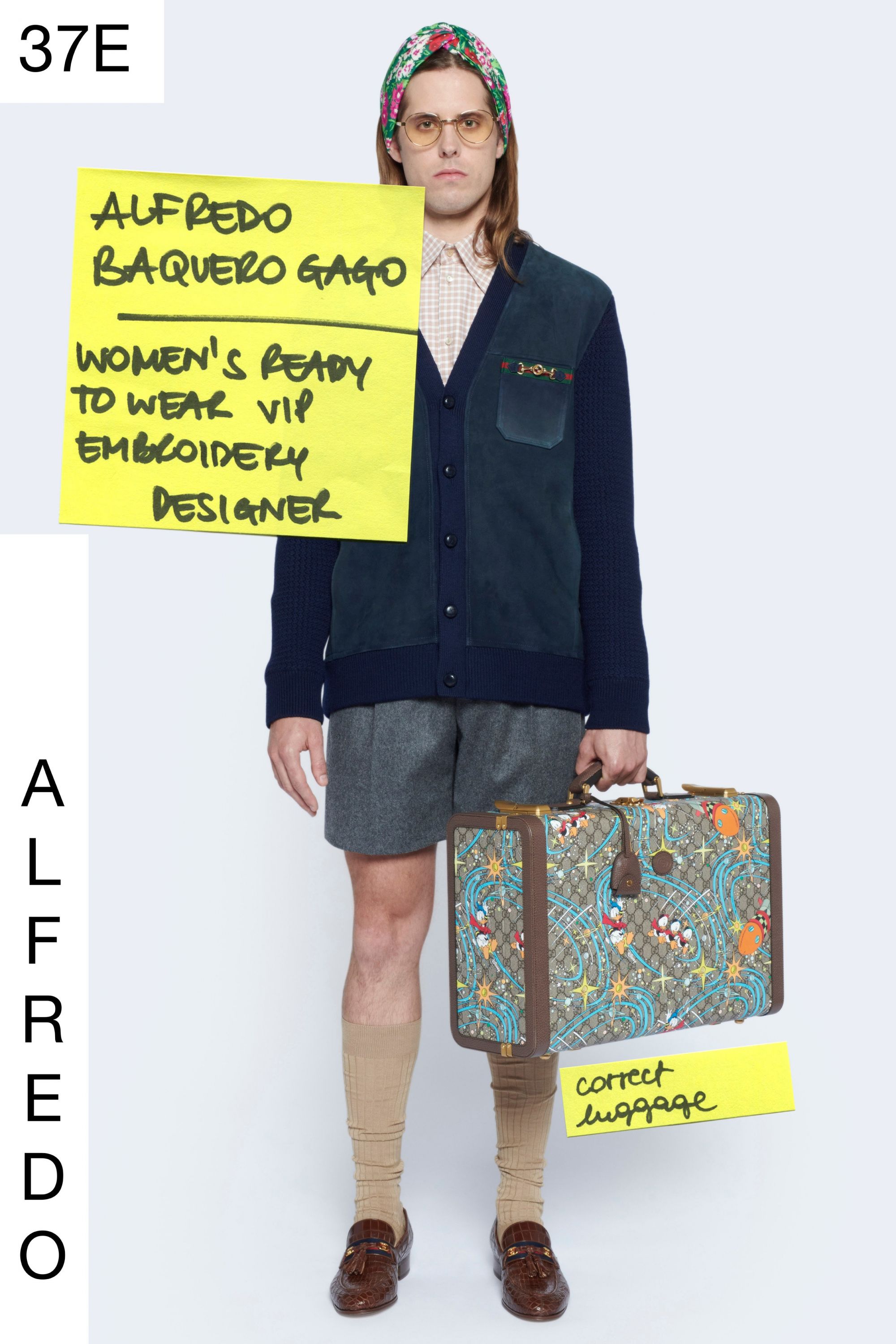

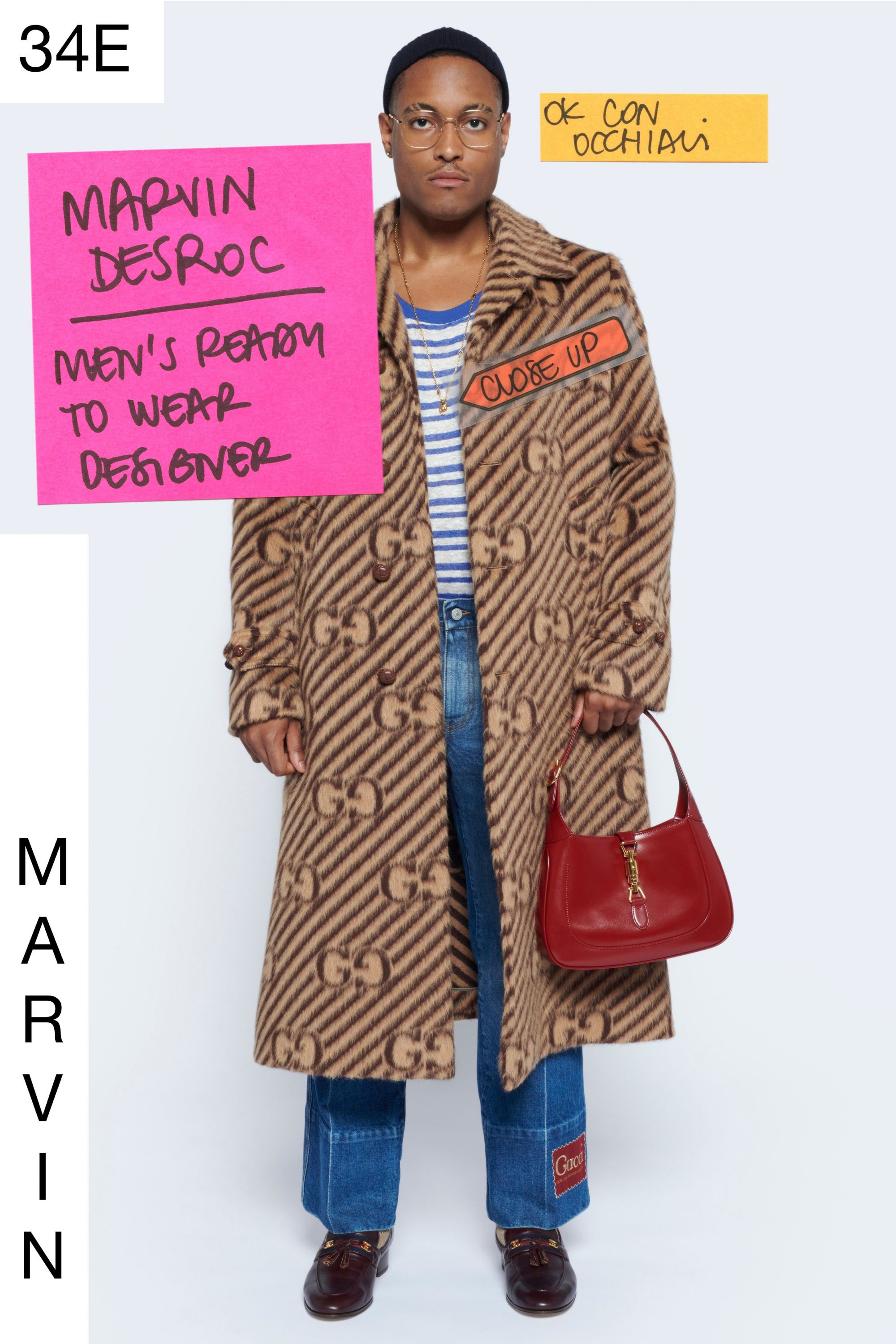

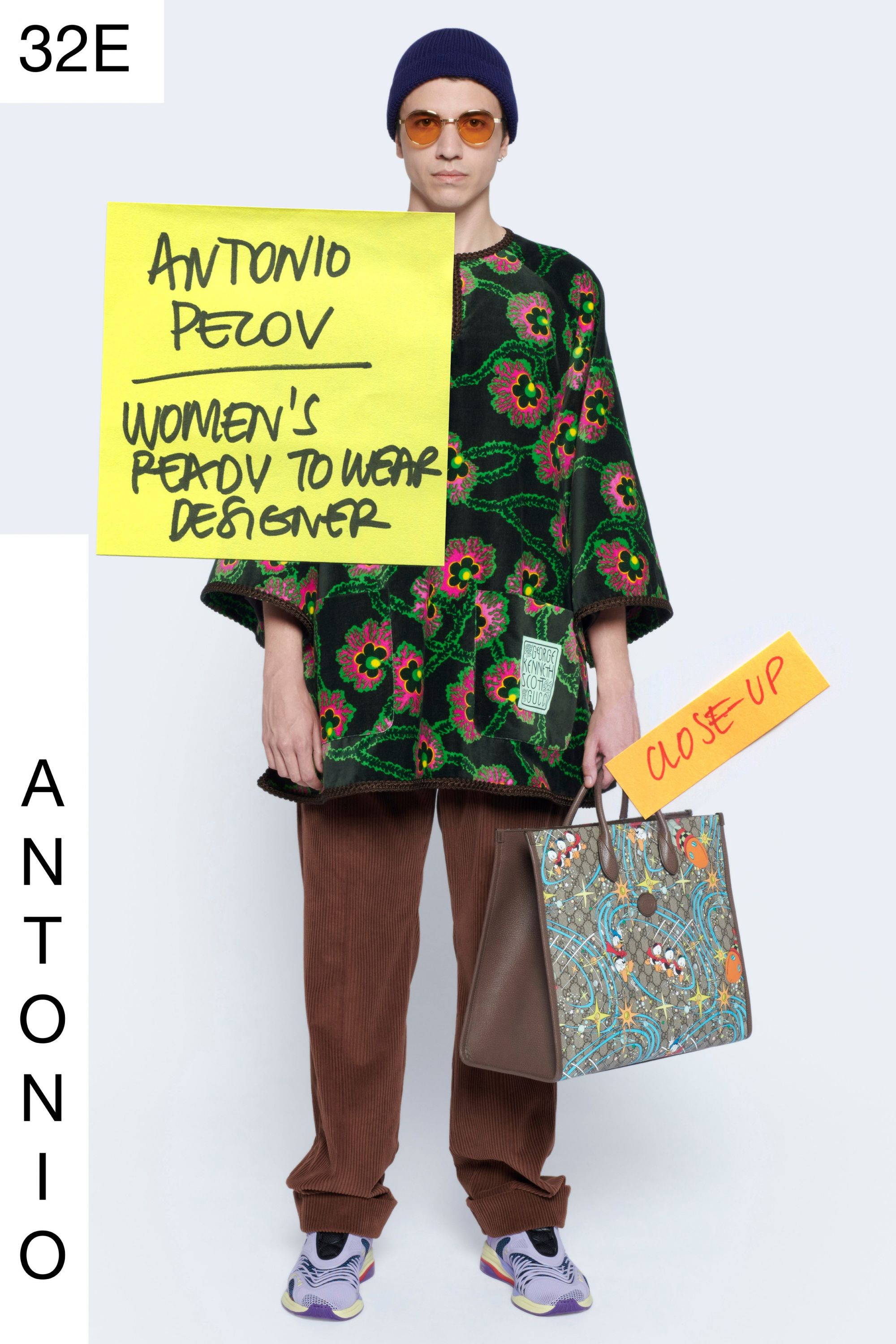

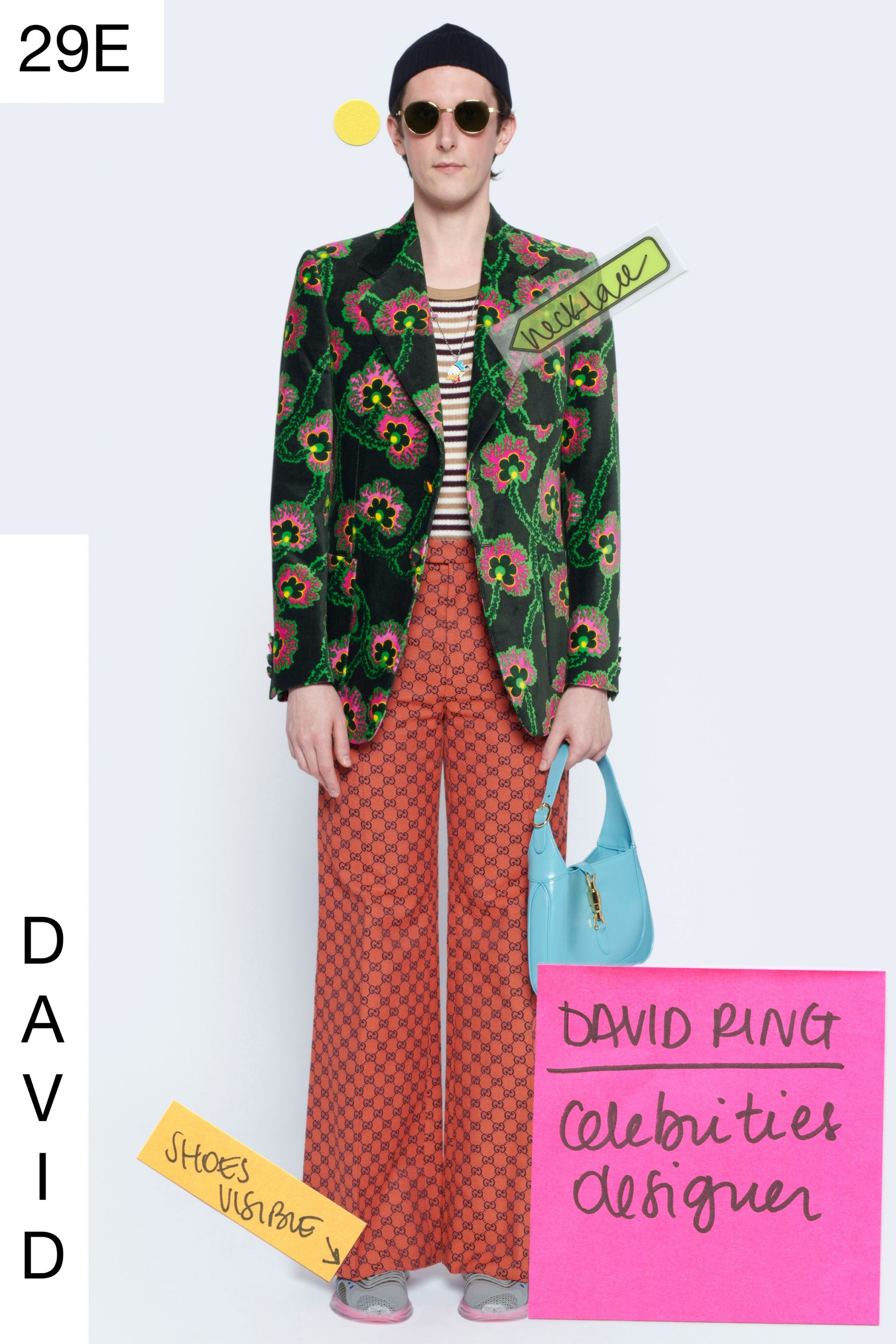

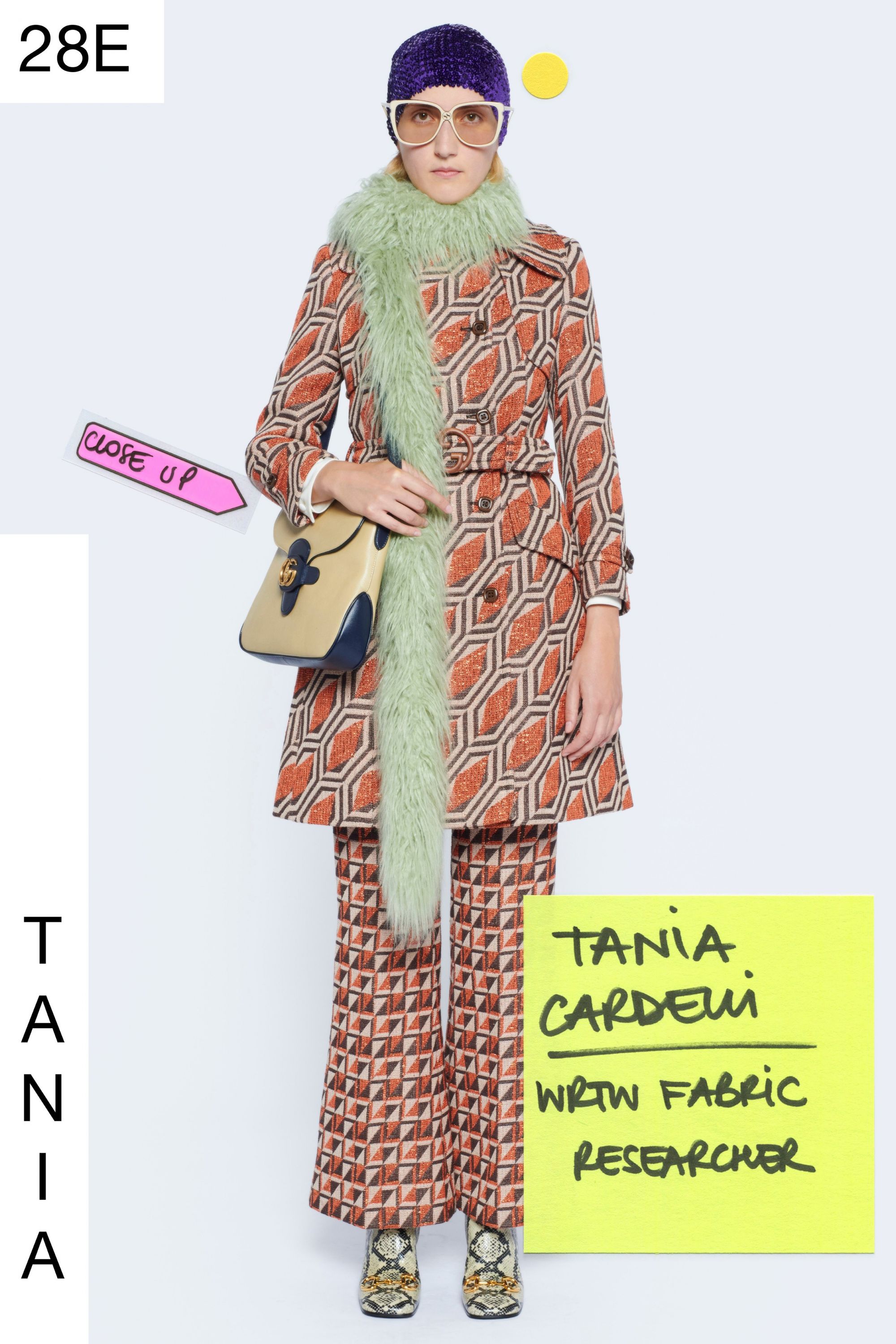

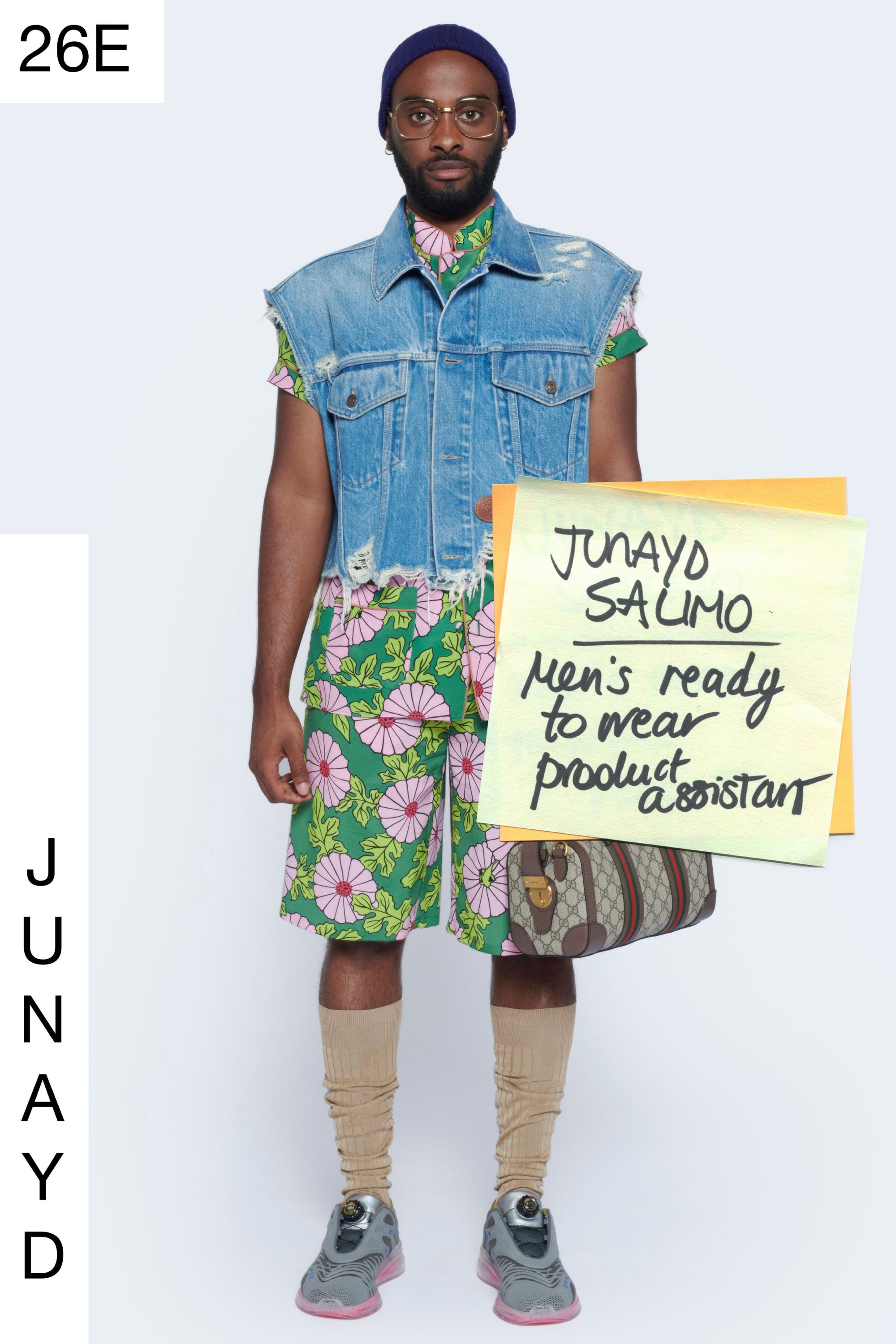

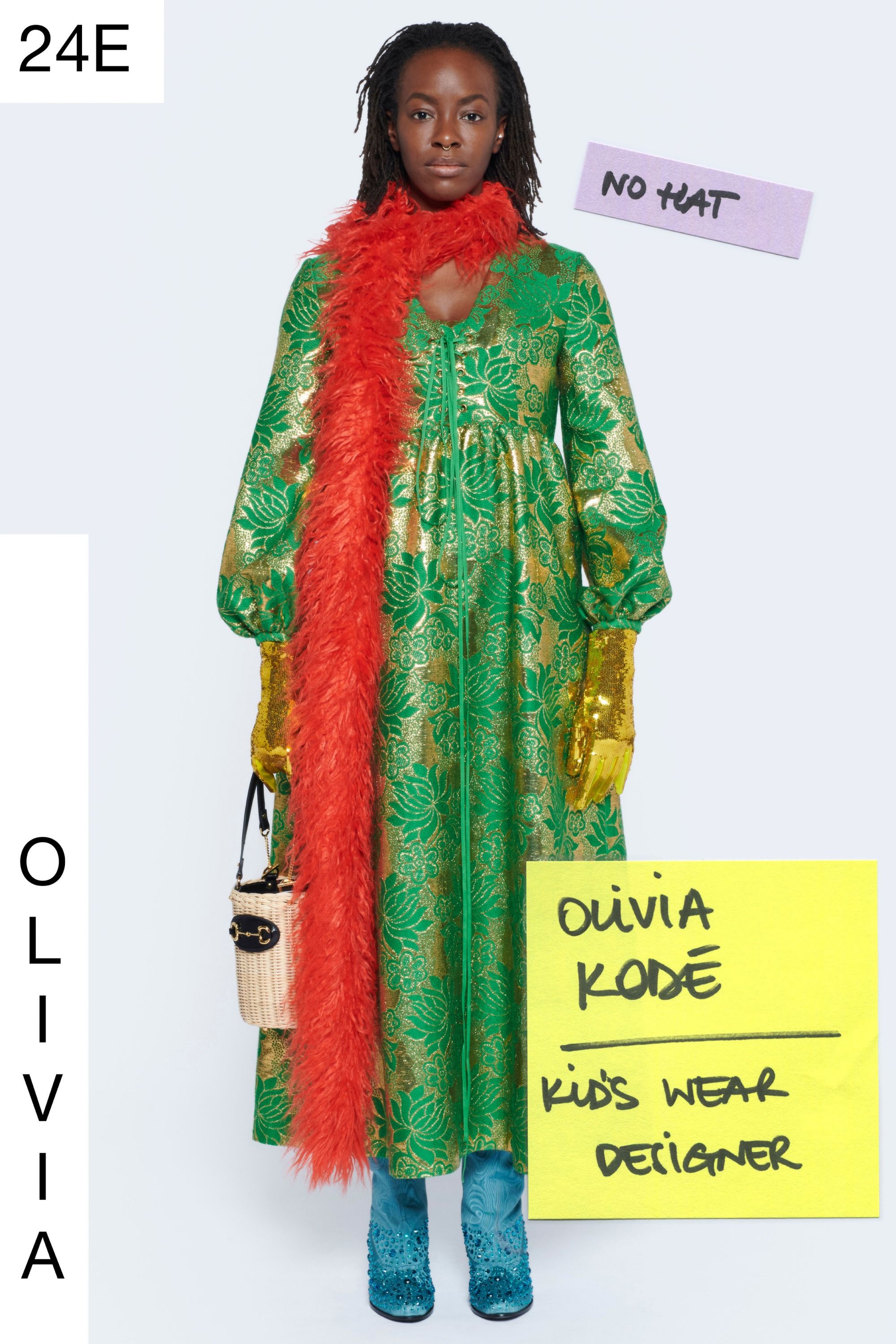

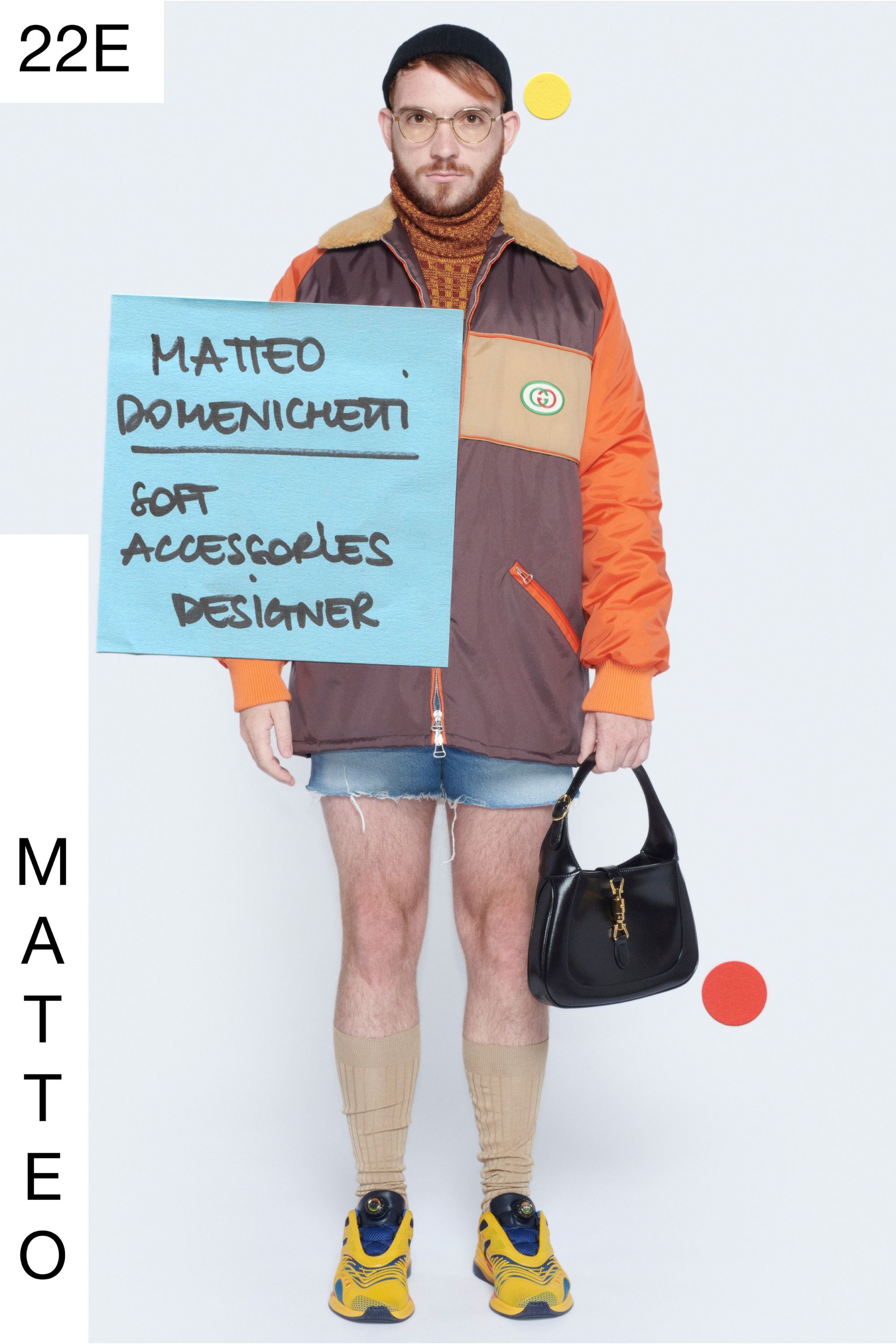

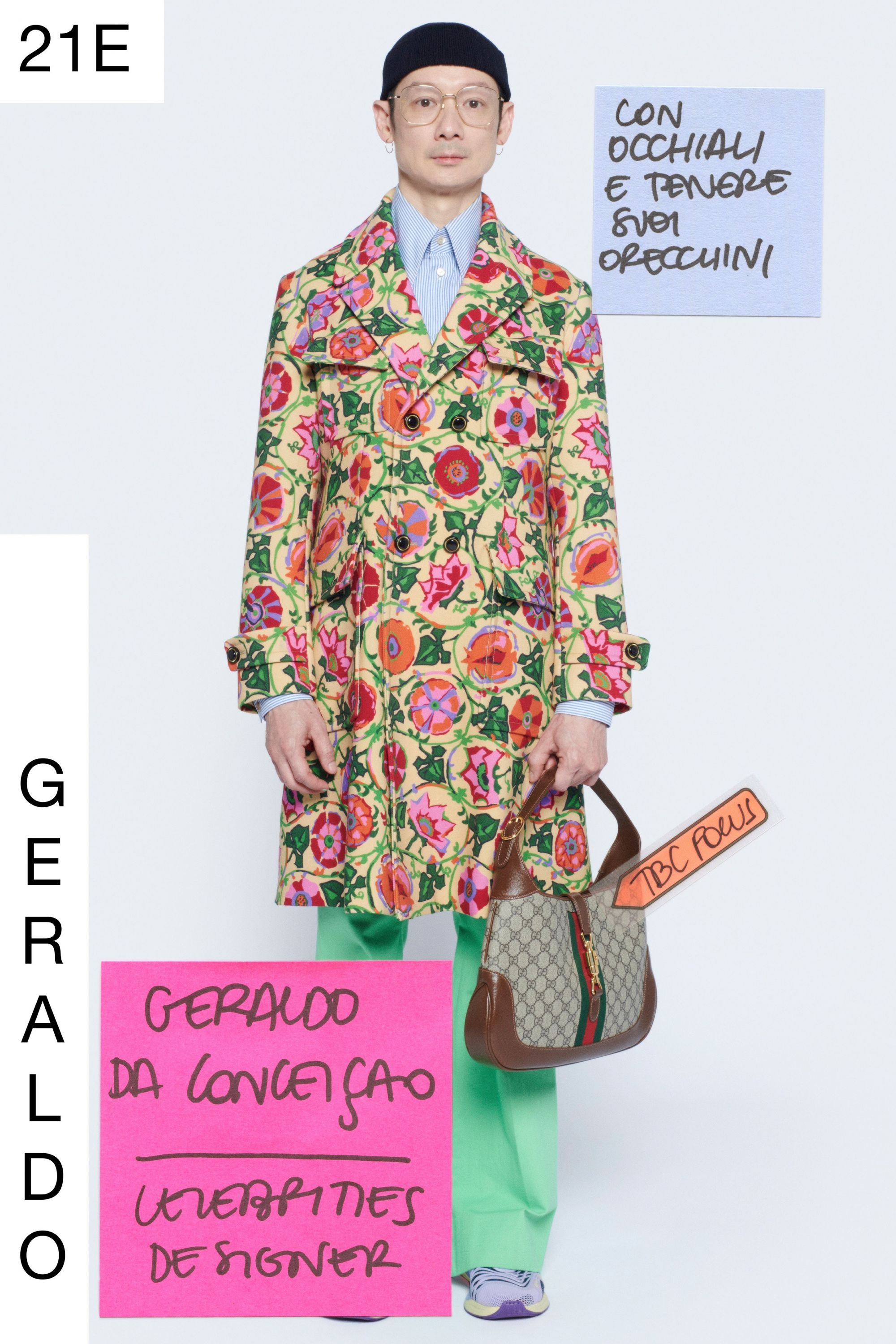

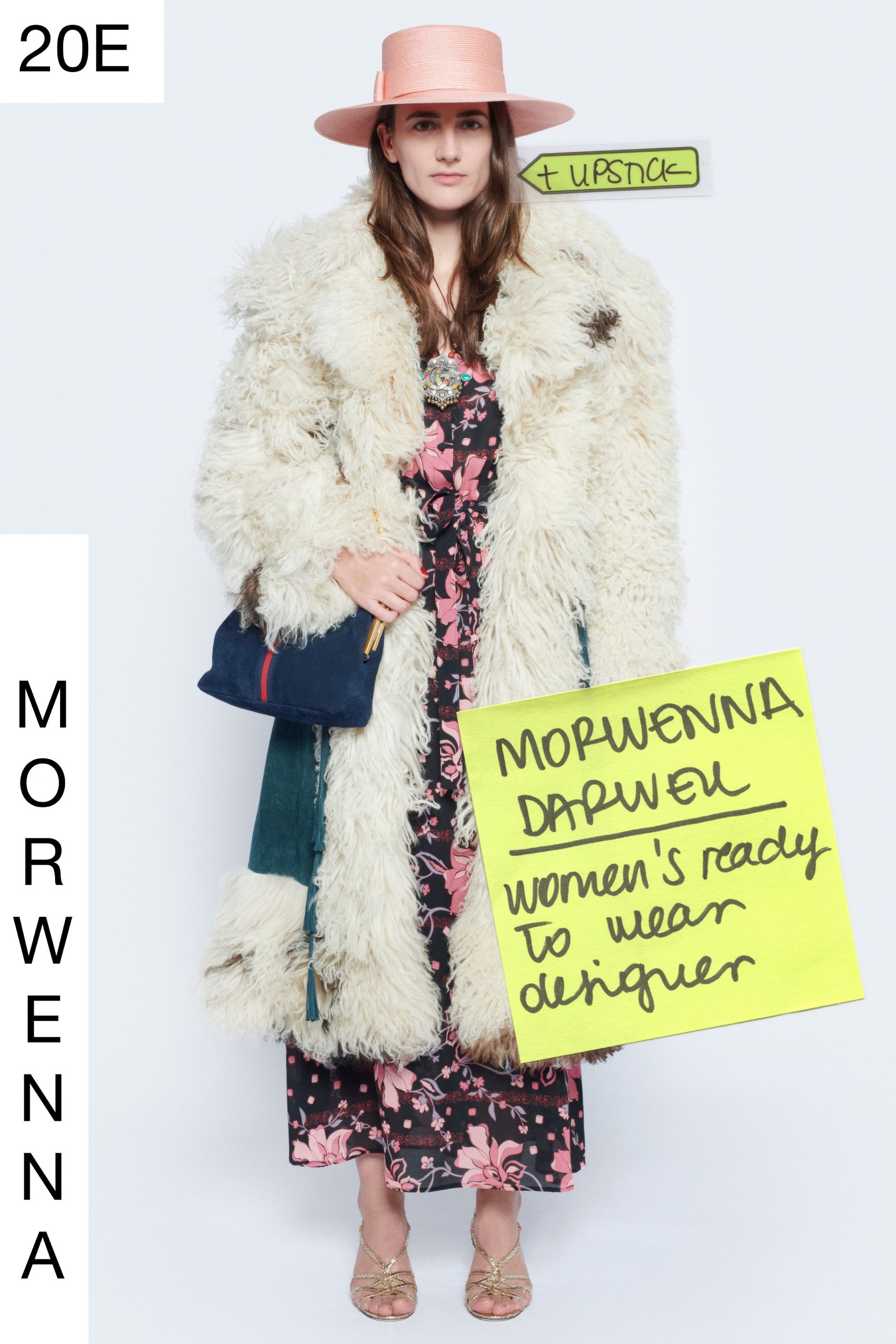

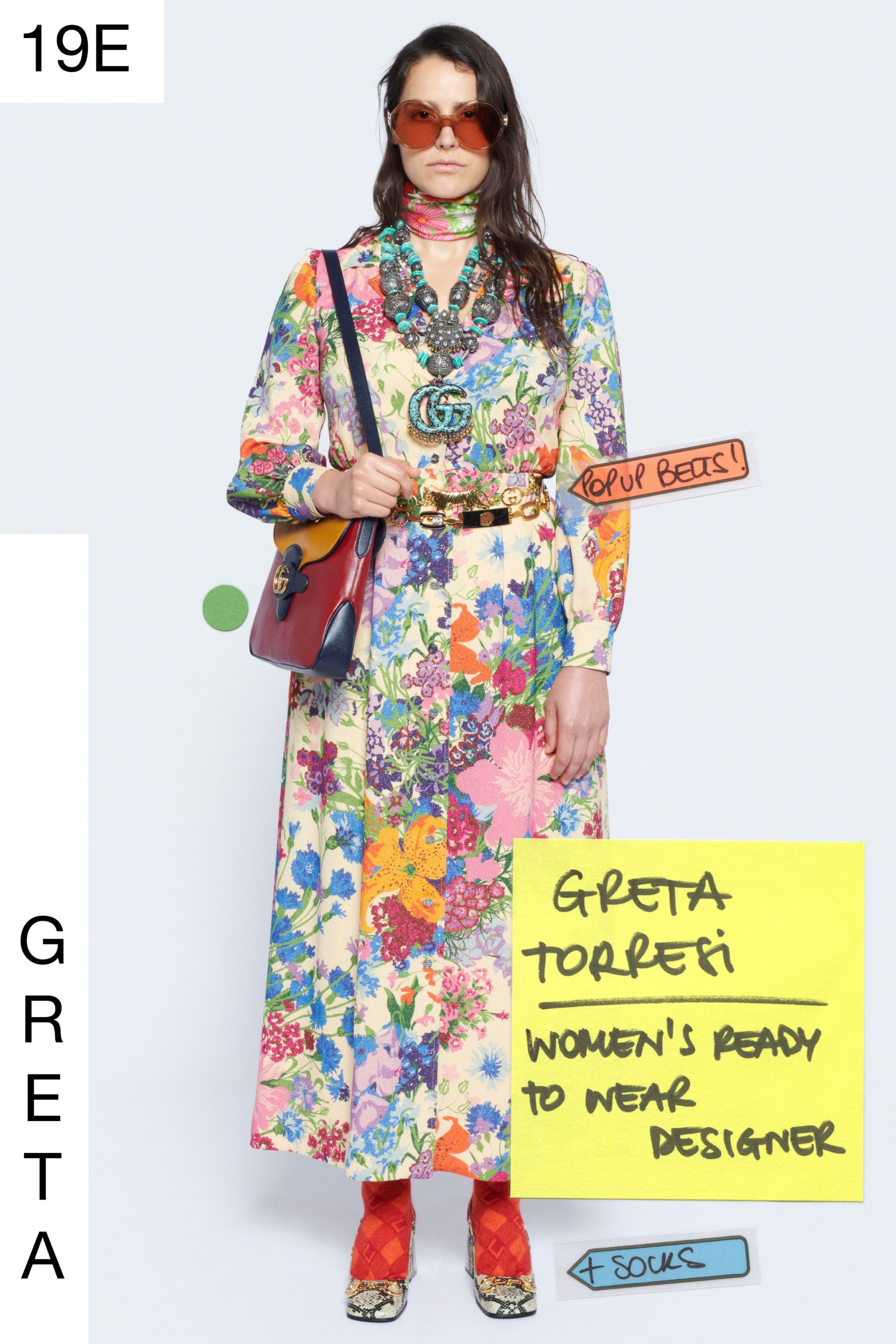

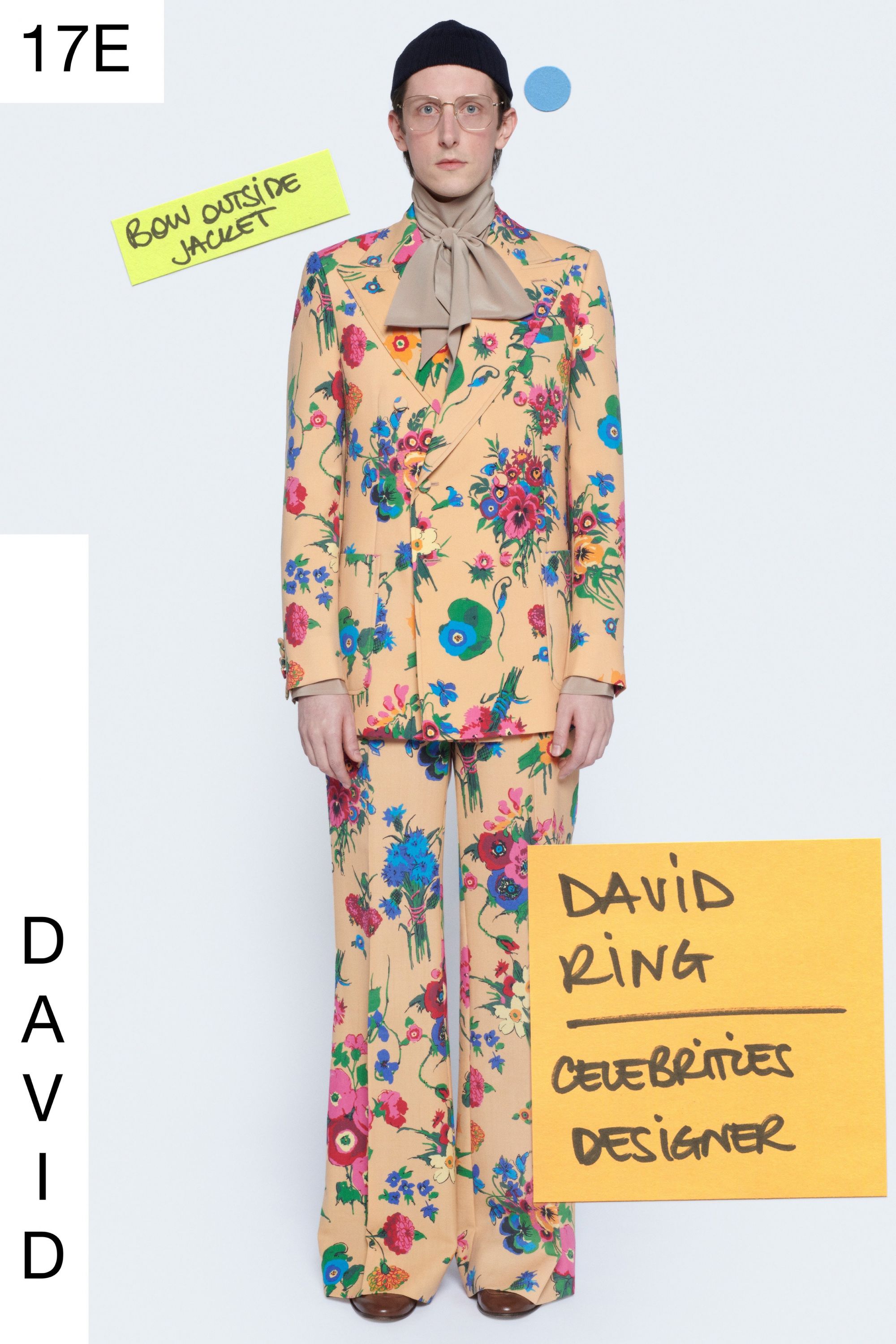

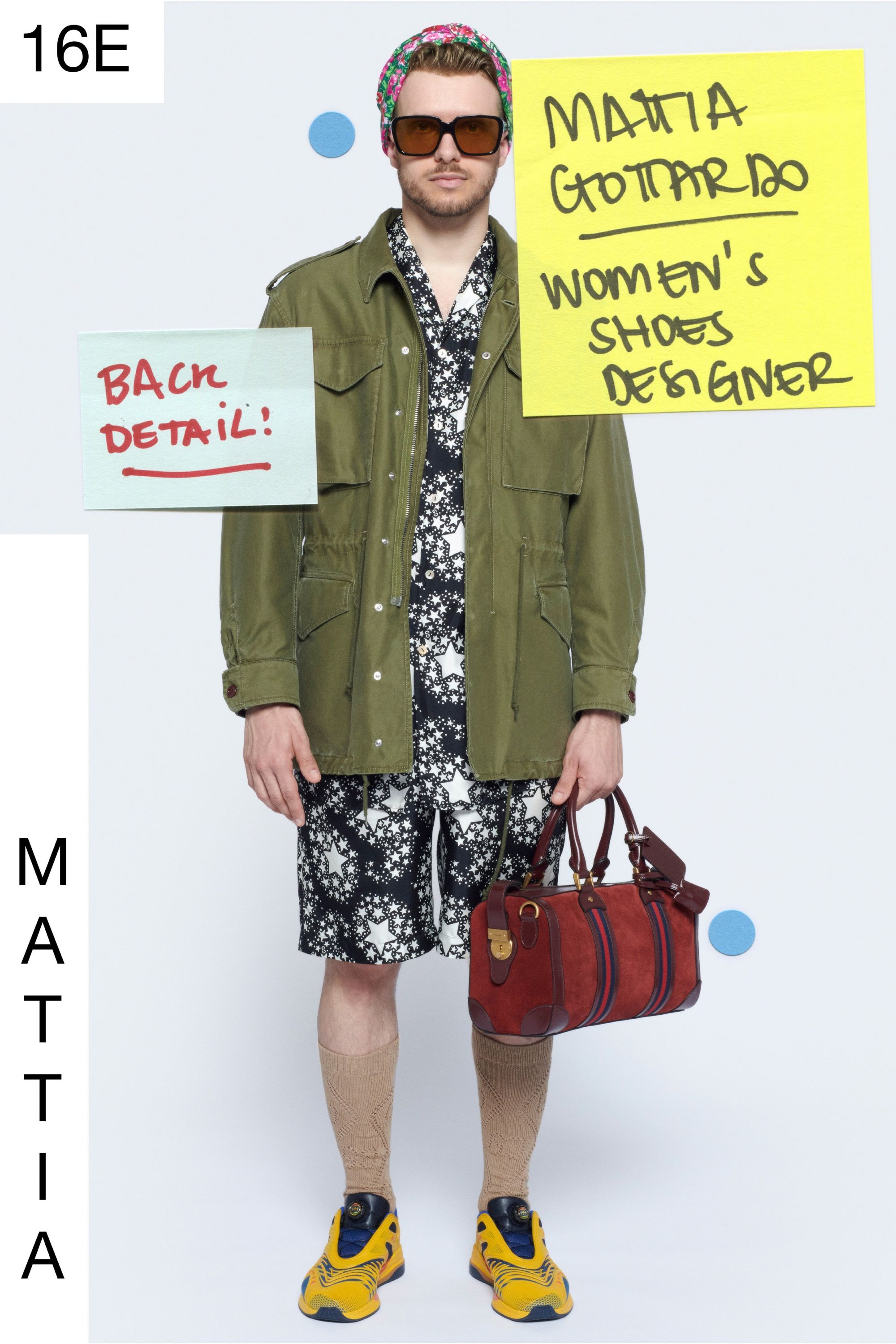

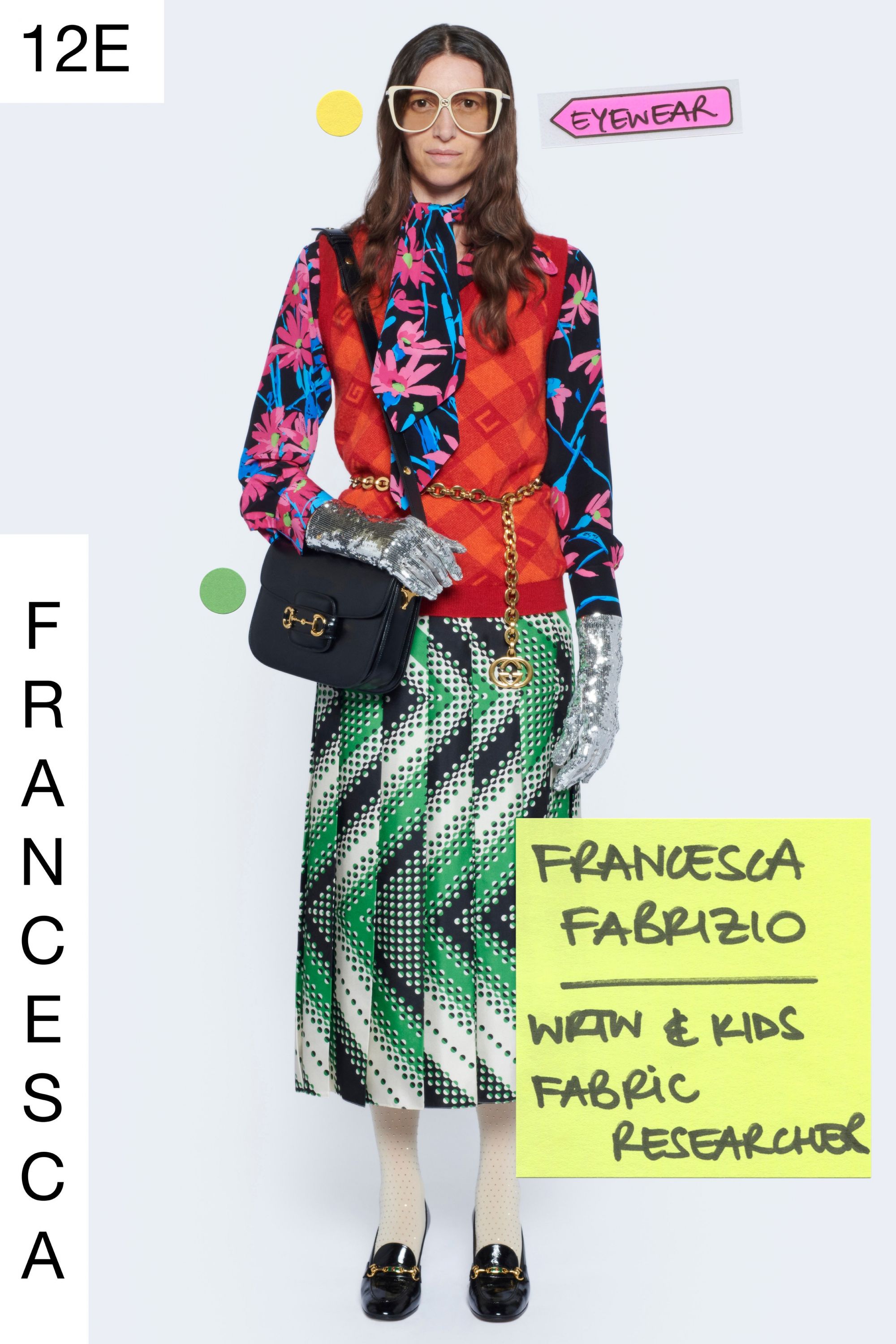

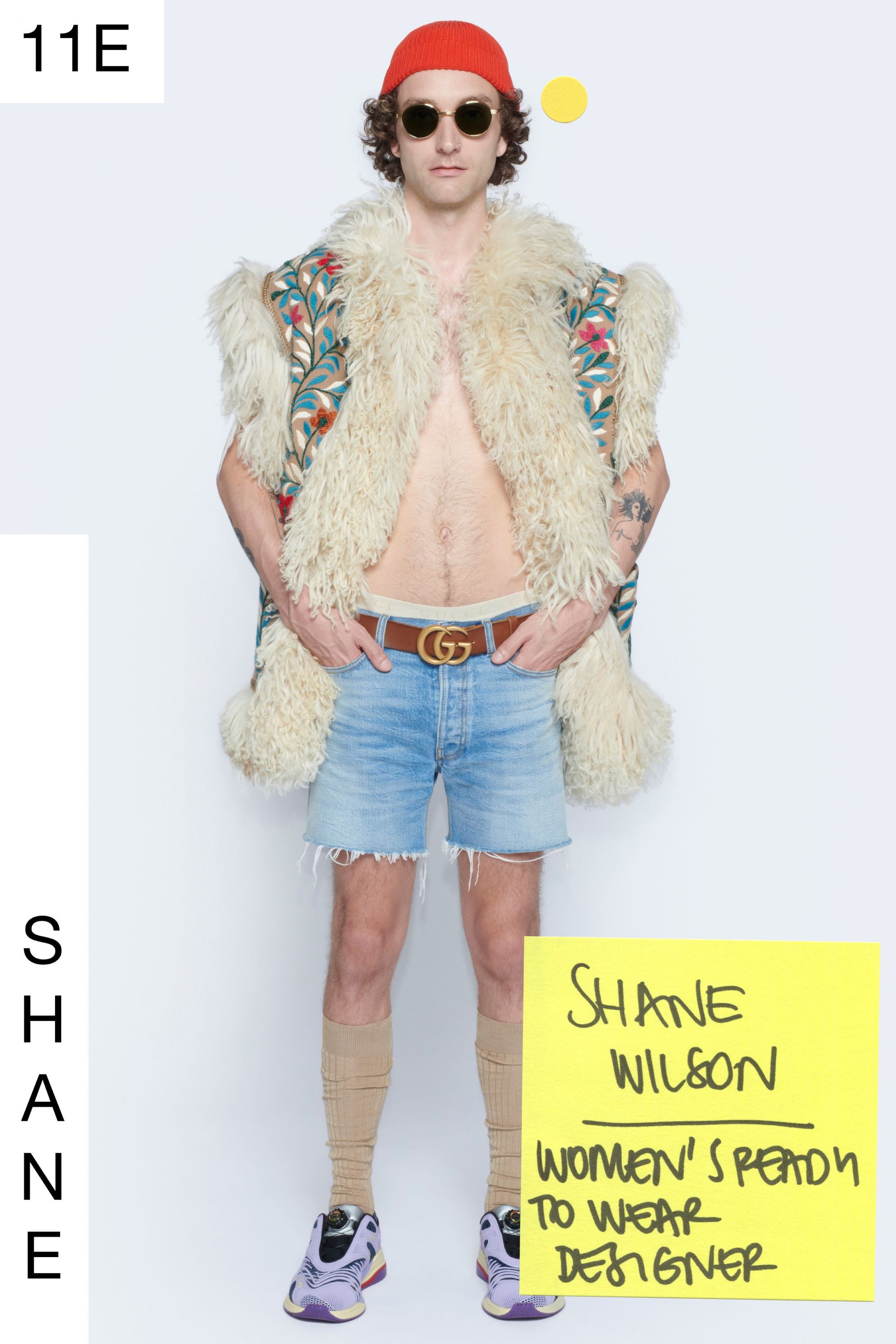

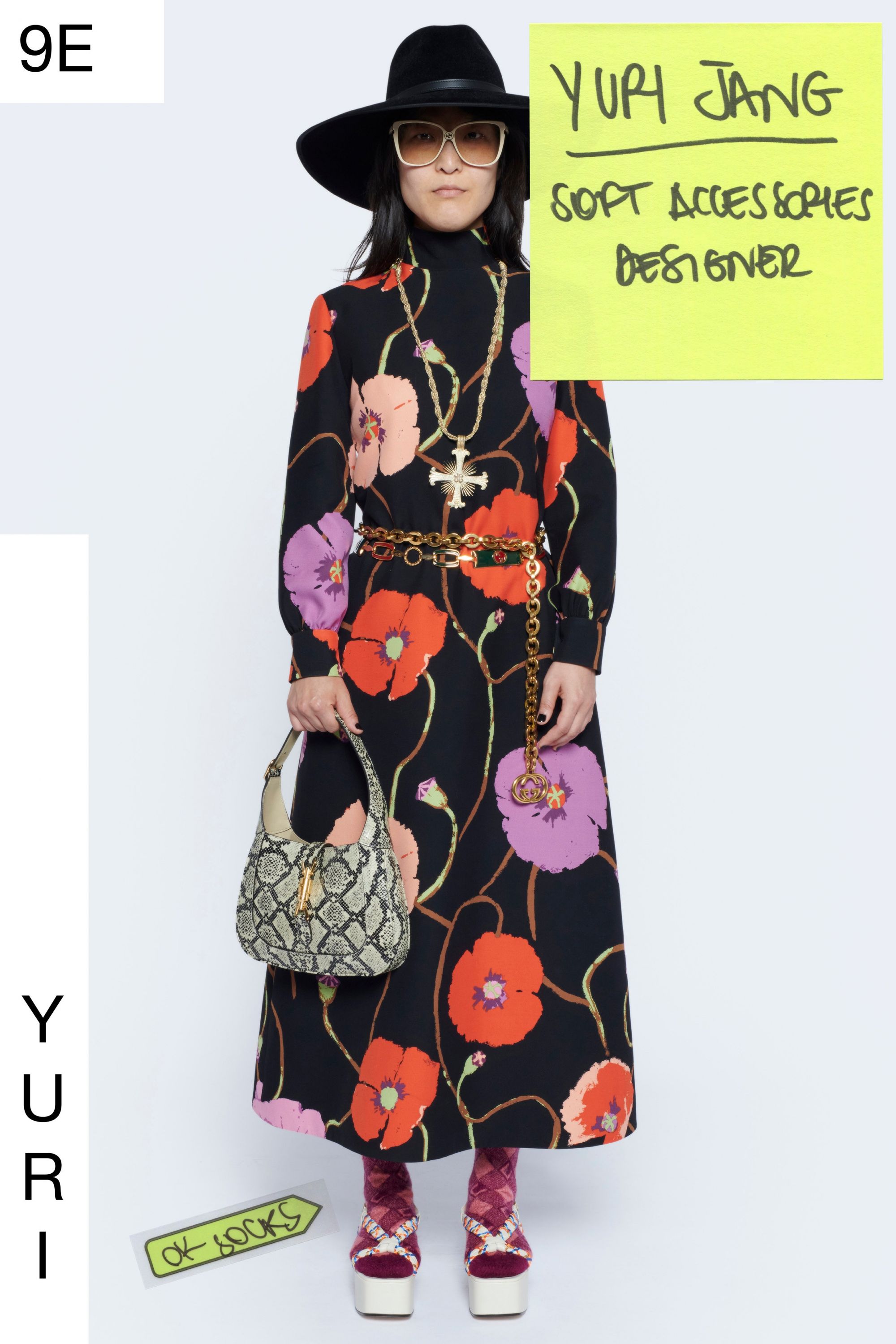

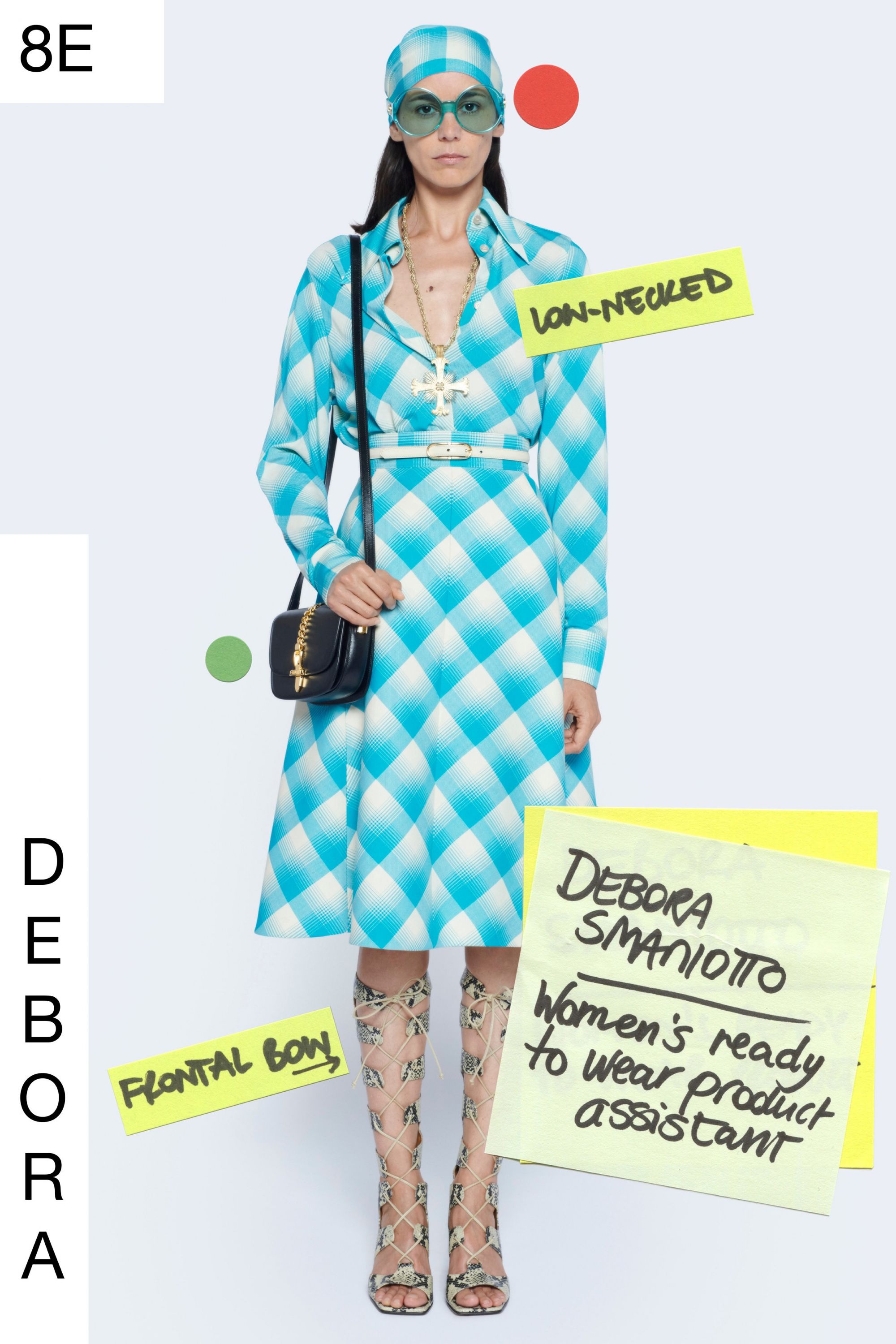

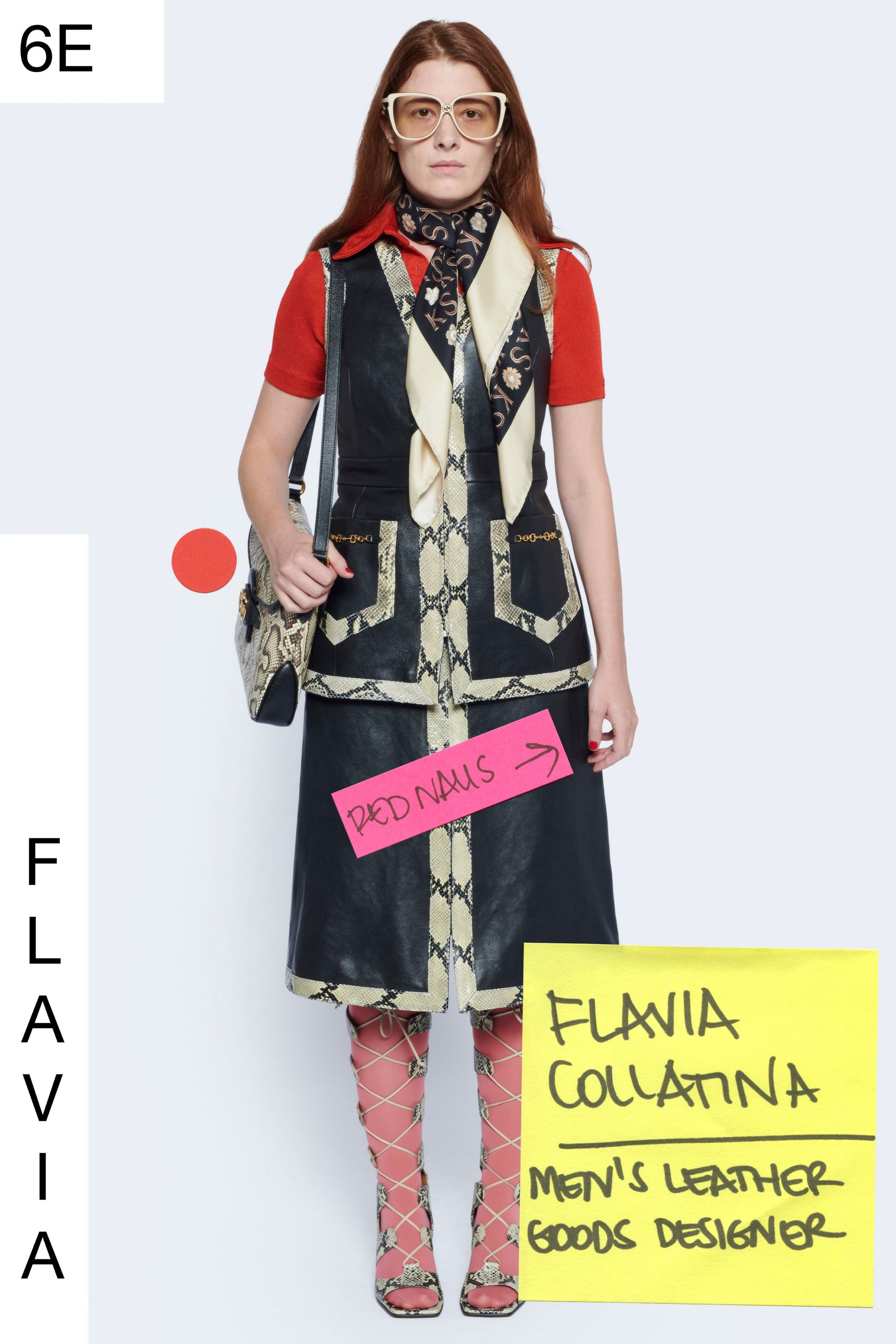

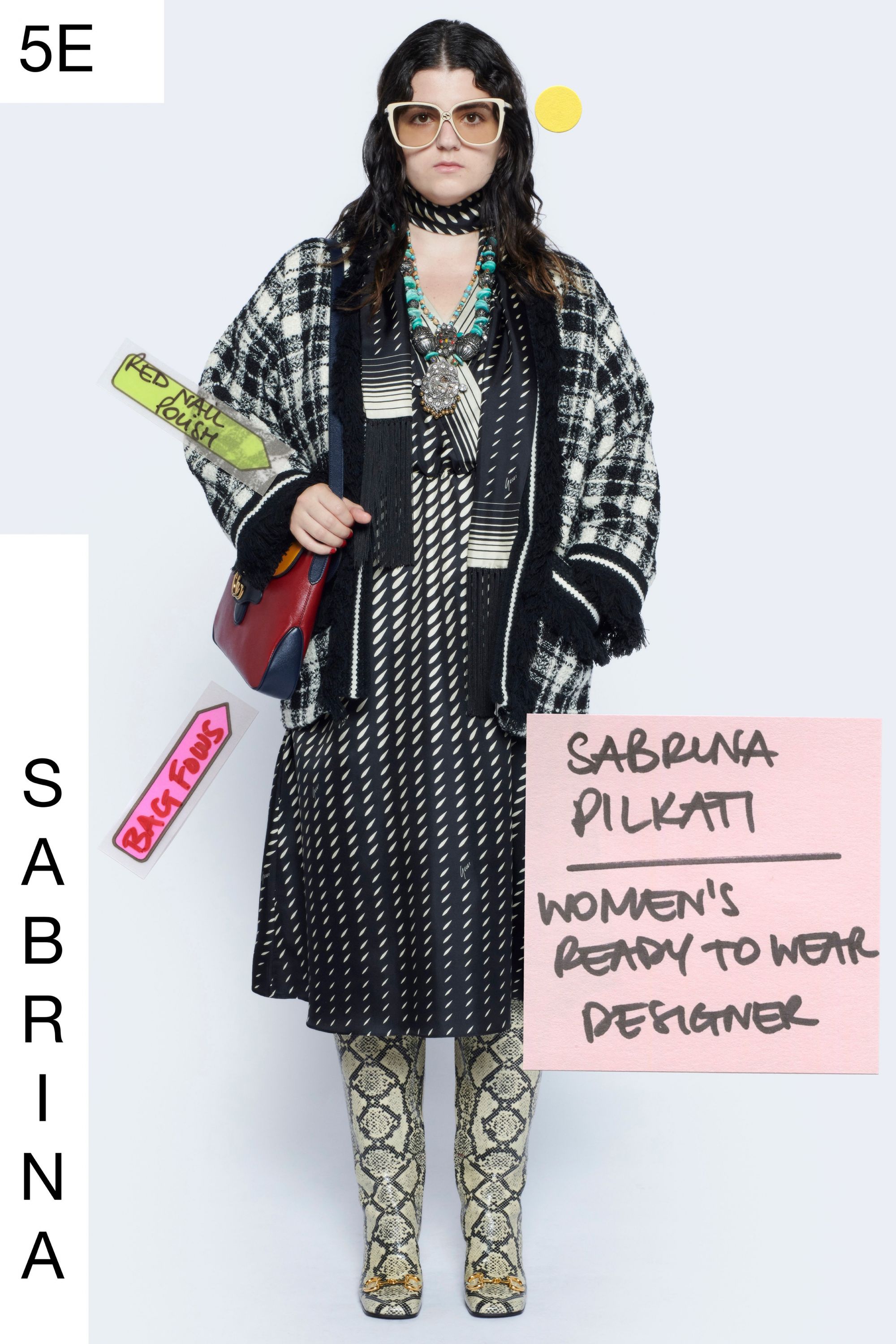

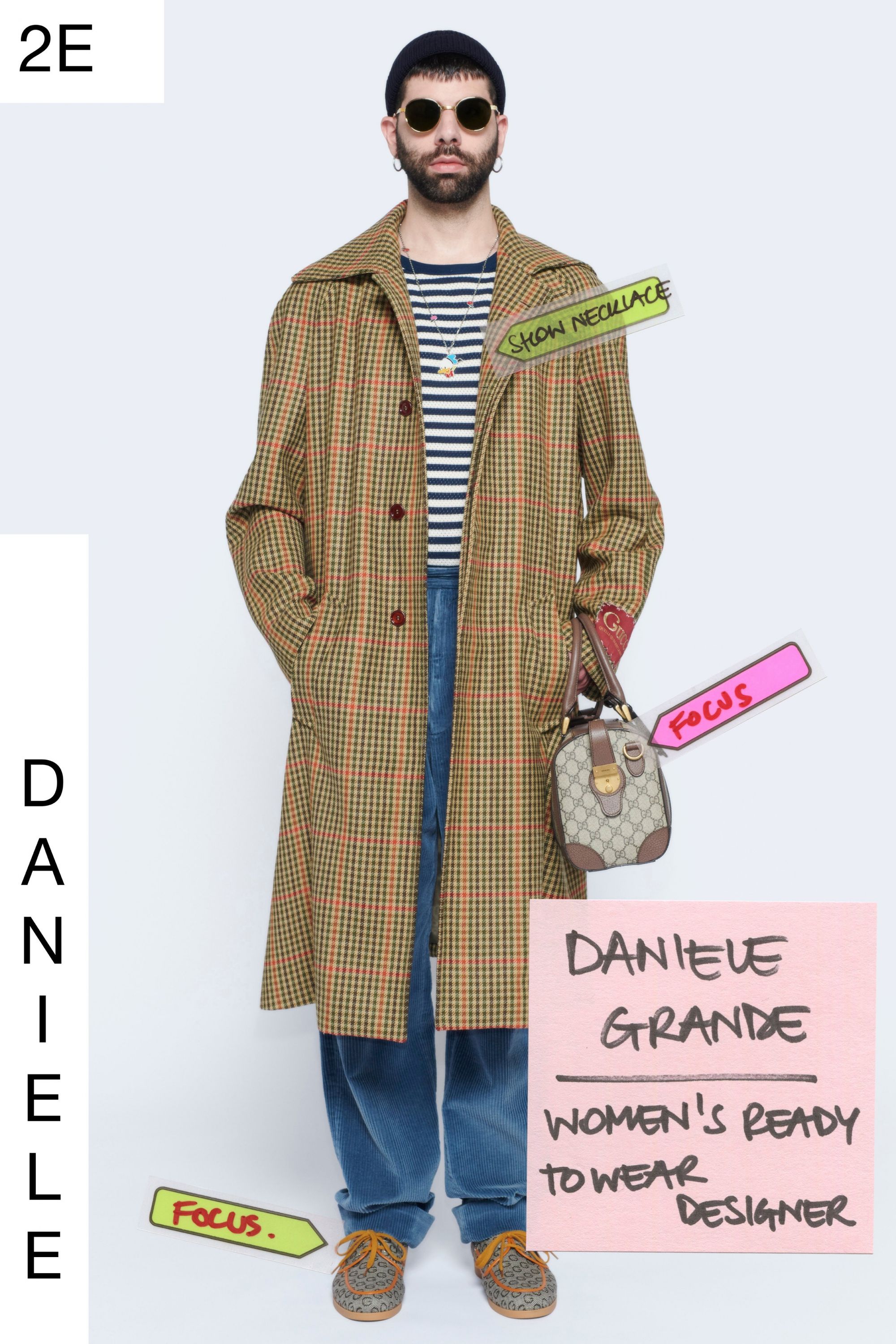

Despite the declines, both groups are not losing their optimism towards the future, also supported by the (weak) signs of recovery after the end of the lockdown. Just to give an example, Gucci has just launched an eco-sustainable collection and its first non-binary line. The launch of this latest genderless collection, inaugurated on the online shop online section of the official website, also confirms the increasingly important importance of e-commerce: the last few months have radically changed the way of shopping also for the luxury market and it is foreseeable that the mechanisms of online shopping will increasingly influence the marketing strategies of large groups and conglomerates of luxury fashion.