The Global Streetwear Report An in-depth look at the numbers defining streetwear's characteristics, brands, products, trends, influences and sales.

The consulting firm Strategy& who carry out some of the biggest and most extensive survey services worldwide, in cooperation with Hypebeast, has just released the data from a survey that dives deep into the heart of what is a seemingly simple, yet complicated, idea: defining streetwear. Going about this by conducting a global survey through various platforms, social groups, and interviews with industry figures such as Fragment design founder Hiroshi Fujiwara, Contemporary artist Daniel Arsham, and StockX founder Josh Luber. The data is divided into 4 parts:

001 - Defining Streetwear details streetwear’s origin, key cultural components and considers the evolution of the face of streetwear.

002 - Measuring Streetwear reports consumer spending habits, including how much they spend, best selling products and regional insights.

003 - How Streetwear Communicates traces streetwear’s relationship with social media and the communication loop between consumer and brand.

004 - How Streetwear Sells dissects streetwear’s tight-knit direct-to-consumer relationship, painting a picture of its innovative “drops” model and the burgeoning secondhand market.

Data

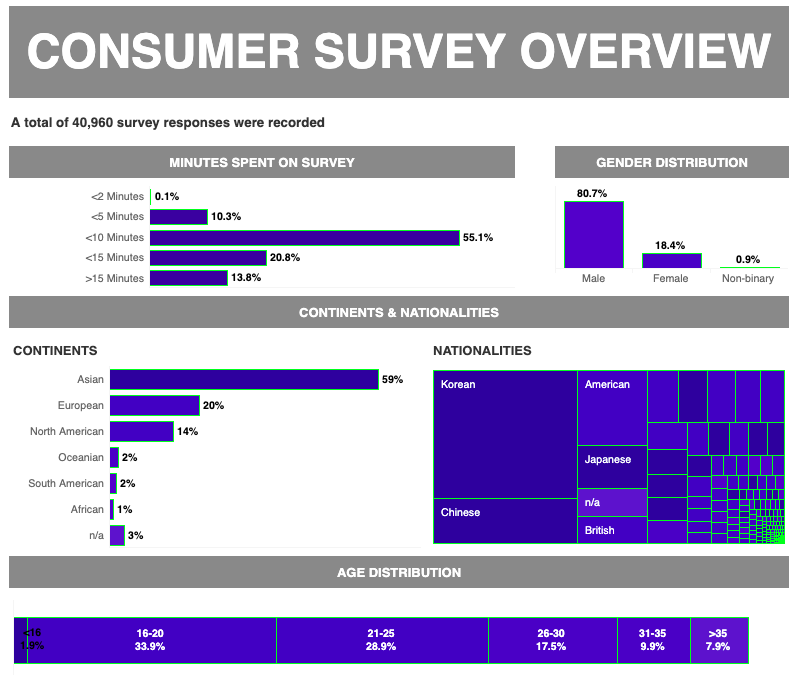

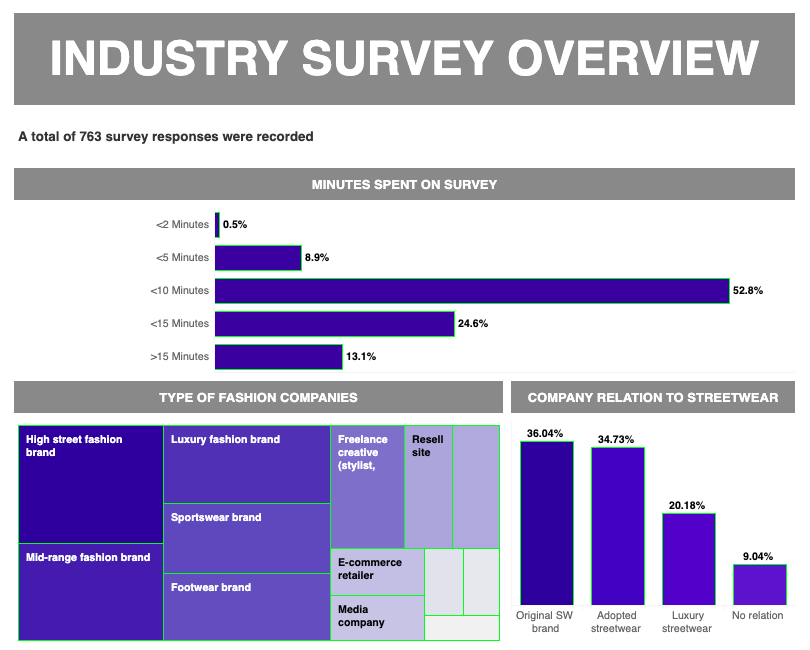

Starting by looking at how the data was collected, the research methods for the report built on a consumer and industry survey. The consumer survey collected a total of 40,960 respondents across the globe while the industry survey collected a total of 763 respondents from a range of industry figures. The consumer survey was distributed in English, French, Korean, Japanese, and Chinese across Hypebeast’s global websites and social media channels.

The industry survey was in turn distributed directly to key industry figure, companies, and brands within the fashion industry. When looking at the distribution we can quickly summarise that Asia had the greatest number of interactions, followed by Europe and North America. Mainly done by 16-25 year olds and 80% males, so bare that in mind when reading the results from here on out.

Defining streetwear

In the study of anything, defining exactly what you aim to study is key in the understanding of its results. Streetwear as the word defines itself is simple enough, it's clothing not worn for special occasions or activities - i.e. formal or sportswear. It's casual and comfortable clothing for everyday use that's still underpinned by some sort of fashion aligned choice. Though that definition underplays a today multi-billion-dollar retail phenomenon, with roots in the subcultures of the 1980s and 1990s, including graffiti, skate, surf, hip-hop, and rave. In essence defined in the reports as:

“streetwear involves the production, promotion, sale and resale of casual fashion, principally of footwear, such as sneakers, but also T-shirts and other items – in ways that bypass traditional retail channels, often subverting the way the fashion industry has long defined and dictated how “cool” is made profitable. The audience, and therefore the target market, is very young: mostly under 25.”

Strategy&

An aspect that can be seen as being a red thread running through these subcultures and into the weave of streetwear is that of authenticity.

"This level of authenticity is unmatched elsewhere in the fashion industry, which has typically operated through a top-down effect. Insiders act as the gatekeepers to the newest styles and trends. Streetwear has subverted this formula with a more democratic model. With streetwear, the tastemakers are not only taking direction from style that comes from the streets, they are taking direction directly from the audience. It’s the consumer who has the power to determine what’s cool as much as the industry insider."

Strategy&

Characteristics

When looking at the results for what key attributes define streetwear, long time aspects such as coolness, exclusivity, and status symbol have been integral to fashion, but streetwear introduces new key factors that have previously had far less importance - Comfort, as odd as it sounds has long had a secondary position to look and design for many, but in particular community. Especially now with its digital explosion has become paired with social media, it's meant the importance of community in defining streetwear has become pivotal to its definition. The exclusivity aspects, that's also long been a part of fashion, within streetwear is based more on a knowledge, or nerding-out aspect of the brand, than by any financial means to purchase it. For brands, tapping into this "in the know" mindset poses the highest obstacle of entry as it lays beyond their control and only genuinely achieved via the consumers and communities themselves.

Brands

The brands that the survey resulted in defining streetwear as were:

At first glance, none of these seem too surprising, with brands such as Supreme and Off-White being perhaps the most named brands when asking anyone about streetwear. What's more interesting to note is the road that often led to them being there and how it often veered rather far off from the 'street'.

Supreme's explosion into wider popular culture was in many ways facilitated by the 2017 collab together with Louis Vuitton which was designed by Kim Jones. The success of which one could argue was an instrumental stepping stone in Virgil Abloh's appointment to creative director of menswear at LV in 2018. Virgil whos own rise, in turn, was greatly helped along by riding the tailwinds of prowess on the biggest hip-hop artist on the planet, Kanye West. Large-scale investment in streetwear has become increasingly common, most notably by Supreme itself, whose sale to The Carlyle Group in 2017 went for an estimated $500 million USD. Also, Japan’s A Bathing Ape (BAPE), received investment as early as 2011. Other listed names such as Nike and adidas are both huge companies that are among the biggest in the world. In other words, what many consider to be streetwear is on a corporate level anything but, and a huge business machine has made sure you think that way.

"What began as a niche culture – literally starting with the printing of logos on T-shirts – is now a primary driver in the fashion industry, adopted by all genders and stretching from luxury to mall brands."

Strategy&

Measuring Streetwear

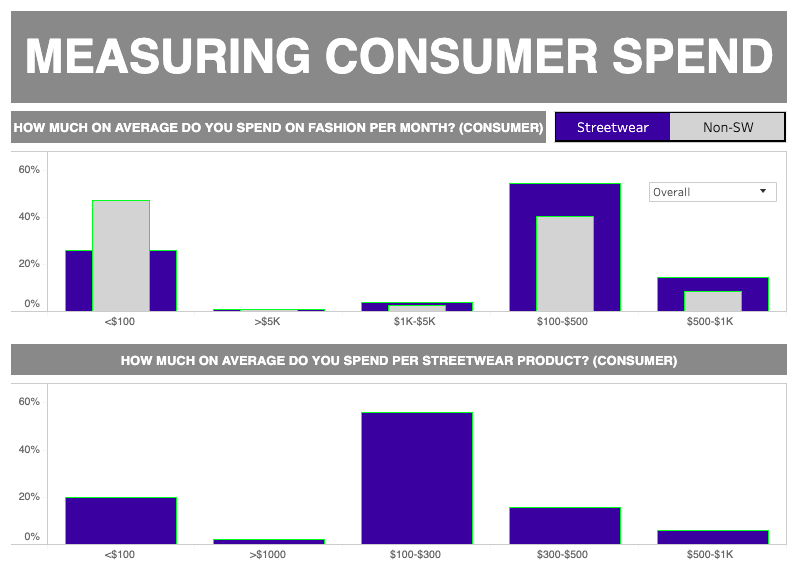

The next part of the survey concerned spending habits within streetwear. Streetwear again has an interesting dualistic nature in that it often on a retail level remains very affordable, but due to hype and incredible demand prices on second-hand markets can skyrocket. Supreme is a case study in this, in how a box logo shirt will retail at around €100 but will easily collect anything from 5-10 times that number when resold. In fact, actually being able to acquire a supreme box logo at retail when it drops has become next to impossible and today resembles much more a luxury goods market.

The average streetwear consumer spends around 100-300 euros on a given product, but a problem facing the most hyped street brands is that they are unable to retain that defining streetwear pricepoint with the most hyped brands such as Off-White now retailing for luxury brand prices.

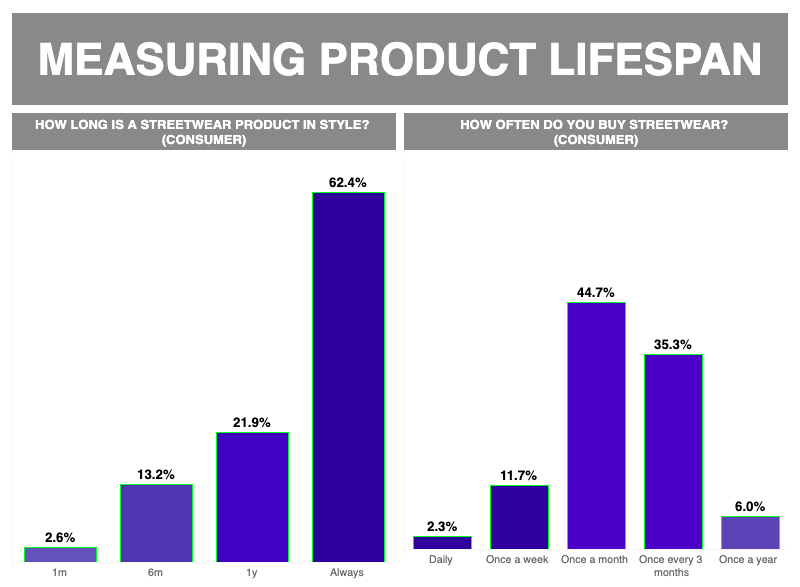

Coupled to this we see the next data graph which shows how the ever faster pace of fashion sees no signs of slowing down. The data here seems a bit contradicting, if 62.4% really believe the streetwear t-shirt they just bought, for example, will be in style 'always' when most streetwear fans know you'll be lucky if it lasts a season, and probably also why 44.7% are buying new products every month. Here questions such as quality and sustainability are getting an ever more important role and consumers are reaching the insight that it really does make more sense to get something of higher quality, lifespan, and sustainability in order cut consumptions but also raise standards of productions.

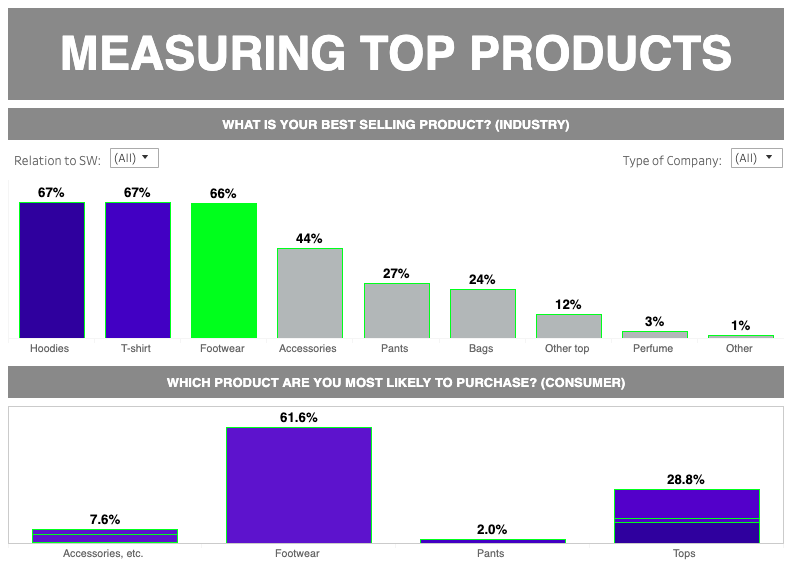

When looking at which individual products rule the streetwear market the age-old signifiers of street fashion, the hoodie, the t-shirt, and sneakers all reign supreme above the rest of the categories such as accessories, bags, and pants. With sneakers taking up a whole 61.6% of which product we're most likely to buy next, let's keep in mind that 80% male survey taker figure right about now.

Influence

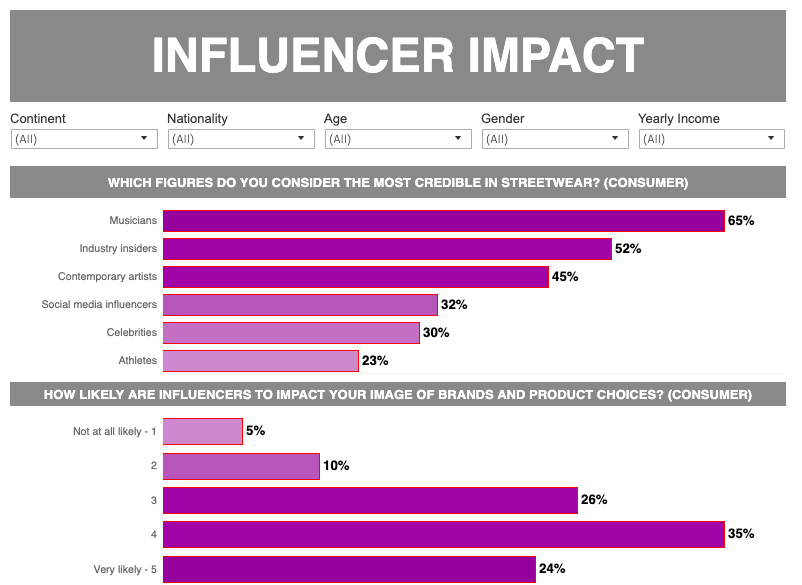

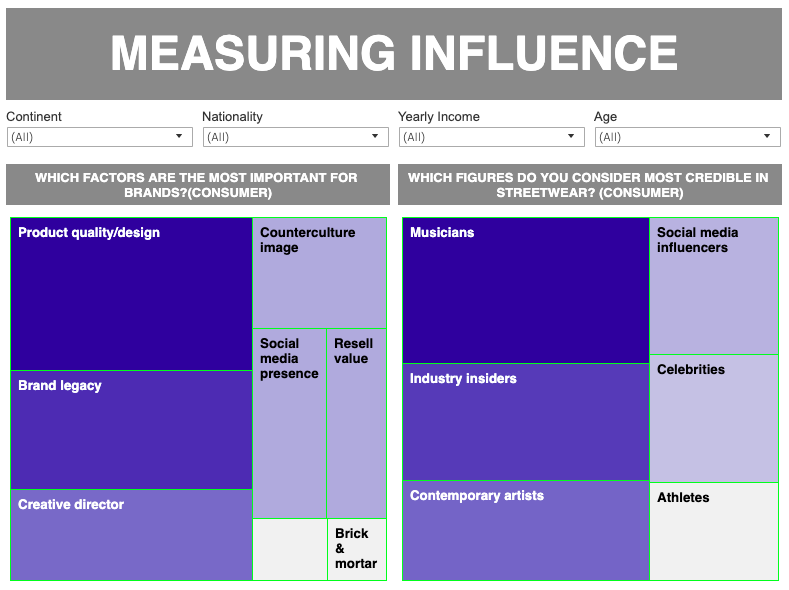

The factor of influence is greatly discussed in these modern times. In Italy in particular, where the influencer trend is bigger than in most countries, we're seeing a constant focus as to the value some of these personas actually add. Looking at the survey results we see that the influence of others is a fairly large part in what guides our retail decisions, however the majority (80%) of consumer respondents indicated that hip-hop/rap music was the major influence and almost half pointed to contemporary art (42%) and sports (40%). Only 32% selected social media influencers as a source and perhaps why a lot of the influencer economy is being reevaluated.

When looking at which factors were most important for brands, the majority (63%) of consumers indicated brand legacy, coming in second to product quality and design (81%). These results again return to streetwear’s biggest defining attribute: authenticity. Human interaction and community are of a higher value than a say nameless digital source. Consumers do value a product’s quality and design, but they want interactions with the brand, friends, influencers and creative directors who exhibit a deep-rooted knowledge of a community to again make a brand feel more authentic.

Communication

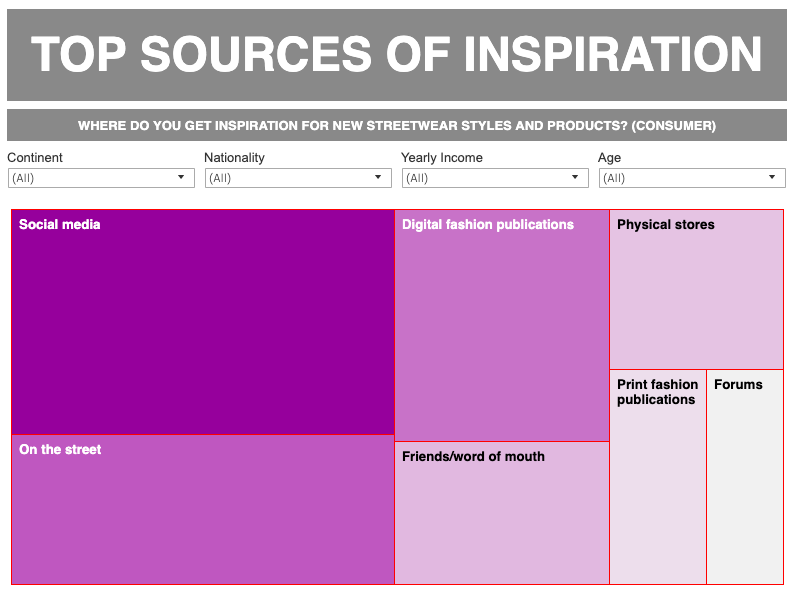

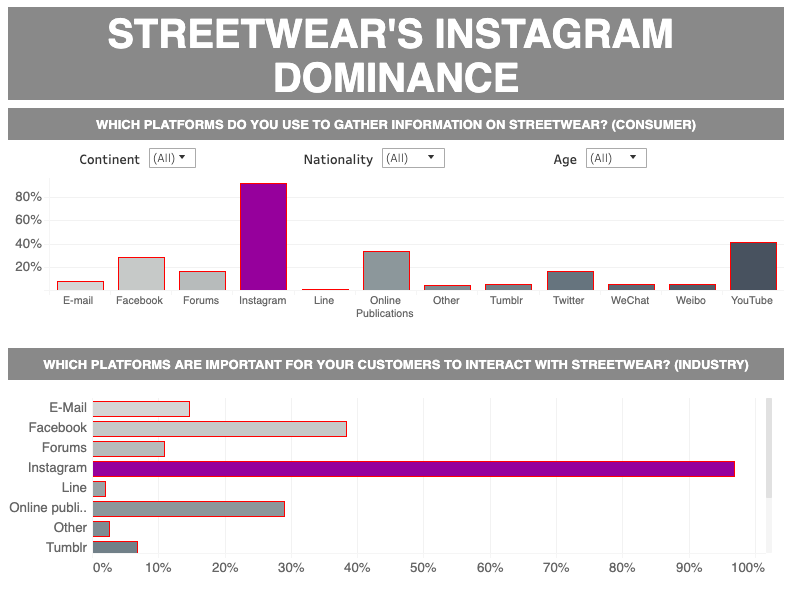

It should come as no surprise that the success of any brand, and in particular streetwear, is intrinsically linked to their prowess of utilizing social media nowadays. As streetwear was from its inception a counterculture, it has always been used to communicating outside the realms of mainstream news and has fluidly adapted to internet communication in a way that higher fashion brands are now looking to emulate. Where the importance of Facebook and forums were of greater just a few years ago, the current climate very clearly points to one source being the king above all others, Instagram. A whopping (96%) of consumer respondents cited Instagram, followed by YouTube (42%) with just 16% of consumers reporting that they still use forums.

Interestingly social media is even more important than the proverbial street. When industry respondents were asked where their customers find inspiration 88% reported social media as the top source, followed by the street (74%) and then friends or word of mouth (52%). Outweighing the amount reported from digital (47%) and printed (16%) fashion publications as sources of inspiration for customers.

Streetwear sales

Looking at how streetwear then sales, we again see this thread of authenticity is a key factor:

Streetwear companies often build their brand awareness by interacting directly with customers, communicating on social media and meeting consumers in-store. This relationship flies in the face of traditional fashion brands that rely purely on creative directors to provide a vision for each season. Each streetwear brand’s value is derived from a range of sources, including celebrity followers and desirable items, but arguably no factor supersedes authenticity, garnered by relating directly to the customers buying the products and building a tight-knit relationship with the community.

Strategy&

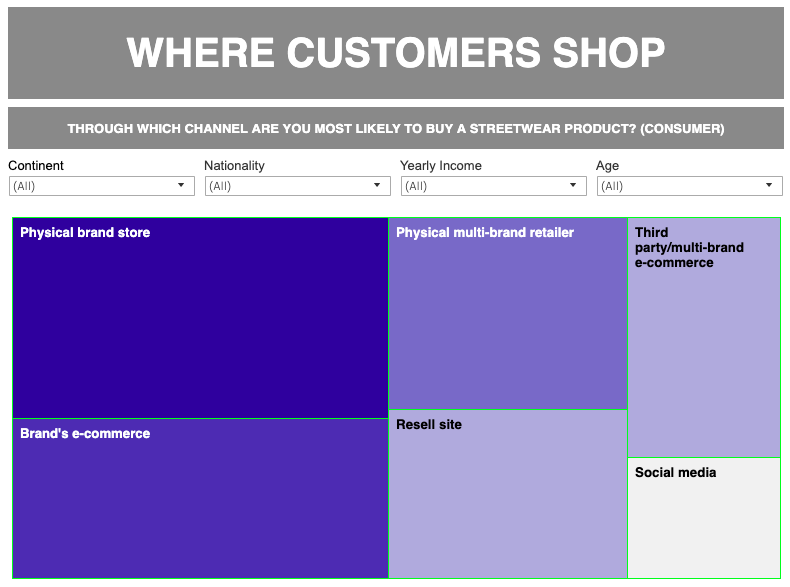

Consumers are increasingly interested in an as close to the source experience as possible, opting when possible to shop directly from a flagship outlet or, failing that, from the brands own site. Especially with hard to get releases, the brand's direct sources also offer up a greater level of security in that you actually copped those hard to get items and at the best possible price.

The increasing adaptation of the drop model of releases has also meant consumers are driven more directly to brand outlets and is sometimes also the only source to acquire the said item. This has meant that traditional customer services, such as returns and refunds are taking a second place to the principally most important factors of accessibility and availability.

Resale markets

In a time of booming second-hand markets we see:

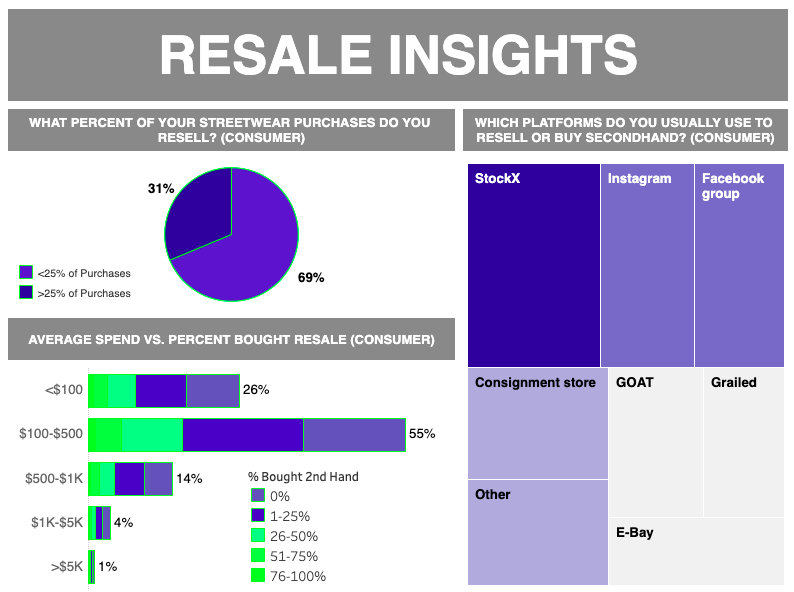

A majority (70%) of respondents said they bought no more than a quarter of their items through resale, meaning a third of consumers are buying at least a third of their items exclusively through the resale market. While it is almost entirely driven by unofficial channels, the resale market is significant enough that 69% of industry respondents find the resale business model attractive to tap into.

Strategy&

It's all boiling down to two main factors. Those who are willing to wait in line or those who'd rather pay a premium to get the desired item, which is also what we see differentiates streetwear from fashion at large.

There you have it, how the streetwear world works when broken down into facts and figures, the complete report is available for you to read here.